Highlights

Xero website

Xero is a leading cloud-based accounting platform designed to simplify financial management for freelancers and small businesses. Founded in 2006 in New Zealand, Xero has grown into a global solution with over 4.2 million subscribers across major markets like the US, UK, Australia, and beyond.

Its appeal lies in making bookkeeping tasks accessible to non-accountants – you can send invoices, track expenses, and reconcile bank transactions from any device with ease. Freelancers, sole traders, and small business owners often find Xero perfect for their accounting needs thanks to features that save time and reduce paperwork.

Xero’s user-friendly design and automation capabilities let business owners spend less time on spreadsheets and more time growing their business. It was even recognized as the top accounting software for small businesses in early 2025, underscoring its strong reputation in the market.

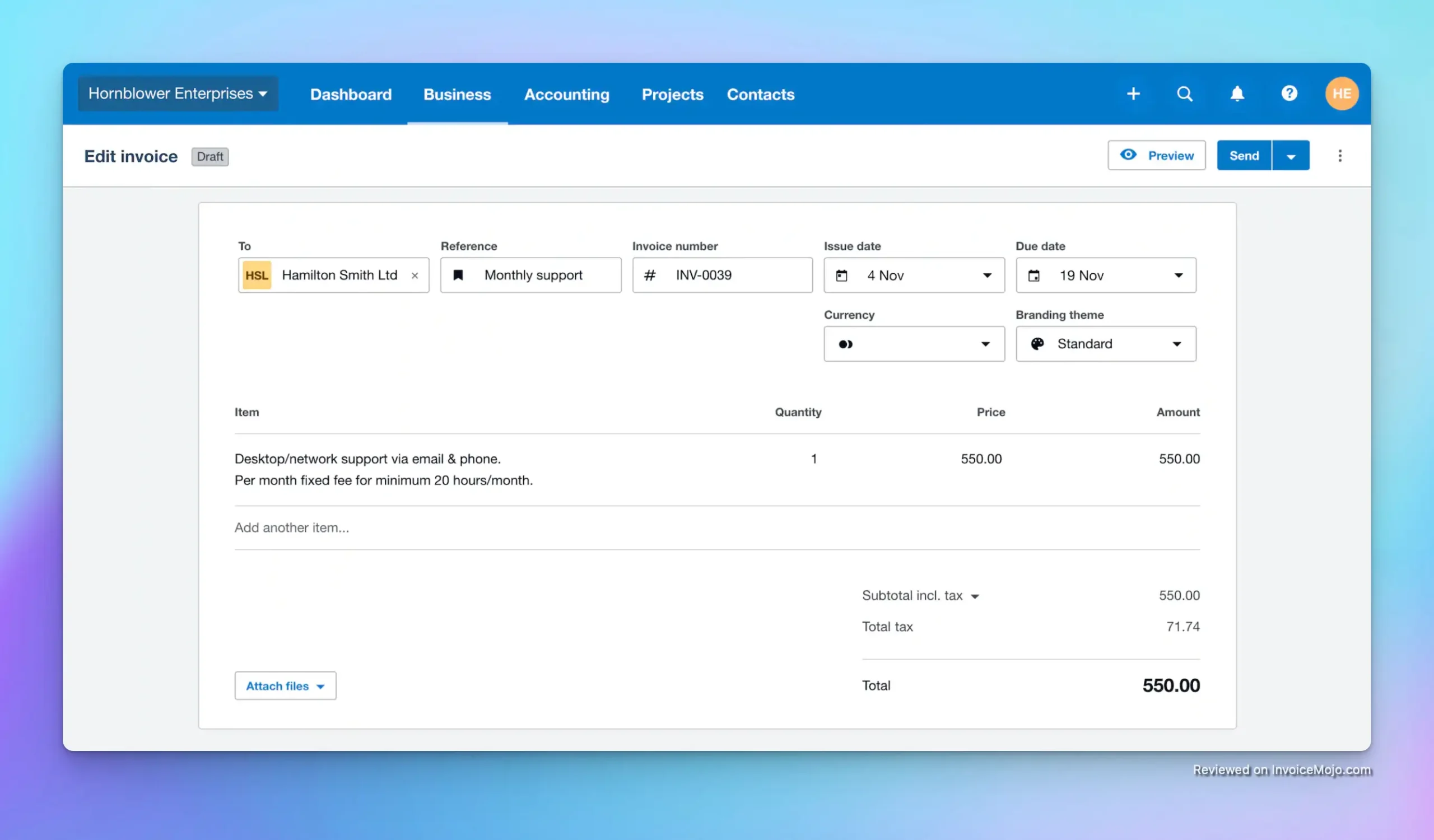

Invoicing is one of Xero’s standout strengths. The software makes it simple to create professional-looking invoices with your own branding and logo. You can generate and send invoices (or quotes) in a few clicks, and even do it on the go with Xero’s mobile app.

For example, a freelance designer could quickly bill a client from their phone right after completing a job. Xero also supports recurring invoices – perfect for retainer services or subscription-based businesses – and it can send automatic payment reminders to clients for overdue invoices.

This means Xero will politely nudge your customers via email when an invoice due date passes, saving you the awkward collections calls. Another handy touch is that Xero lets you email invoices directly from the platform (with a personalized message), and you can see when the client has opened the invoice.

