Highlights

Customizable templates in Zoho Invoice

Customizable templates in Zoho Invoice

Zoho Invoice is a free, cloud-based invoicing solution designed specifically for freelancers and small business owners. Part of the Zoho suite of business tools, it stands out by offering robust features without the usual price tag: a compelling proposition for budget-conscious entrepreneurs. From creating professional invoices and estimates to tracking time and expenses, this app streamlines your billing process completely free of charge. The software has earned impressive ratings across review platforms, scoring 4.7 out of 5 on both G2 and Capterra. In this market with no shortage of invoicing tools, ranging from basic invoice generators to complex accounting systems, Zoho Invoice hits a sweet spot for many people. It’s more capable than simple invoice templates, yet far more affordable (being free) than comprehensive accounting platforms. This makes it particularly valuable for freelancers, consultants, and small business owners who need professional invoicing without the overhead of complicated accounting software.

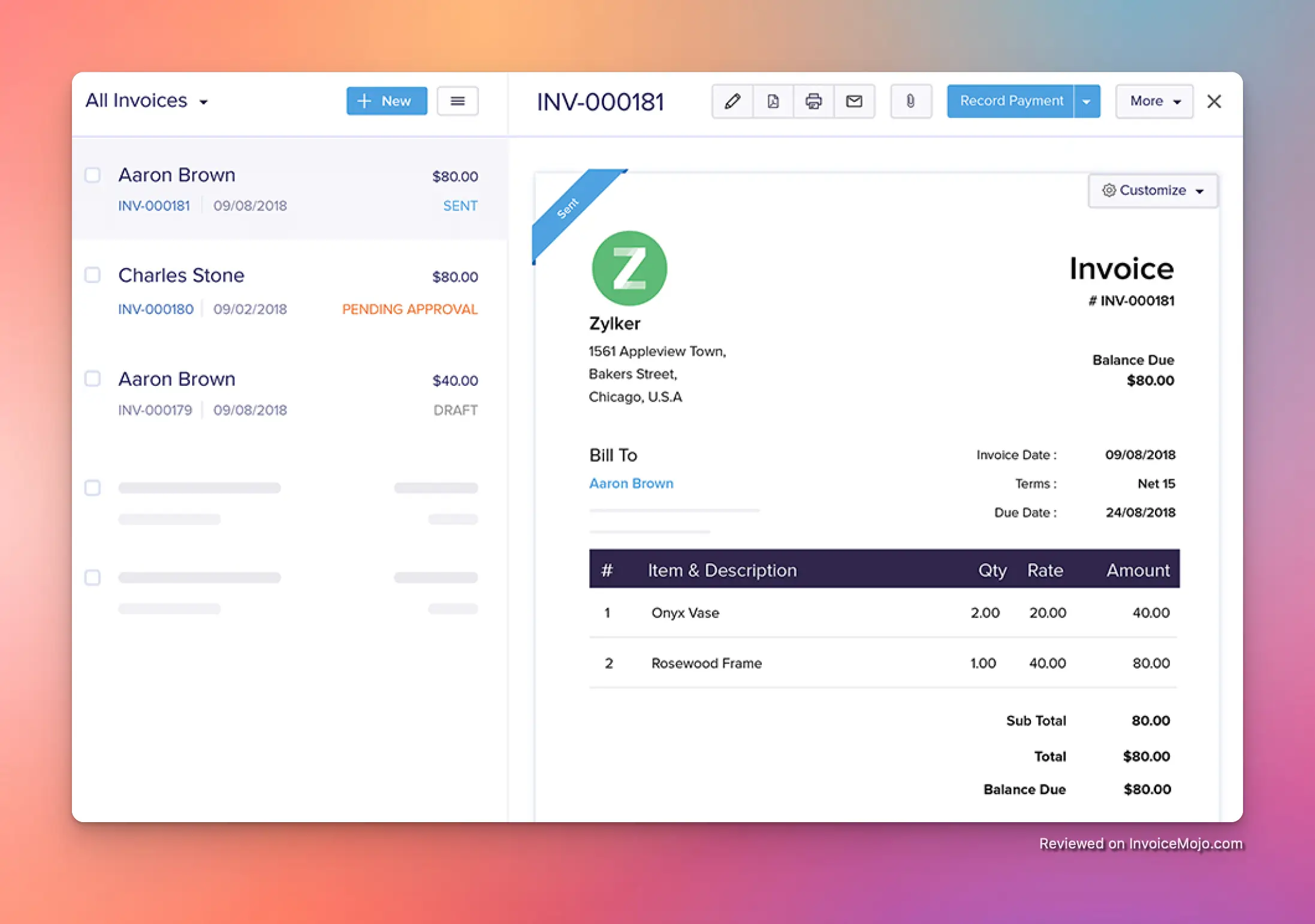

Create and send polished, tax-compliant invoices in just a few clicks. Zoho Invoice allows you to generate unlimited invoices (within annual limits) with your own branding, and supports multiple languages and currencies for billing clients globally (Zoho.com). You can issue detailed estimates and easily convert them to invoices once approved, streamlining your workflow. Each invoice can be emailed directly or downloaded as PDF, with the option to schedule invoices for future dates: perfect for ensuring recurring bills go out on time.

