Efficient invoicing stands at the core of maintaining healthy cash flow and professional client relationships. PayPal Invoicing stands as an accessible solution integrated within one of the world’s most recognized payment platforms. With over 430 million active users globally, PayPal’s invoicing system combines simplicity with worldwide reach, making it particularly appealing for freelancers and small businesses operating in both local and international markets. PayPal Invoicing allows users to create and send professional invoices directly from their PayPal account. The system streamlines the billing process while offering seamless payment integration, allowing clients to pay invoices through various methods including credit cards, debit cards, and PayPal accounts. In 2026, this invoicing software continues to be a popular choice for businesses of all sizes seeking to simplify their billing processes. This review examines whether PayPal Invoicing capabilities meet today’s business needs, exploring its features, pricing structure, and real-world performance based on paypal invoicing reviews from users. We’ll help you understand if PayPal Invoicing provides good value compared to other invoicing software like QuickBooks, FreshBooks, or Zoho, or if you should consider alternatives.

PayPal Invoicing Website

PayPal Invoicing includes a range of features designed to simplify the invoicing process for small businesses and freelancers. In this section, we’ll examine how PayPal Invoicing stands compared to traditional invoicing software like FreshBooks, QuickBooks, and Xero. Here’s what you can expect:

You can quickly create professional-looking invoices with several customization options:

While not as extensive as some dedicated invoicing software, these customizable invoice options are sufficient for most small businesses to create and send professional invoices that reflect their brand. Users who need highly customizable invoice designs may find the customization options somewhat restrictive compared to specialized solutions like FreshBooks or Zoho.

One of PayPal Invoicing’s strongest advantages is the variety of payment methods it supports:

This flexibility in payment methods makes it easier for clients to pay invoices using their preferred method, potentially helping you get paid faster and improving cash flow. When clients receive an invoice, they can choose to pay through their PayPal account or use other options, providing an enhanced client experience compared to some competing invoicing software with more restrictive payment options.