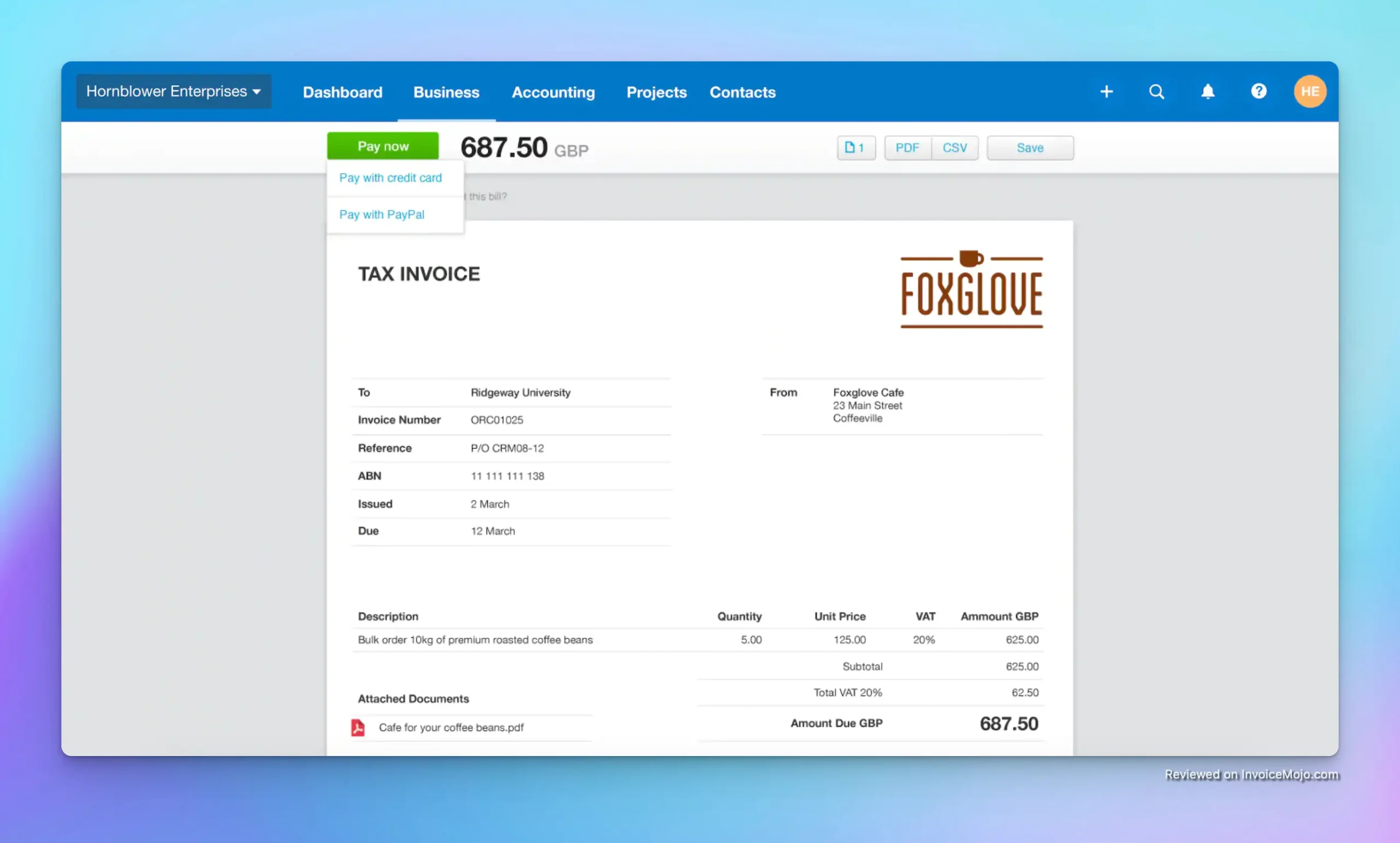

Getting paid is faster too: Xero integrates with popular payment gateways like Stripe and PayPal, so clients can pay online through the invoice. All these invoicing features help you maintain a healthy cash flow with minimal manual effort – a big win for any small business owner.

Creating an invoice in Xero

Ask any small business owner about bookkeeping headaches, and many will mention reconciling bank statements. Xero shines here by making bank reconciliation incredibly smooth and smart.

You can connect Xero directly to your bank accounts – it supports connections to over 21,000 banks and financial institutions worldwide – which allows your transactions to flow into Xero automatically each day. Xero then tries to match bank transactions with your recorded income and expenses.

For instance, if you invoiced a client $500 in Xero and they pay you via bank transfer, Xero’s reconciliation screen will automatically suggest matching that $500 deposit to your invoice. In one click, that transaction is reconciled.

If Xero isn’t sure how to categorize something (say a $20 unknown charge), you can create a rule (e.g., always assign charges from “Joe’s Gas Station” to the Travel Expenses category). Over time, these rules and matches mean Xero can auto-categorize many of your transactions, drastically reducing data entry.

The interface gives a clear “OK” or “Match Found” prompt, so even non-accountants can confidently reconcile accounts daily rather than postponing it to month-end. This up-to-date bank reconciliation provides an accurate view of cash flow at all times.

![]()

