Highlights

Freelancers and small business owners often find themselves caught between overly simplified spreadsheets and unnecessarily complicated accounting software. TrulySmall Accounting steps in to fill this gap with straightforward financial tools that don’t require an accounting degree to use.

Coming from the makers of Kashoo, TrulySmall Accounting offers a suite of financial management solutions including TrulySmall Accounting, TrulySmall Invoices, and TrulySmall Expenses that can work independently or as an integrated suite. Let’s take a closer look at what makes this platform worth considering for your small business needs in 2025.

TrulySmall Website

Running a small business means wearing multiple hats, and financial management shouldn’t eat up precious time you could spend growing your business. TrulySmall Accounting aims to simplify invoice creation, expense tracking, and accounting for those who need functional tools without excess complications.

The company’s approach targets businesses that truly are small, freelancers, solopreneurs, and micro-businesses with straightforward financial needs. By focusing on this specific audience, TrulySmall Accounting has created products that prioritize simplicity and practicality over extensive features that small operations rarely use.

What sets TrulySmall Accounting software apart is its modular approach. You can choose just the invoicing tool if that’s all you need, add expense tracking, or opt for the complete accounting package. This flexibility allows businesses to pay only for what they’ll actually use, making it an ideal solution for small businesses.

TrulySmall divides its offerings into three distinct products, each addressing specific aspects of financial management for small business owners.

This cornerstone product helps freelancers and service providers create and send invoices quickly and efficiently.

