Highlights

If you’ve ever spent hours manually creating invoices, tracking payments, and sending reminders to clients, you know how tedious the billing process can be. Automated invoicing changes all that.

Automated invoicing uses software to handle the creation, delivery, and management of invoices with minimal human intervention. Unlike traditional methods that rely on spreadsheets or paper-based systems, automated solutions handle the heavy lifting. They can generate invoices on schedule, deliver them directly to clients, and even track when payments come in.

The beauty of this approach isn’t just in saving time, it’s about creating a better experience for everyone involved. Your clients receive professional, consistent invoices, and your team spends less time on paperwork.

Several elements work together to make automated invoicing effective:

Manual invoice processing comes with hidden costs that add up quickly. Staff hours spent creating invoices, printing and mailing costs, and the expense of correcting errors all impact your bottom line.

Automated invoice processing cuts these costs dramatically. With less time required for administrative tasks, your team can focus on revenue-generating activities instead. One small business owner told us she saved approximately $1,200 monthly after switching to an automated system, mostly in recovered productive hours.

Perhaps the most immediate benefit you’ll notice is the time saved. Creating invoices manually can take hours each week, especially as your business grows. With automation, invoices can be generated and sent in seconds.

Think about what your team could accomplish with those extra hours each month. More client outreach? Product development? Strategic planning? When routine billing tasks happen automatically, your business gains valuable time for growth and can save time on repetitive tasks.

We’re all human, and mistakes happen, especially when manually entering data. A mistyped amount or incorrect client information can lead to payment delays and awkward conversations.

Automated systems reduce these errors significantly. Once you’ve set up your products, services, and client information, the system uses this invoice data consistently across all invoices. This accuracy extends to your financial reporting too, giving you more reliable information for business decisions.

Cash flow is the lifeblood of any business, and invoice automation software helps keep it flowing smoothly. By sending invoices promptly and making payment easier for clients, you’ll see faster payments and more predictable income.