Expense tracking in Xero

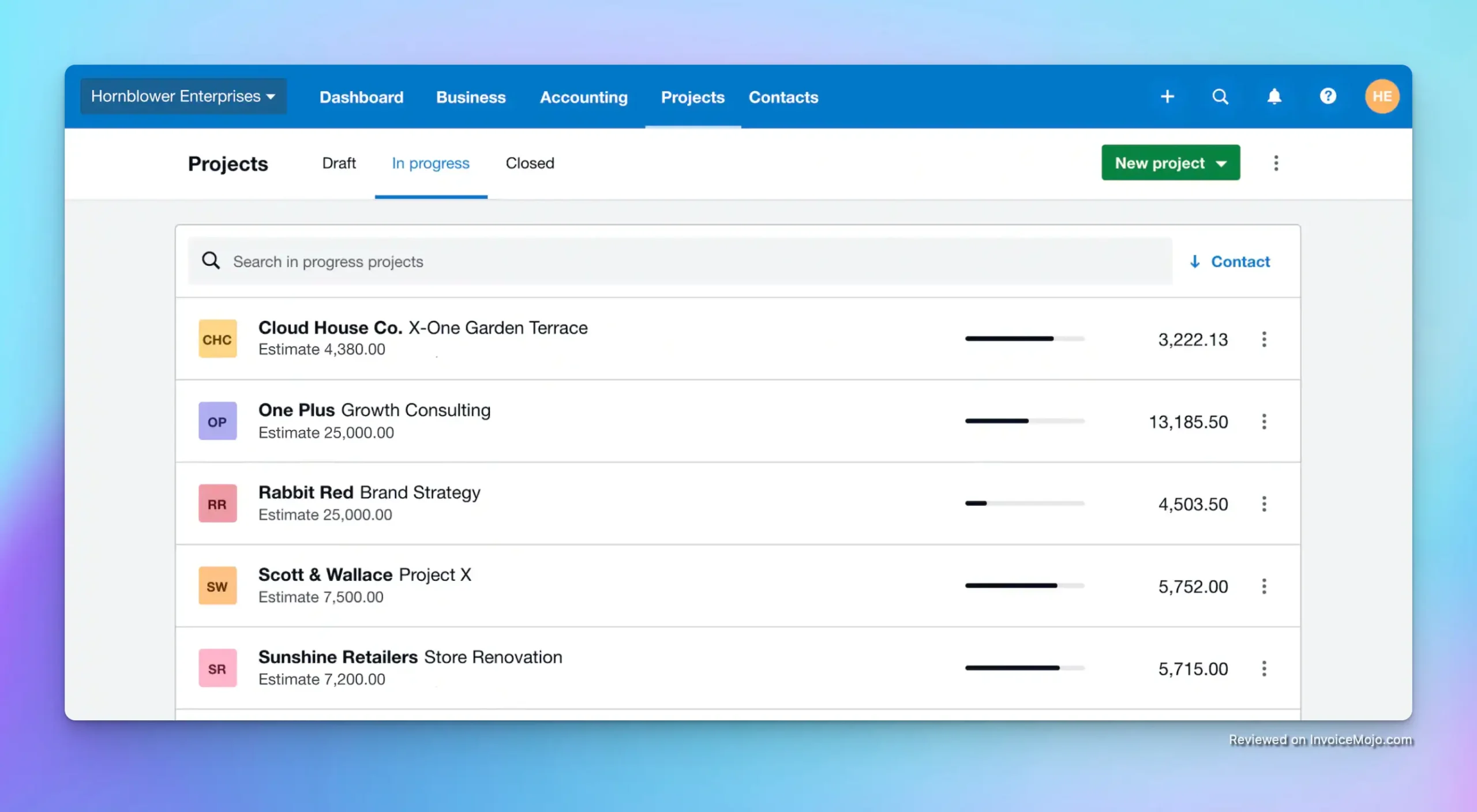

For service-based businesses, Xero’s project tracking feature is a great bonus. Included with the Established (Premium) plan, Xero Projects allows you to monitor project-specific finances – think of it as lightweight project management focused on job costing.

You can create a project in Xero, allocate expenses and time to it, and then bill customers for that project’s work. For example, imagine you run a small marketing agency. You could set up a project for each client campaign. As team members work and log time (Xero Projects has a built-in timer and time entry), and as you incur expenses (like buying stock photos for the campaign), you assign those costs to the project.

Xero will show you project profitability in real time, calculating your revenue vs. costs. When the project is done, you can generate an invoice for all billable hours and expenses in one go, right from the project. This ensures nothing slips through the cracks and you get paid for all the work completed.

Users find this useful for keeping client jobs on budget and seeing which projects are most profitable. This feature makes Xero especially suited to contractors, agencies, and consultancies who juggle multiple jobs.

Project management with Xero

No software can do everything, but Xero comes close thanks to its vast integrations marketplace. Xero connects with over 1,000 third-party apps and services, which is one of the largest ecosystems in the accounting software space.

This means you can plug Xero into the other tools you use to run your business. For instance, you can integrate e-commerce platforms like Shopify or WooCommerce with Xero to automatically import online sales and fees each day. You can connect payment processors (Stripe, Square, PayPal) so that when customers pay you, the transactions are recorded in Xero instantly.

Xero also has integrations for CRM software (to sync customer contacts), for project management and time tracking apps (to push time entries into Xero for invoicing), and for inventory management systems. In total, the Xero App Store covers everything from POS systems to payroll services.