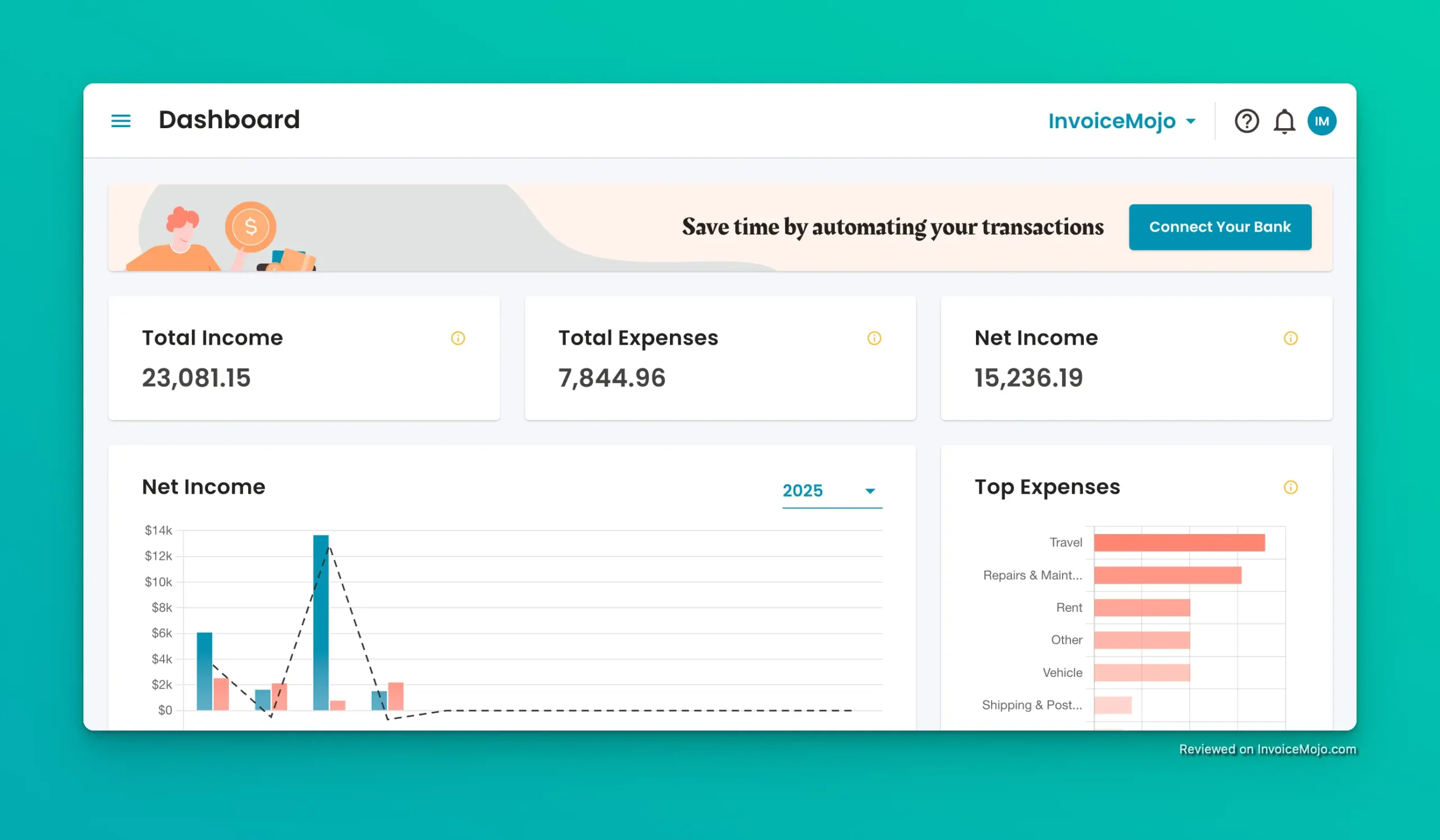

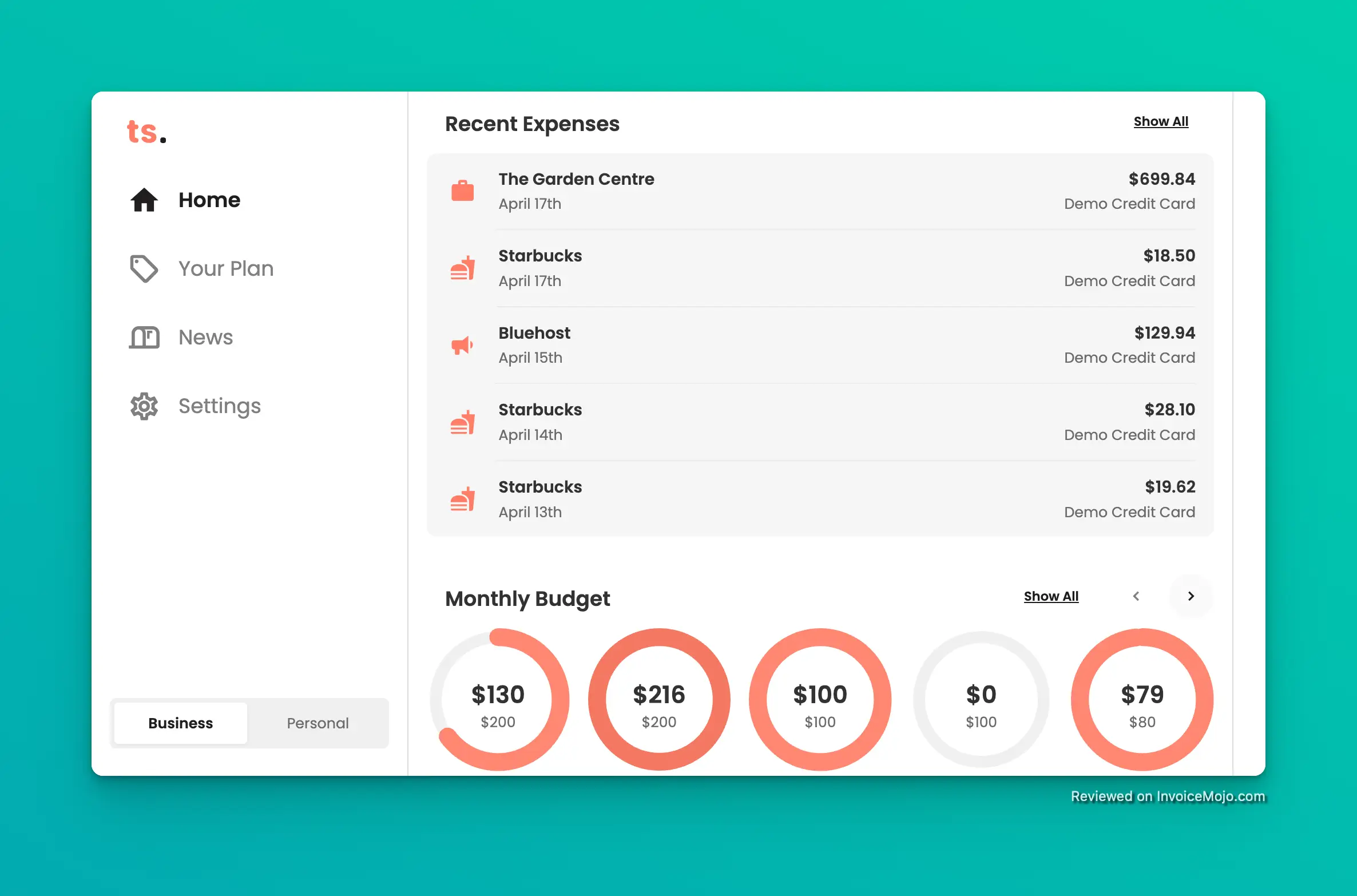

TrulySmall Dashboard

The full accounting solution expands beyond invoicing with comprehensive financial tools:

The expense tracking product rounds out the suite:

TrulySmall Accounting pricing is straightforward with both monthly and annual options. The annual plans provide savings compared to paying monthly.

| Product | Monthly Price | Annual Price | Savings |

|---|---|---|---|

| TrulySmall Accounting | $20.00 | $216.00 ($18.00/mo) | $24.00 |

| TrulySmall Invoices | $8.99 | $89.99 ($7.50/mo) | $17.89 |

| TrulySmall Expenses | $8.99 | $89.99 ($7.50/mo) | $17.89 |

The full accounting package at $20/month sits in the mid-range for small business accounting software. While not the cheapest option available, it’s specifically designed for very small businesses and solopreneurs.

Some user reviews note that the price seems somewhat high for an entry-level application, particularly when compared to alternatives like Wave (which offers basic features for free) or FreshBooks (which includes more features at a similar price).

However, at $8.99 per month, both TrulySmall Invoices and TrulySmall Expenses provide good value for businesses that only need those specific functions to automate their accounting tasks.