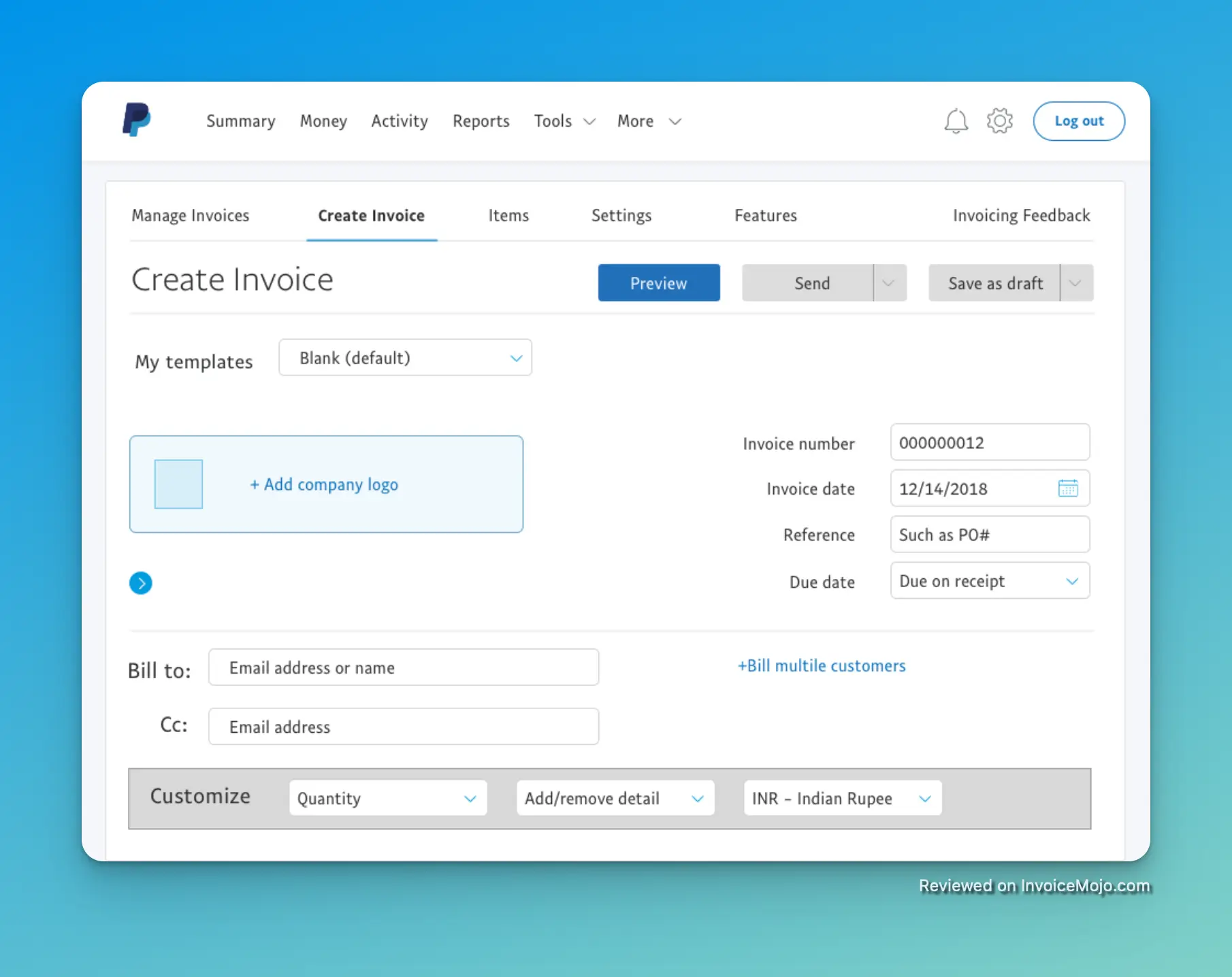

Invoice management in PayPal

The platform provides a centralized dashboard for managing invoices and all your invoicing activities:

This system helps you manage invoices and maintain an overview of your outstanding and completed invoices, helping you stay organized and on top of your accounts receivable. The ability to track an invoice from sent to paid status is a significant advantage for businesses looking to streamline their payment process.

PayPal Invoicing helps streamline your billing workflow with:

These automation features help reduce the administrative burden of managing invoices and following up on payments. While PayPal Invoicing offers basic recurring invoices and expense tracking, user reviews suggest that the recurring invoice functionality isn’t as robust as some dedicated invoicing software solutions.

Creating an invoice in PayPal

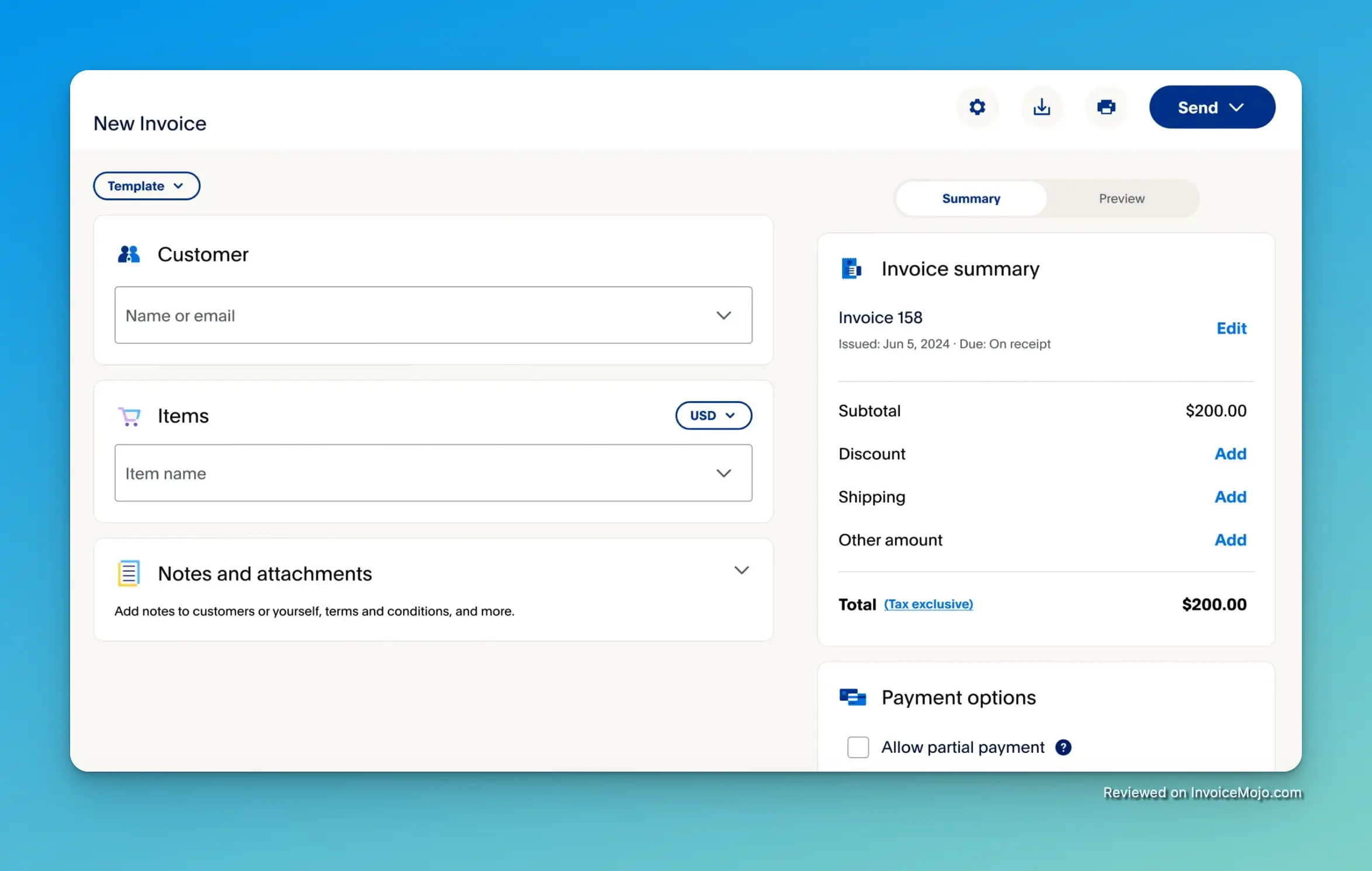

For businesses that work with deposits or installment payments, PayPal Invoicing offers:

This functionality is particularly useful for service-based businesses that require deposits or work with payment plans. When you send invoices with partial payment options, clients can pay in installments, making it a budget-friendly option for them while ensuring you receive steady payments. This feature helps streamline the invoicing process for businesses with flexible payment arrangements.