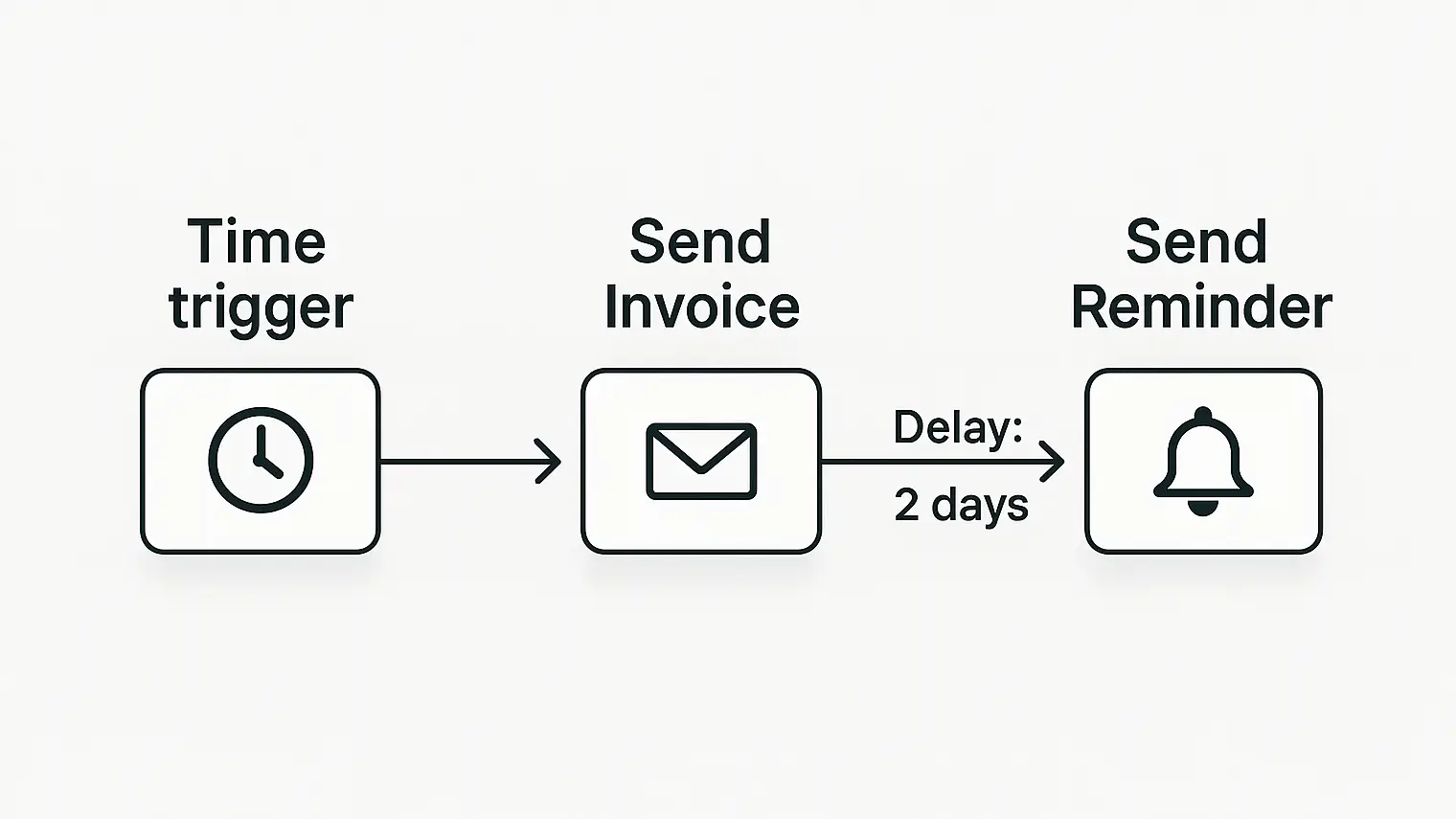

Many automated systems also include scheduled payment reminders, reducing the number of late payments without requiring uncomfortable collection calls. This consistent cash flow makes it easier to plan for expenses and investments in your business.

When the invoice process connects seamlessly with the rest of your business processes, everything runs more smoothly. Project completion automatically triggers invoice creation. Payments automatically update your accounting software. Client information stays consistent across platforms.

This connected processing workflow eliminates the gaps where things typically fall through the cracks. No more forgetting to bill for that small add-on service or losing track of which clients have paid.

Finding the perfect invoicing solution for your business requires careful consideration. Here’s what to look for:

Here at InvoiceMojo we have reviewed a whole bunch of options, which offer flexible features for businesses of different sizes. If you’re weighing invoicing tools, check out this comparison of free versus paid invoicing software to understand what might work best for your needs.

Getting set up is just the beginning, ongoing monitoring helps ensure you’re getting maximum benefit from your automated invoice processing system. Key metrics to track include:

Regular check-ins with your team can also reveal opportunities for improvement. Perhaps certain invoice formats need adjustment, or maybe additional automation capabilities would streamline things further.

We have seen small businesses across multiple industries make remarkable improvements after switching to finance automation. One SF-based graphic design studio reported that their average payment time decreased from 45 days to just 12 days after implementing automated invoicing with payment reminders.

Another example comes from a small consulting firm that reduced administrative hours spent on billing by 40%. This allowed their office manager to take on more client-facing responsibilities, improving their service quality and client satisfaction scores.

Even solo entrepreneurs benefit significantly. One freelance writer shared that sending recurring invoices completely eliminated the income gaps she previously experienced between projects, creating much-needed financial stability.

The path to successful automation work isn’t always smooth. Companies that have made the transition share these common challenges and solutions:

Change resistance is a common hurdle. Some staff members may be comfortable with existing manual processes and hesitant to learn new systems. The most successful implementations involve the team early, explaining benefits of invoice automation and addressing concerns before the switch.

Integration issues can also arise, particularly when connecting with older accounting automation systems. Starting with a thorough test phase using a small subset of clients can help identify and resolve these issues before rolling out to everyone.

Many businesses also report that they initially underutilized their new systems. Taking time to explore all features and regularly reviewing new updates can help you get the most value from your investment in invoice processing automation.

What are the benefits of automated invoicing?

The benefits of automated invoice processing include reduced costs, saved time, improved accuracy, enhanced cash flow, and increased overall workflow efficiency. Most businesses see faster payments and fewer billing errors after implementing an automated invoice system.

How do I choose the best invoice automation software for my business?

Consider your specific needs, including the number of invoices you send monthly, whether you need recurring billing options, and which other business systems you’ll need to integrate with. Also factor in your budget and the level of customer support provided when choosing the right invoice automation software.

Can automated invoice software integrate with my current accounting system?

Most modern invoicing solutions offer integration with popular accounting software like QuickBooks, Xero, and FreshBooks. Check the compatibility list for any processing solution you’re considering, or ask the vendor directly about specific integrations you need.

What kind of support can I expect from invoicing software vendors?

Support varies by provider, but typically includes some combination of documentation, video tutorials, email support, and live chat. Premium plans often include phone support and dedicated account managers. During your selection process, test the support options to ensure they meet your needs.

Automated invoicing represents a significant opportunity for businesses of all sizes to improve their financial operations. By reducing manual work, eliminating errors, and speeding up payment collection, these invoice automation systems deliver both immediate and long-term benefits.

The transformation goes beyond just saving time, though that alone is valuable. Automated invoice processing creates a more professional experience for your clients, provides better financial visibility for your business decisions, and frees your team to focus on growth rather than paperwork.

If you’re still creating invoices manually or using a system that requires significant oversight, now is the perfect time to explore automation options. Start by assessing your current invoice process and identifying pain points, then research solutions that address those specific challenges.

Remember that successful implementation requires thoughtful planning and team buy-in. Take time to choose the right software, set it up properly, and train everyone involved. The investment in getting it right will pay dividends through smoother operations and improved cash flow.

Your business deserves systems that support growth rather than creating administrative burdens. Automated invoice processing is one of the simplest yet most impactful changes you can make to improve your financial operations, and there’s no better time to start than now. Check out these reviews to see how other businesses have benefited from invoice automation software.