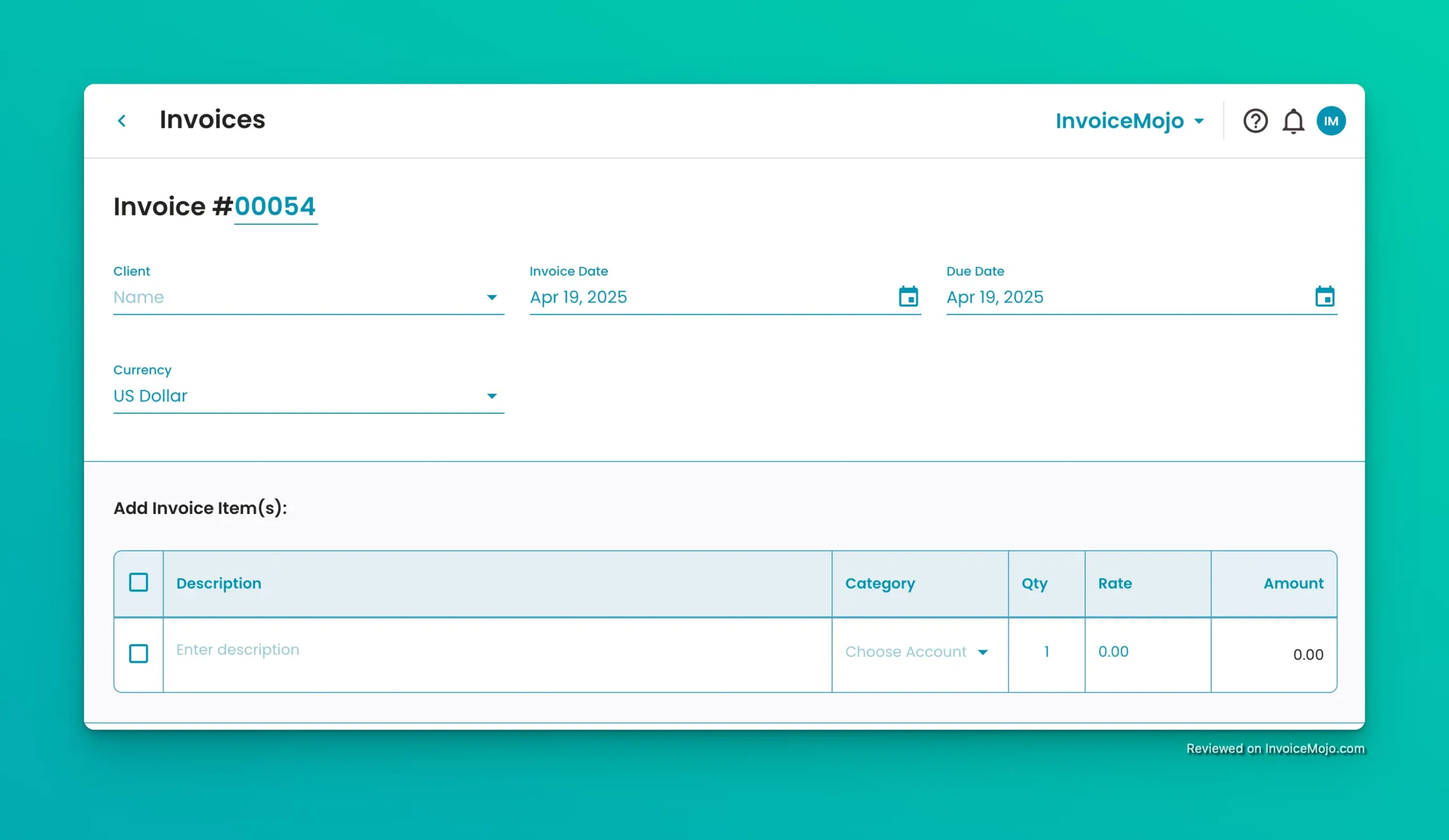

Creating an invoice in TrulySmall

After analyzing TrulySmall Accounting reviews and product features, here are the main advantages and limitations of TrulySmall:

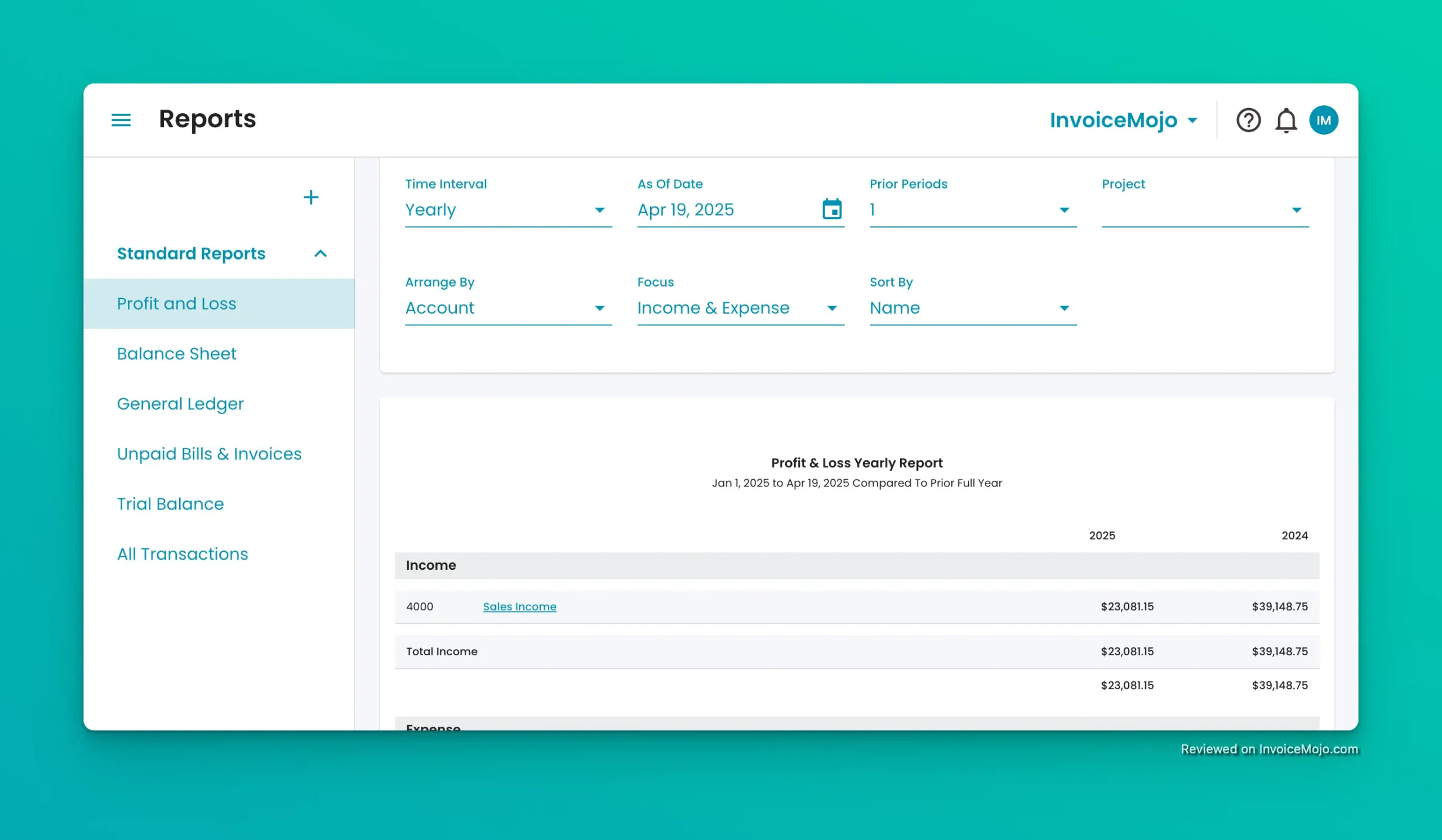

Reports in TrulySmall

Feedback from actual TrulySmall Accounting reviews provides valuable insights into the real-world experience with the platform.

Many users highlight how quickly they got up and running with TrulySmall Accounting software. One freelancer mentioned, “TrulySmall Accounting was very easy to figure out and utilize when starting out in my freelancer journey. It was recommended to me by a friend and I am very happy with the platform overall.”

Another business owner appreciates the user interface is very clean: “I really like the fact that TrulySmall Accounting is very intuitive and easy to use. I also like the fact that the dashboard allows me to see an overall financial picture of my business without a lot of manual input on my part.”

The invoicing functionality receives particular praise: “It’s pretty much flawless at keeping track of invoices. Adding new clients is simple, and the actual act of creating invoices for those clients and sending them off is quick and easy. Whenever a client pays me, I can register that within 2 clicks.”

Many users who found other accounting software overwhelming appreciate TrulySmall’s approach to invoicing: “I was using an Excel spreadsheet to account for my business, as Quickbooks was too much for what I needed. This fits the bill perfectly.”

A small business owner shares: “As a small business owner, this accounting software has been a lifesaver for managing incoming and outgoing expenses. The ability to easily attach receipts has streamlined my organization process.”

Expense tracking in TrulySmall

Some users question the value proposition: “It still feels a little bit expensive for what it is, but this might simply be my lack of experience with comparable pieces of accounting software.”

Another user admits: “It would be nice if it were a little less expensive but the yearly pricing seems to be in keeping with other similar software that offers what I am looking for.”

Several users point out specific functionality they wish was included: “The only thing I think would improve usage is if you could start an invoice and come back to it later on, an auto save function or something similar. Instead if I am not finished and have to log off, my all work disappears.”

A service business owner notes: “I’m likely to leave truly for another filing app because truly doesn’t have savable options for easier charging. I run a service base business, and the products which i sell are items that i have to type in for every invoice. If there was an option to save products, services, and the corresponding prices, this would truly be better.”

Some users experienced difficulty with specific functions: “The bank account connect feature should be easier to set up and an available feature for more countries.”

Mobile app limitations were mentioned: “The login process is annoying, would be nice to have FaceID as an option for the mobile app.”

Banking connectivity issues came up several times: “There was some difficulty connecting to our company bank account.”

Based on collected reviews, here’s how users feel about key aspects of TrulySmall:

| Aspect | Positive | Neutral | Negative |

|---|---|---|---|

| Ease of Use | 85% | 10% | 5% |

| Value for Money | 60% | 25% | 15% |

| Feature Set | 70% | 15% | 15% |

| Customer Support | 65% | 20% | 15% |

| Mobile Experience | 75% | 15% | 10% |

| Bank Integration | 60% | 20% | 20% |

This analysis shows that TrulySmall Accounting’s greatest strength is user experience, while most criticisms focus on pricing and specific feature limitations.

TrulySmall Accounting works particularly well for certain types of businesses:

Why it fits: The simple interface, quick invoice creation, and mobile app make it perfect for one-person operations.