One notable integration is payroll: in the U.S., Xero integrates with Gusto for full-service payroll, letting you handle payroll taxes and direct deposits seamlessly through a partner. (In some countries like the UK and Australia, Xero offers its own built-in payroll functionality as well.)

This flexible approach means you can choose the best-in-class apps you need and trust that they will work with Xero. Additionally, Xero’s accounting can connect to your bank directly for bank feeds (as mentioned, 21,000+ financial institutions are supported), ensuring that data flows in without manual imports.

Accepting online payments with Xero

Xero offers three main subscription plans in 2026, each designed for different business needs. In the U.S. these plans are called Early, Growing, and Established (in some regions they are labeled Starter, Standard, and Premium, respectively, but the features are equivalent). All plans include the core accounting tools, such as invoicing, billing, bank reconciliation, and basic reporting, with higher tiers adding more advanced capabilities. Importantly, Xero does not charge per user: even the lowest tier allows unlimited users, so your whole team (and accountant) can access the system without extra fees. Xero pricing is month-to-month (no annual contracts required), and a 30-day free trial is available on any plan. Below is a breakdown of Xero’s pricing tiers as of 2026:

| Plan (Tier) | Monthly Price (USD) | Best For | Key Limits/Features |

|---|---|---|---|

| Early (Starter) | ~$20/month | Freelancers or new solo businesses just starting out | Caps of 20 invoices/quotes and 5 bills per month; bank reconciliation, basic reporting, and Hubdoc receipt capture included |

| Growing (Standard) | ~$47/month | Small businesses with regular transactions (no foreign currency needs) | Unlimited invoices and bills; includes all Early features plus bulk transaction reconciliation and optional add-ons like Inventory (stock) management |

| Established (Premium) | ~$80/month | Established or growing businesses that need advanced features or multiple currencies | Unlimited invoices/bills; includes all Growing features, multi-currency support, project tracking, expense claims, and the ability to add Analytics Plus for advanced cashflow forecasting |

Pricing as of 2026. Regional pricing may vary. For example, the Starter plan is around £15 in the UK, but feature limits remain the same. Xero often runs promotions for new customers, such as 50-90% off for the first few months.

Each plan is tailored to a stage of business growth. The Early/Starter plan is very affordable but intentionally limited: it works for a freelancer or consultant who only sends a few invoices a month. If you exceed 20 invoices or 5 bills in a month, you’d need to upgrade.

The Growing (Standard) plan is the most popular choice for small businesses, as it removes those transaction caps and lets you comfortably manage a higher volume of invoices and expenses. Growing plan users get everything in Early, so no features are lost in upgrading.

Finally, the Established (Premium) plan unlocks the full power of Xero, crucially adding multi-currency accounting (a must-have if your business transacts in, say, both USD and EUR) and including the Projects and Expenses modules at no extra cost.

One thing to note is Xero’s add-ons: some functionality like advanced analytics (Analytics Plus) or enhanced inventory management (Inventory Plus) can be added to certain plans for an extra fee. However, many small businesses won’t need these add-ons right away.

From a pricing perspective, Xero is competitively positioned in the market. Its mid-tier plan (Growing at ~$46) is often significantly cheaper than equivalent plans from QuickBooks Online or FreshBooks when you factor in multiple users. For example, QuickBooks Online’s “Plus” plan (comparable functionality) can cost over double Xero’s Growing plan price, and QuickBooks also limits the number of users unless you pay more.