Maintain a professional image with customizable invoice designs. Zoho Invoice provides a gallery of templates you can adjust to match your brand’s logo, colors, and layout preferences. Everything from address formats to invoice fields can be modified. This level of personalization means your invoices look polished and consistent with your business identity: a feature some competitors charge extra for. You can even add custom fields to capture specific information and include digital signatures for authenticity through Zoho Sign integration.

Zoho Invoice doubles as a mini-CRM for your clients. Store customer contact details and payment preferences, save credit card information securely for recurring billing, and provide a self-service portal. The customer portal is a standout feature. It allows clients to log in to view their invoices, quotes, and payment history in one place. Through the portal, clients can approve estimates, pay invoices online (partial or full payments), and leave feedback on your services. This client collaboration enhances your professional image and makes it easier for clients to pay promptly.

Getting paid is straightforward with Zoho Invoice. It integrates with over 10 payment gateways, including popular options like Stripe, PayPal, Square, and Authorize.net. You can offer clients multiple online payment options (credit card, PayPal, bank transfer, etc.), and set up auto-charge for recurring invoices to automatically bill a client’s saved card. Zoho Invoice also automates payment reminders. You can configure email notifications to go out before or after an invoice is due, nudging late-paying customers without manual effort. If a client overpays or you need to record a refund, you can issue credit notes to adjust their balance. All payments (including offline ones like cash or check) can be recorded in the system for a complete financial picture.