Real benefit: A freelance designer can create and send invoices directly after completing a project, even while still at a client’s office, increasing the likelihood of prompt payment.

Why it fits: Client information storage, professional branding, and multiple payment options support service providers.

Real benefit: A small consulting firm can maintain professional client relationships with branded invoices and estimates while easily tracking which clients have viewed and paid, reducing admin tasks.

Why it fits: The intuitive interface doesn’t require accounting expertise, while auto entry for GST filing and snapshot analysis on the dashboard provide insights into your business’s financial situation.

Real benefit: A new shop owner can understand business finances without accounting expertise, helping make informed business decisions from day one.

Why it fits: Affordable pricing, focused features, and time-saving automation work well for occasional use.

Real benefit: Someone running an online store on the side can quickly manage invoices and expenses directly without spending too much time on financial administration.

Why it fits: TrulySmall Accounting covers the basics without complex features that small businesses rarely use.

Real benefit: A local service provider can keep accurate books without paying for enterprise-level features, ensuring compliance with tax regulations without unnecessary expense.

What exactly is TrulySmall Accounting? TrulySmall Accounting is a financial management suite designed specifically for very small businesses and freelancers. It includes three main products: TrulySmall Accounting, TrulySmall Invoices, and TrulySmall Expenses.

Who makes TrulySmall Accounting software? TrulySmall Accounting is developed by Kashoo, a financial software company that specializes in solutions for small businesses.

Can I use TrulySmall Accounting on my phone? Yes, TrulySmall has mobile apps for both iOS and Android devices, allowing you to manage finances, create invoices, and track expenses while on the go.

Will TrulySmall Accounting work for my growing business? TrulySmall Accounting is primarily designed for very small businesses and may have limitations for rapidly growing companies with complex needs. As your business expands, you might eventually need more advanced features.

Can I connect my bank accounts with TrulySmall Accounting? Yes, TrulySmall Accounting allows you to connect business bank accounts for automatic transaction importing and categorization, though some users report challenges with certain banks.

Does TrulySmall support multiple currencies? Yes, TrulySmall supports multiple currencies, making it suitable for businesses with international clients.

Can I customize invoices with my company logo? Yes, TrulySmall Invoices allows you to upload your company logo, customize colors, and select professional themes for your invoices.

Do I need to buy all three TrulySmall products? No, each product can be purchased separately based on your specific needs. TrulySmall Accounting is the most comprehensive solution, while Invoices and Expenses focus on specific aspects.

What kind of customer support is available? TrulySmall provides customer support through chat, phone, and 24/7 support channels. They also offer a knowledge base with help guides and videos.

After examining TrulySmall Accounting features, pricing, user reviews, and capabilities, it’s clear that this software delivers on its promise of providing straightforward financial tools for truly small businesses.

| Category | Rating | Comments |

|---|---|---|

| Ease of Use | 4.5/5 | Very user-friendly with intuitive interface |

| Feature Set | 4.0/5 | Good core features for small businesses with some limitations |

| Value for Money | 3.8/5 | Reasonable value but somewhat expensive compared to alternatives |

| Mobile Experience | 4.3/5 | Strong mobile apps with good functionality |

| Customer Support | 4.0/5 | Generally positive with some mixed reviews |

| Scalability | 3.5/5 | Works well for very small businesses but limited for growing organizations |

Great For:

Not Ideal For:

TrulySmall lives up to its name by providing a focused financial management solution for small businesses. Its best features are the user-friendly interface, time-saving automation, and mobile accessibility. The suite finds a good balance between simplicity and functionality, giving you important tools without overwhelming you with unnecessary complexity.

While the price is higher than some alternatives when looking at features-to-cost, the time savings and ease of use may justify the investment for many small business owners. Being able to purchase only the components you need (Invoices, Expenses, or full Accounting) gives flexibility that many competitors don’t offer.

For freelancers and very small businesses wanting to improve their invoicing and financial management without a steep learning curve, TrulySmall Accounting is worth considering. It’s particularly valuable for those just starting their business journey or those who want to focus on their actual work rather than struggling with complicated accounting software.

Some businesses may eventually outgrow the platform due to limited advanced features and customization options, but for its intended audience, TrulySmall Accounting offers a practical, accessible solution to basic financial management needs.

If you’d like to write a review based on your own experience with TrulySmall Accounting, many platforms allow you to share your insights to help others make informed decisions.