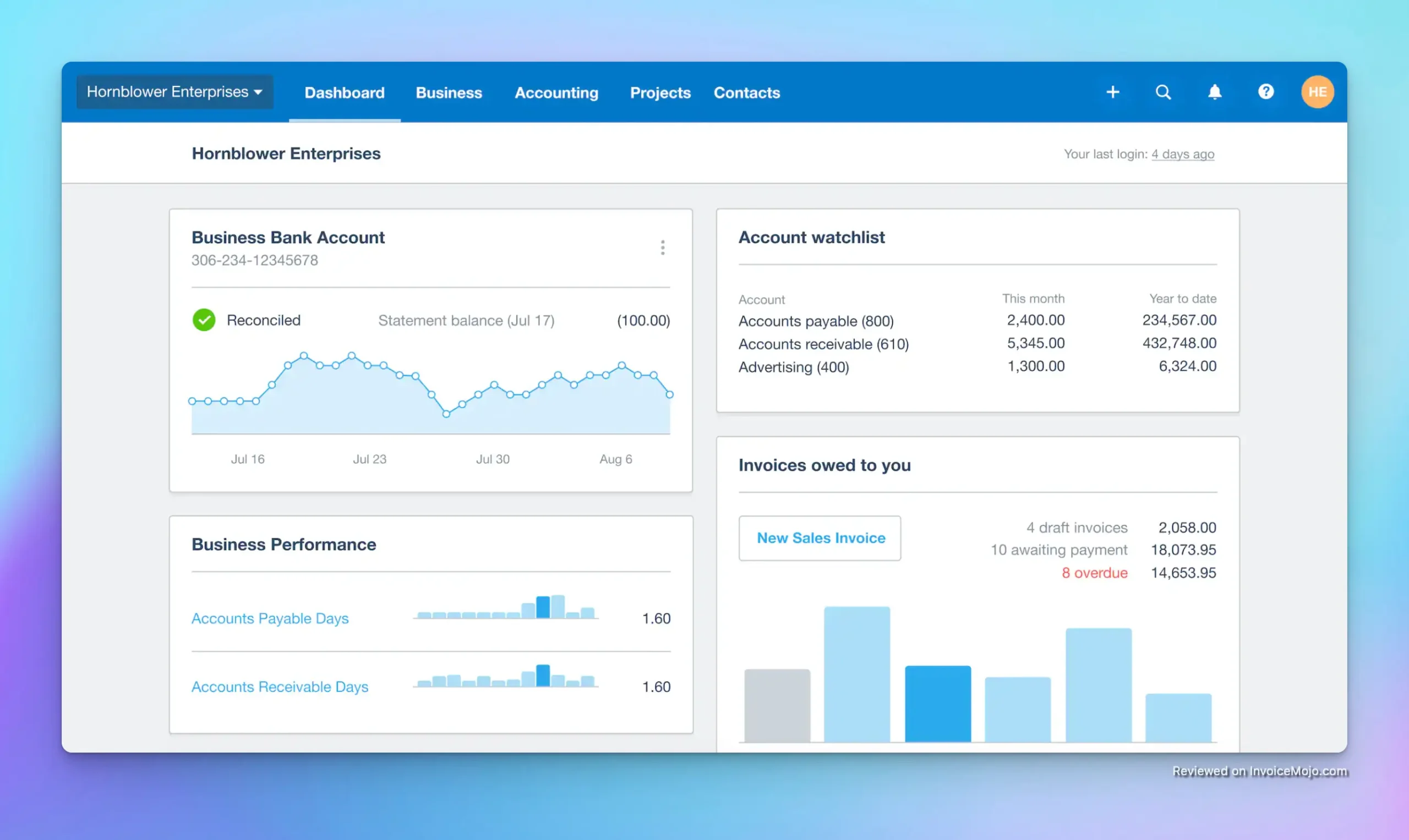

Xero Dashboard

Comprehensive Feature Set: Xero offers a complete suite of accounting features (invoicing, bills, bank reconciliation, inventory, projects, etc.), meaning you likely won’t need a second software for any core financial tasks. It’s essentially an all-in-one solution for small business accounting.

Cloud Access & Collaboration: Being cloud-based, Xero lets you access your finances anywhere and on any device. Multiple users can work simultaneously, and Xero allows unlimited users on all plans (no extra per-user fee), ideal for teams and accountants to collaborate.

Ease of Use & Automation: Xero is generally easy to use with an intuitive dashboard, and it automates repetitive tasks. Users praise how “the dashboard is great” for navigating routine tasks like invoicing and bank reconciliations. Automated bank feeds, smart reconciliation matches, and recurring invoices all save you time.