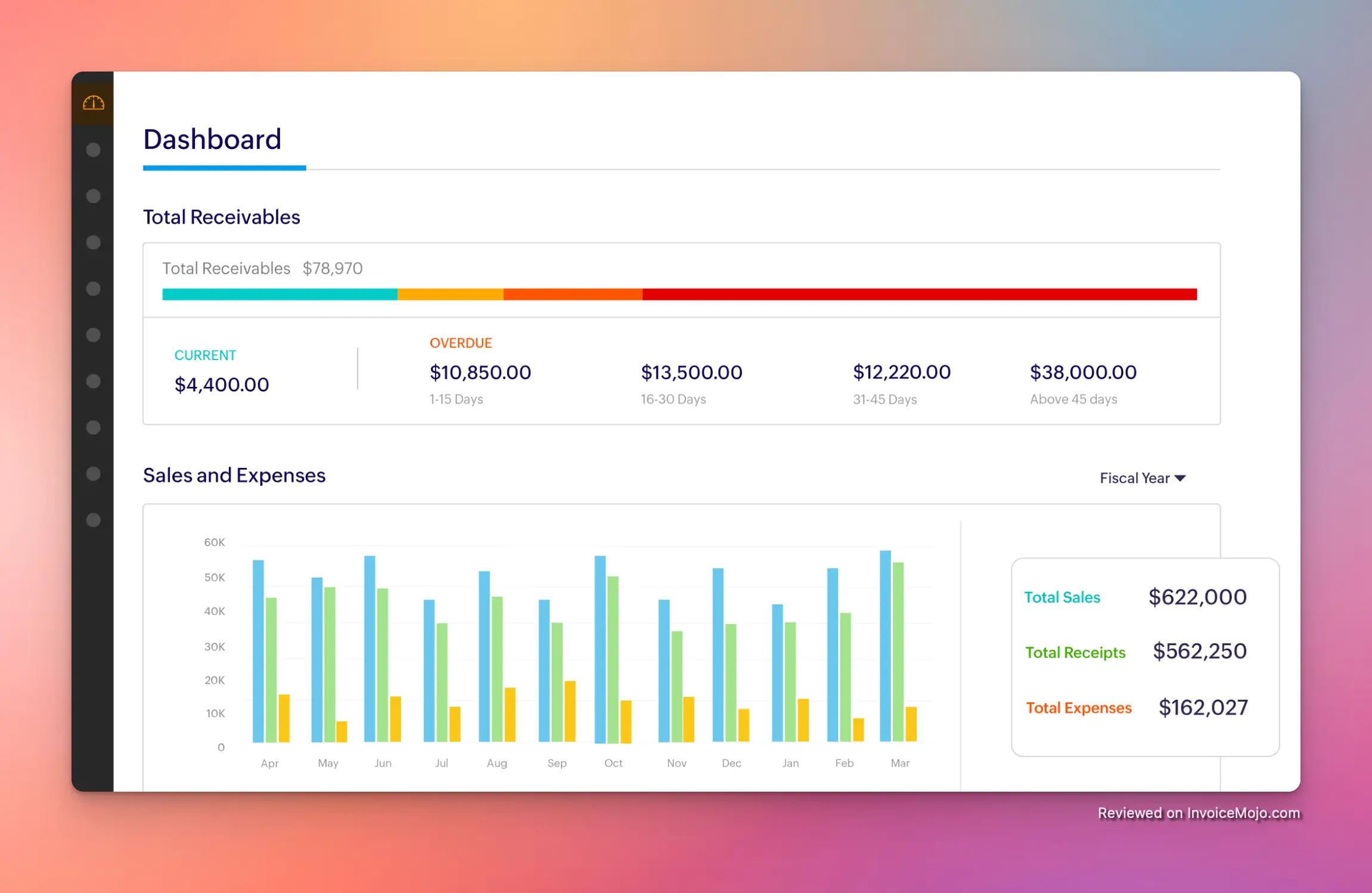

Zoho Invoice Dashboard

Zoho Invoice Dashboard

Beyond invoices, Zoho Invoice helps manage expenses. Record costs, categorize them, and snap photos of receipts to attach via the mobile app. For expenses that need to be billed back to a client, you can mark them as billable and quickly convert those expenses into invoice line items. There’s even a mileage tracking feature: input miles driven for business and the app calculates the expense based on your reimbursement rate. By logging expenses in Zoho Invoice, you can monitor your spending and ensure you bill clients for all applicable costs.

Freelancers and agencies will appreciate the built-in time tracking and project management features. Create projects (up to 3 in the free plan) and tasks within Zoho Invoice, then log hours worked using a timer or manual entry. The timesheet module accumulates all your logged hours and shows a breakdown of billable vs. unbilled hours. When it’s time to bill your client, you can automatically generate an invoice from the project’s hours with one click: no need to manually copy times. You can bill based on project hours or task hours and set different rates for each if needed. This feature ensures accurate billing for your time, crucial for freelancers charging hourly or project rates. It eliminates the need for a separate time-tracking app.