Competitive Pricing: Xero’s plans are affordably priced for the feature set you get, often undercutting competitors. Its mid-level plan costs less than half of what some QuickBooks plans charge, especially when you consider multiple users. There’s also a free 30-day trial and frequent discounts for new users.

Strong Integrations Ecosystem: With over 1,000 integrations, Xero connects with a vast range of third-party apps. This flexibility means you can sync Xero with your CRM, e-commerce site, payment processors, and more, streamlining your workflow across different business tools.

Scalability for Small Businesses: Xero can scale with your business from a one-person startup to a growing company with more complex needs. You can start on a basic plan and upgrade to add multi-currency, project tracking, and advanced analytics as your operations expand. There’s no need to switch platforms as you grow.

Mobile App: Xero’s mobile app is highly rated, allowing you to send invoices, reconcile transactions, and capture receipts from your phone. This on-the-go access is perfect for busy entrepreneurs.

Learning Curve for Beginners: While Xero is user-friendly, it can feel daunting at first if you’re completely new to accounting software. Some users report a steep learning curve initially. Xero has a lot of features and accounting concepts (like chart of accounts, reconciliation) that may require a bit of learning for true novices.

Limited Invoice Customization: Xero’s invoice templates cover the basics well, but customization is somewhat limited without using Xero’s advanced template editor or third-party tools. Users have noted a lack of deep customization in invoicing (for example, inability to easily rearrange certain fields). It works for most, but perfectionists might find the invoice design options slightly constrained compared to some competitors.

No Direct Phone Support: Xero’s customer support is primarily via email and online tickets. There isn’t a phone number or live chat for immediate help. While the support team is available 24/7 and generally responsive by email, the absence of real-time support can be frustrating if you encounter an urgent issue.

Occasional Bank Feed Glitches: For the most part Xero’s bank feeds are reliable, but there have been instances of transactions not importing or bank connections requiring reauthorization. Such glitches are infrequent, but when they occur it can cause reconciliation gaps that need manual fixing.

Feature Gaps in Entry Plans: The Starter/Early plan’s limits (only 20 invoices and 5 bills per month) are restrictive for many businesses. You may outgrow it quickly and be forced to upgrade. Also, some useful features like multi-currency, expense claims, and projects aren’t available on lower tiers. Essentially, to get the full Xero experience, you need the highest plan, which comes at a higher cost.

Interface Updates and User Frustrations: Xero has been modernizing its interface (e.g., the “new invoicing” module replaced the classic version). Changes like these have drawn some negative feedback from longtime users who preferred the old ways. A few users feel that certain updates haven’t hit the mark, especially around the invoice screen and reports.

Nothing speaks louder than the experiences of real users. Overall, Xero enjoys positive reviews on most software platforms, though feedback is mixed in some areas. On G2 Crowd, for example, Xero holds an average rating of about 4.3 out of 5 stars, based on hundreds of reviews.

Users on G2 frequently praise Xero’s ease of use and the time saved on bookkeeping tasks. One reviewer noted that “Xero is super easy to use and great for people like me who work from home. The dashboard is great and easily links to day-to-day routine tasks such as raising invoices or reconciling bank accounts.” This sentiment of a clean interface and efficient workflow comes up often.

Another user highlighted how Xero simplifies payroll integration and daily usage, mentioning that viewing payslips or schedules is “easy enough” when Xero is paired with compatible apps (such as workforce management tools). Many business owners also love the fact that multiple users can collaborate in Xero without extra cost: a point that comes through in reviews from growing teams.

On the other hand, Trustpilot reviews paint a more cautious picture with an average rating around 3.7 out of 5. Some long-time users have voiced frustration over recent changes and support. For instance, Xero’s rollout of a new invoicing interface drew criticism from a subset of users who preferred the older version.