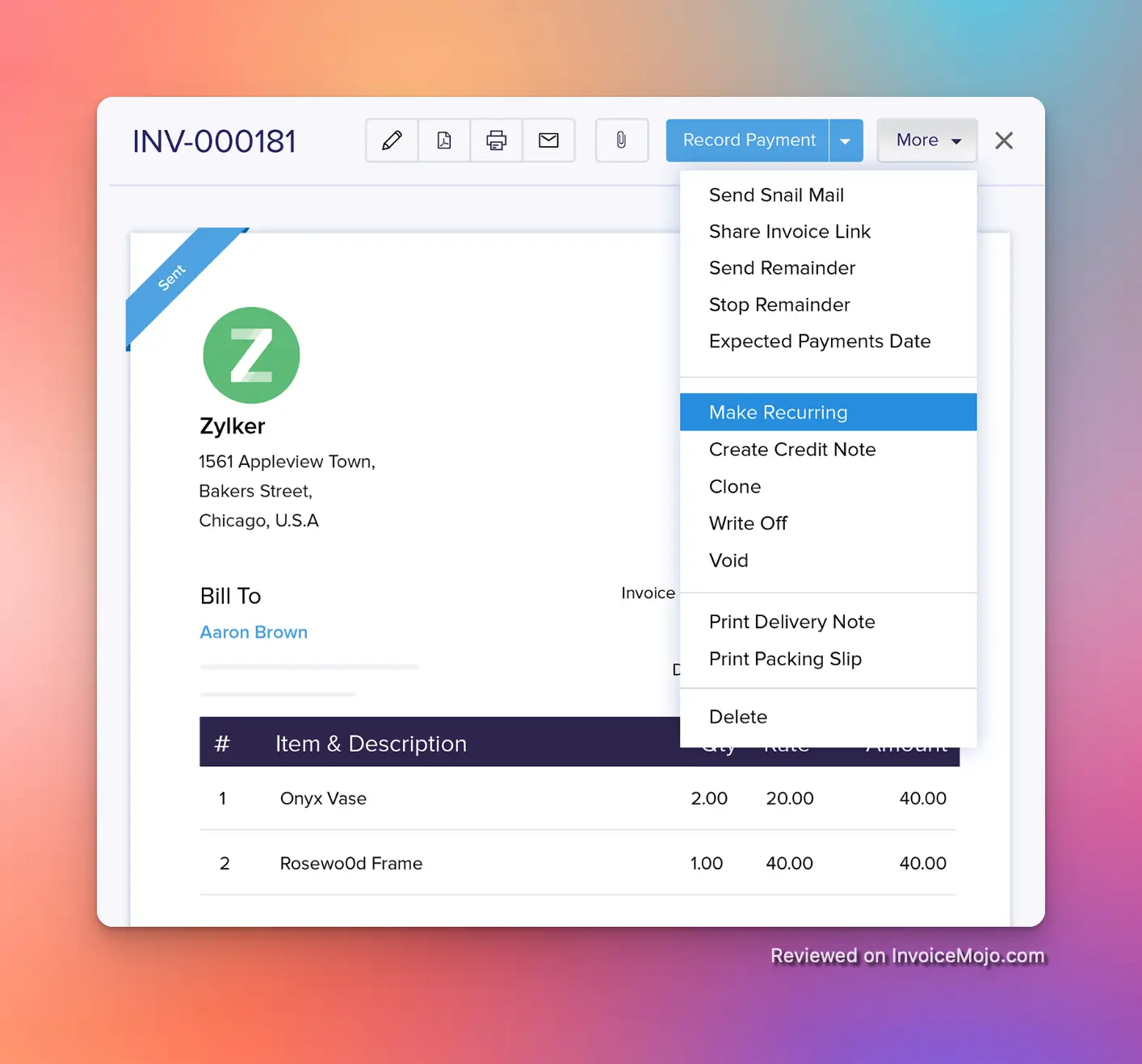

Converting an invoice into a recurring invoice in Zoho

Converting an invoice into a recurring invoice in Zoho

For retainer clients or subscription services, Zoho Invoice offers recurring invoices. Set up an invoice to recur at chosen intervals (e.g., monthly, quarterly) and the system automatically creates and sends those invoices on schedule. Pair recurring invoices with saved payment methods to auto-charge clients, truly automating the entire billing cycle. Zoho Invoice also supports recurring expenses and can automatically add unbilled project hours to recurring invoices. Additional automation includes payment reminders and thank-you notes after payment, features that help you get paid faster with less manual work.

Stay on top of your finances with Zoho Invoice’s reporting tools. The app offers over 30 built-in reports covering sales, expenses, income by customer, aging accounts receivable, invoice history, and timesheet reports. You can generate profit-and-loss style reports to gain insight into your business health. Reports are customizable with filters (date ranges, client, etc.), and exportable if needed. The real-time dashboard provides a quick snapshot of key metrics (outstanding receivables, paid vs. unpaid invoices, top expenses, project hours logged, and more) giving you an instant view of your financial status. For advanced analytics, Zoho Invoice integrates with Zoho Analytics, allowing you to create custom reports or dashboards if you’re data-savvy.

If you have a small team, Zoho Invoice supports adding additional users to your organization (up to 2 users on the free plan). Each user can be assigned specific roles and permissions. For example, you could allow an employee to create invoices but restrict them from viewing financial reports. You can even limit users to see only certain clients (useful if you have contractors working with specific customers). This role-based access ensures you maintain control over sensitive data while still collaborating. While the free plan’s user count is limited, it’s usually enough for a freelancer plus an assistant or a small founding team.

Being a cloud solution, Zoho Invoice is accessible anywhere, via web browser or through highly-rated mobile apps for iOS and Android. The mobile apps are praised for being nearly as powerful as the web version, allowing you to create invoices, log expenses (with receipt photos), track time, and send invoices from your phone. Users have rated the app around 4.8/5 on app stores, indicating a smooth experience. There are also Windows and Mac apps if you prefer desktop applications. This cross-platform availability means you can manage your billing anytime, anywhere: send an invoice immediately after a client meeting or check who still owes you money while traveling.

Managing invoices on Zoho Invoice

Managing invoices on Zoho Invoice

A major advantage of choosing Zoho is the ecosystem. Zoho Invoice integrates seamlessly with other Zoho apps like Zoho CRM, Zoho Books, Zoho Projects, Zoho Inventory, Zoho Expense, Zoho Sign, and Zoho Analytics.

For instance, if you use Zoho CRM, you can pull client information directly into Zoho Invoice when billing. If you upgrade to Zoho Books later, all your invoice data can migrate over. Beyond Zoho’s tools, Zoho Invoice offers integration with popular third-party services: G Suite, Office 365, Slack, and APIs for custom integrations.

These integrations make Zoho Invoice a flexible hub that fits into your existing business workflow. You could create automations where a signed Zoho CRM deal generates an invoice in Zoho Invoice, or use Zapier to add new invoice info to a Google Sheet.

Zoho offers free invoicing

Zoho offers free invoicing

One of the most attractive aspects of Zoho Invoice is its pricing: it’s completely free. Zoho made Invoice free in 2021 to support small businesses and has maintained it as a forever-free product since then. There are no premium tiers for Zoho Invoice itself; every feature we outlined is included in the free plan.

The free plan does have usage limits to ensure it serves small business needs. If your business grows beyond these limits, Zoho encourages upgrading to their paid accounting software (Zoho Books) or other solutions.