Other negative reviews commonly cite the limited customer service channels, as Xero relies on email support which can be slow in urgent situations. It’s worth noting that satisfied users are less likely to post on sites like Trustpilot, which sometimes skew toward unhappy experiences

In summary, users are saying that Xero significantly streamlines their accounting, with strong invoicing and bank reconciliation capabilities that make bookkeeping much easier. The ability to have your accountant log in remotely, the seamless bank feeds, and helpful reports are often praised. On the flip side, users want to see improvements in customer support responsiveness and for Xero to be careful when overhauling features that loyal users depend on.

Does Xero have a free trial or free plan?

Xero offers a 30-day free trial for any of its plans with full features, no credit card required. There’s no free-forever plan, though. After 30 days, you’ll need to choose a paid subscription.

Is Xero easy to learn and use for beginners?

Generally yes: Xero is designed with small business owners in mind, not just accountants. The interface is modern and intuitive, with guided prompts for common tasks. There is a learning curve, but Xero offers extensive tutorials and help resources.

Do I need an accountant to use Xero, or can I manage on my own?

You can absolutely use Xero on your own. It’s designed to be DIY-friendly for day-to-day bookkeeping. That said, an accountant’s help with setup and periodic reviews is valuable, especially for taxes and compliance.

Can Xero handle payroll and taxes?

Xero handles sales taxes well. For payroll in the US, Xero integrates with Gusto. In the UK, Australia, and New Zealand, Xero offers built-in payroll. For income taxes, Xero provides the financial reports needed for filing but isn’t tax preparation software.

What kind of customer support and help can I expect from Xero?

Xero provides 24/7 email-based support and a comprehensive online Help Center. There’s no phone support, which some users find limiting. Many questions can be answered quickly by searching Xero’s knowledge base.

Does Xero integrate with my bank and other business tools?

Very likely yes. Xero connects with over 21,000 financial institutions and 1,000+ third-party apps, including e-commerce platforms, payment processors, CRMs, and more. The integration capabilities are among the most extensive in the industry.

Xero earns a solid 4.2 out of 5 stars based on its comprehensive feature set, automation capabilities, and excellent value for money. The software excels in its core accounting functions, offering an impressive balance of sophistication and usability that serves both accounting novices and professionals effectively. The platform’s extensive integration ecosystem and unlimited user access across all plans make it particularly attractive for growing businesses.

The main drawbacks are the learning curve for complete beginners and the email-only customer support, which can be limiting during urgent situations. Additionally, the entry-level plan’s transaction limits force many users to upgrade sooner than expected, though this doesn’t significantly impact the software’s overall value proposition.

Is Xero the right accounting solution for you? For many freelancers, entrepreneurs, and small businesses, the answer is a resounding yes. Xero combines a user-friendly, cloud-based design with the robust features of traditional accounting software, striking a balance that appeals to non-accountants and finance pros alike.

Its strengths lie in automation and efficiency – recurring invoices, automatic bank reconciliation, and integrated receipt capture take laborious tasks off your plate. The platform’s flexibility (unlimited users, tons of integrations) means it can adapt as your business grows and your needs become more sophisticated.

Plus, with multi-currency support, project tracking, and advanced analytics available, Xero is capable of handling a wide array of small-to-medium business scenarios. It’s not surprising that Xero has been awarded top honors in the small business accounting arena and continues to earn high marks for customer satisfaction.

That said, Xero isn’t perfect – total beginners should be prepared for a learning curve, and the reliance on email support might be a drawback if you value immediate troubleshooting. Very large or complex enterprises might also find Xero’s scope limiting (those cases might warrant an ERP or more specialized software).

But for its target market of small and growing businesses, Xero delivers tremendous value. Its affordable pricing and time-saving tools can actually pay for themselves by helping you avoid costly bookkeeping mistakes and freeing up hours each week.

If you’re tired of wrestling with spreadsheets or outgrowing manual invoicing, give Xero’s free 30-day trial a go. There’s no credit card required, so you can test drive features like invoicing, bank feeds, and reporting with zero risk. Imagine having your invoices sent, expenses tracked, and books reconciled while you focus on your business – Xero makes this a reality.