Here’s a summary of Zoho Invoice’s plan and the related upgrade path:

| Plan | Price | Key Limits/Features |

|---|---|---|

| Zoho Invoice (Free) | $0 forever | All features included with no ads. Up to 2 users per organization, up to 3 projects, and can send up to 500 invoices per year. Supports multiple currencies and 10+ languages, 1,000 clients, and 1 GB document storage. Email and forum support available (24/5). |

| Zoho Books (Standard) (upgrade option) | $10 per month | Full accounting solution including all Zoho Invoice features plus double-entry accounting, bank reconciliation, advanced reports, and more. No user limit on paid plans and higher transaction limits (up to 5,000 invoices/year). Offers phone support and integration with Zoho Inventory. |

Zoho Invoice’s pricing is unbeatable: you get a professional invoicing app for free, with generous limits designed for small operations. For example, 500 invoices per year breaks down to about 42 invoices per month, which is plenty for a freelancer or small business with weekly invoicing cycles. Having two user seats means you (the owner) can collaborate with an assistant or partner at no cost.

It’s important to know the limits so you can plan ahead: if you approach 500 invoices/year or need more than 2 users, you should prepare to upgrade to a paid Zoho Books plan or another solution. Zoho has set these caps to make Zoho Invoice a starting point. Once you’re big enough to exceed them, your revenue can likely justify paying for Zoho Books (starting at $10/month).

The value proposition is clear: Zoho Invoice is free forever for small businesses, with all features included, as long as you stay within the usage limits. There are no upsells or ads in the interface. This “free-but-limited” model is extremely friendly for startups and freelancers. You can sign up without entering credit card information, and if you never exceed the free tier limits, you’ll never pay anything.

Completely Free with No Hidden Fees: Zoho Invoice offers tremendous value by providing all its features for free. There are no monthly subscriptions or surprise costs, making it ideal for freelancers and small businesses on tight budgets.

Feature-Rich and Highly Customizable: Despite being free, Zoho Invoice’s feature set rivals many paid competitors. You get invoicing, quotes/estimates, expense tracking, time tracking, recurring billing, multi-currency support, and more in one app. The templates and documents are deeply customizable to fit your brand.

User-Friendly Interface: Users consistently praise Zoho Invoice for its intuitive and modern interface. The platform is beginner-friendly, with an organized dashboard and clear navigation that makes it easy to find what you need. Many actions are automated or take only a few clicks, so even non-accountants can quickly grasp how to use it.

Mobile Apps and Multi-Platform Access: Zoho Invoice excels in mobility. Its top-rated mobile apps let you invoice clients and record expenses on the go: perfect for freelancers or contractors who aren’t always at a desk. The mobile experience is nearly as full-featured as the web app and maintains the same ease-of-use.

Client Portal: The included self-service portal for clients is a standout advantage. Few invoicing tools (especially free ones) offer a dedicated portal where customers can log in to view their transaction history, pay invoices, and accept estimates. It provides a smooth, modern experience to your clients and reduces administrative back-and-forth.

Automation Features: Zoho Invoice reduces repetitive work through automation. Recurring invoices, automated payment reminders, and auto-billing functionality mean the software handles routine billing tasks in the background. This saves significant time if you charge subscriptions or have retainer clients.

Strong Reporting: The reporting capabilities are robust for a free tool. You can quickly generate reports to see who owes you money, which services earn the most, and track expenses. The dashboard provides instant insight into key metrics to help gauge your financial health.

Zoho Ecosystem Integration: As part of the larger Zoho ecosystem, Zoho Invoice integrates seamlessly with apps like Zoho CRM, Zoho Books, Zoho Projects, and more. Data flows easily between them, and it connects with common tools like Google Workspace, Office 365, and Slack.

Secure and Reliable: Zoho is a well-established company known for secure cloud services. Zoho Invoice offers PCI-DSS compliant security for payments and 256-bit SSL encryption on all data. You also get options for two-factor authentication. Being cloud-based means you won’t worry about software updates or losing data if your computer crashes.

Usage Limits: The free plan imposes caps that may affect growing businesses: 500 invoices per year, 2 users maximum, and up to 3 projects for time tracking. There’s also a limit of 1,000 clients and 1GB of storage. While generous for many freelancers or very small businesses, these restrictions become problematic as you scale. Exceeding these limits requires migrating to Zoho Books (paid) or another solution.

No Native Inventory Management: If your business involves selling products with inventory, Zoho Invoice might fall short. It allows adding items with rates/SKUs to invoices but lacks advanced inventory tracking features. Stock levels won’t auto-update when you invoice a product. Users who need integrated inventory management would need to upgrade to Zoho Books or use a separate system.

Limited Accounting Features: Zoho Invoice focuses on invoicing and basic income/expense tracking. It is not full accounting software. It doesn’t handle detailed financial statements, bank reconciliation, or payroll. While you can track revenue and expenses at a simple level, you might eventually need an accounting tool for taxes and broader bookkeeping.

Customer Support Limitations: Zoho Invoice offers free support but with some constraints. They provide 24/5 email support and telephone support for free users, which is good. However, some users report there is no live chat, and phone support might not be readily advertised. You might rely mostly on email or self-service resources (help docs, forums) for assistance.

UI Complexity for Advanced Tasks: While generally easy to use, Zoho Invoice’s extensive feature set means certain advanced configurations can be somewhat hidden or require a learning curve. Fully customizing templates or setting up workflows might require exploring the settings in depth. The interface can be “sprawling” at times, requiring scrolling to find certain options.

Cannot Delete Certain Data: Once you add a client or certain records, Zoho Invoice doesn’t allow deleting them: you can mark them inactive, but not remove them entirely. This is likely a design choice to maintain record integrity but can frustrate users who created test data or who prefer to keep their database extremely clean.

Limited Payment Integrations for Niche Needs: Zoho Invoice covers all major payment gateways, but if you have a very specific local payment processor or need cryptocurrency payments, you might not find a direct integration. Most small businesses will find a suitable option among the supported gateways, but specialized payment workflows could require custom integration via API.

Zoho Invoice has earned very positive reception from users across review platforms. Here’s what real freelancers and small business owners say about their experience with the app.

Overall User Ratings: Zoho Invoice scores exceptionally well, with 4.7 out of 5 stars on G2, based on hundreds of reviews. Over 82% of users on G2 have given it a full 5-star rating. Similarly, on Capterra, Zoho Invoice holds about 4.7/5 stars from over 700 reviewers. These high ratings indicate strong customer satisfaction.

Positive Feedback: Users frequently praise Zoho Invoice’s ease of use and comprehensive features. Many freelancers appreciate doing “everything in one place” (invoice clients, log expenses, track time, etc.) without needing multiple tools. The fact that it’s free consistently exceeds expectations. One Capterra reviewer wrote that Zoho Invoice is “Absolutely FREE to use!” and appreciated how “user-friendly [the] platform [is] with easy to get started user experience.”

Users also comment on how the professionalism of their invoices improved. A G2 reviewer mentioned, “Even the free account has a professional, polished looking invoice at the end. A client actually complimented me on it!” This highlights how Zoho Invoice’s templates can impress not just users but their clients too.

The time tracking and project billing features receive particular praise. Freelancers who bill hourly note that the built-in timesheet saves them time and ensures they capture all billable hours. Customer support also gets favorable mentions; though primarily via email, responses are helpful, and extensive online documentation means users rarely feel stuck.

Negative Feedback: Some users express frustration with the annual invoice cap. Small businesses that approach or exceed the 500 invoices/year limit find it limiting that they need to upgrade or find workarounds. A Reddit user shared that Zoho Invoice is great for “low invoicing needs” but “once you pass 500 invoices you [have to] start paying or can restart your invoice trail for the next 500.”

Some users wish for more advanced features. The most common requests are for accounting-related functions like bank reconciliation or balance sheet reports. These users sometimes feel they need to eventually migrate to Zoho Books or another tool.

A few users expected Zoho Invoice to integrate more directly with Zoho Inventory or other Zoho apps and were disappointed to learn that full integration requires moving to Zoho Books or using Zoho Flow for some connections.

Regarding usability, while most find Zoho Invoice easy to navigate, some mention that with so many features, it can take time to discover everything. Others note the lack of a direct “invoice viewed” notification (read receipt) would be helpful for tracking client interactions.

Is Zoho Invoice really free forever?

Yes, Zoho Invoice is completely free with no hidden costs or subscription fees. Zoho made this decision in 2021 to support small businesses. The free plan includes all core features like invoicing, expense tracking, time tracking, and payment processing, though it has usage limits (500 invoices/year, 2 users, 3 projects).

What are the limitations of Zoho Invoice’s free plan?

The free plan allows up to 500 invoices per year, 2 users per organization, 3 projects for time tracking, 1,000 clients, and 1GB of document storage. If you exceed these limits, you’ll need to upgrade to Zoho Books or another solution.

Can I accept online payments with Zoho Invoice?

Yes, Zoho Invoice integrates with over 10 payment gateways including Stripe, PayPal, Square, and Authorize.net. You can offer multiple payment options to clients and even set up automatic recurring billing for subscription services.

Does Zoho Invoice work on mobile devices?

Absolutely. Zoho Invoice offers highly-rated mobile apps for iOS and Android (4.8/5 stars) that provide nearly full functionality. You can create invoices, track expenses with receipt photos, log time, and send invoices directly from your phone.

Can I customize my invoices in Zoho Invoice?

Yes, Zoho Invoice provides extensive customization options. You can modify templates to match your brand’s logo, colors, and layout preferences. You can also add custom fields, adjust address formats, and include digital signatures through Zoho Sign integration.

How does Zoho Invoice compare to QuickBooks and FreshBooks?

While QuickBooks and FreshBooks offer more advanced accounting features, they require monthly subscriptions ($15-30/month). Zoho Invoice provides comparable invoicing functionality for free, making it ideal for freelancers and small businesses that don’t need full accounting software.

What happens if I exceed the 500 invoice limit?

When you approach the 500 invoice annual limit, you’ll need to either upgrade to Zoho Books (starting at $20/month) which offers higher limits and full accounting features, or migrate to another invoicing solution. Zoho doesn’t offer a paid upgrade option within Zoho Invoice itself.

Can multiple team members use Zoho Invoice?

Yes, the free plan supports up to 2 users per organization. You can assign different roles and permissions to each user, controlling what they can access and modify. For larger teams, you’d need to upgrade to Zoho Books which has no user limits on paid plans.

Is Zoho Invoice worth it for freelancers and small businesses? Absolutely. It’s hard to beat the value proposition: a feature-packed invoicing app that’s completely free and designed specifically for independent professionals and small teams.

The strengths of Zoho Invoice are compelling. Its comprehensive features mean you won’t quickly outgrow it functionally—only in volume might you eventually need more. The ability to automate recurring invoices and accept online payments saves time and speeds up payments. The customization options ensure your invoices reflect your brand, enhancing client perception.

Zoho Invoice is ideal for freelancers, solopreneurs, and small businesses with straightforward invoicing requirements. If you anticipate sending thousands of invoices or require advanced accounting/inventory features immediately, you may need to consider Zoho’s paid offerings or alternatives.

When comparing to competitors, Zoho Invoice holds its own remarkably well. Paid invoicing services like FreshBooks or QuickBooks charge monthly fees that add up over time. Wave is a close competitor but lacks some of Zoho’s project/time tracking features and displays ads.

Zoho Invoice earns a strong 4.6 out of 5 stars based on its feature set, ease of use, and exceptional value proposition. The software performs excellently in its core functionality, offering an impressive balance of simplicity and capability that aligns perfectly with freelancer and small business needs.

The only notable limitations are the usage caps on the free plan and the lack of full accounting features. However, neither significantly diminishes the software’s overall value for its target audience.