Beyond standard invoicing, the platform allows you to:

This feature streamlines the pre-sale process, creating a smooth transition from quote to invoice once a client approves your proposal.

The PayPal Business app extends invoicing capabilities to mobile devices:

For busy entrepreneurs who aren’t always at their desk, this mobile functionality provides valuable flexibility.

PayPal Invoicing includes basic reporting features to help track your business performance:

While not as comprehensive as dedicated accounting software, these analytics provide useful insights into your cash flow and sales patterns.

For businesses operating internationally, PayPal Invoicing offers:

This makes PayPal Invoicing particularly attractive for businesses with international clients, though conversion fees apply.

PayPal Invoicing works within the broader PayPal ecosystem and offers some integration possibilities:

The integration options, while not as extensive as some competitors, can help streamline workflow for many small businesses.

PayPal Invoicing takes a different approach to pricing compared to most dedicated invoicing software. Instead of charging monthly fees or monthly subscription fees like QuickBooks, FreshBooks, or Zoho, PayPal Invoicing is free to use and makes its money through transaction fees when payments are processed. This makes it a budget-friendly option for freelancers and small businesses with variable income.

| Payment Type | Domestic Fee (US) | International Fee |

|---|---|---|

| PayPal Payments | 3.49% + $0.49 | Domestic fee + additional percentage-based fee |

| Cards & Alternative Payment Methods | 2.99% + $0.49 | Domestic fee + additional percentage-based fee |

The specific fees can vary by:

To understand how these fees translate to real-world costs, consider these examples: For a freelancer with 10 invoices per month at $500 each ($5,000 total):

For a small business with 50 invoices per month at $200 each ($10,000 total):

For a growing business with 100 invoices per month at $300 each ($30,000 total):

The “pay-as-you-go” model offers specific advantages:

However, for businesses with higher invoice volumes or larger transaction amounts, the per transaction fees can become substantial compared to flat-rate invoicing software. When comparing PayPal Invoicing with traditional accounting software, it’s important to consider that while accounting software typically includes more advanced features like detailed reporting and inventory management, PayPal Invoicing simplifies the process of sending professional invoices and accepting payments.

While the basic service is free, be aware of these potential additional costs:

Easy Setup and User-Friendly Interface

PayPal Invoicing offers an intuitive platform that requires minimal tech experience to get started. Users consistently praise its user-friendly interface that allows for quick invoice creation and management. According to user reviews, PayPal Invoicing is easy to use even for those with limited experience with invoicing software.

Zero Monthly Fees

Unlike many dedicated invoicing solutions that charge monthly subscription fees, PayPal Invoicing is free to use. You only pay when you receive payments, making it particularly attractive for businesses with inconsistent income streams or seasonal operations.

Widely Recognized and Trusted Brand

PayPal’s established reputation provides an implicit level of trust that can be valuable when billing clients. Many customers already have PayPal accounts and are familiar with the payment process, reducing friction during transactions.

Multiple Payment Options for Clients

Customers can pay invoices through various methods including credit cards, debit cards, and PayPal accounts. In most countries, clients don’t need a PayPal account to pay, which significantly expands your potential client base and makes it easier for them to complete payments.

Global Reach with Multi-Currency Support

For businesses working with international clients, PayPal Invoicing supports multiple currencies and operates in over 200 markets. This global functionality eliminates many barriers to international business without requiring separate integrations or accounts.

Automated Payment Reminders

The ability to set up automatic reminders for overdue invoices saves time and reduces the awkwardness of manually following up on unpaid bills. This feature helps improve cash flow by gently prompting clients about outstanding payments

Mobile Accessibility

The PayPal Business mobile app provides full invoicing functionality on the go, allowing busy entrepreneurs to create and send invoices, check payment statuses, and manage their business finances from anywhere. Users can access their PayPal business account and manage invoices directly from their smartphone, a significant advantage for businesses with mobile needs.

Quick Payment Processing

When clients pay invoices, funds typically appear in your PayPal account almost instantly, improving cash flow compared to some traditional payment methods that may take days to process.

Basic Sales Analytics

PayPal offers simple reporting tools that provide insights into sales trends and transaction data, helping business owners track payments and make more informed decisions about their finances. While not as robust as the detailed reporting available in dedicated accounting software like QuickBooks or FreshBooks, these analytics meet the basic business needs of many small businesses and freelancers.

No Spam Issues with Email Delivery

Some users report that PayPal’s invoice emails rarely get caught in spam filters, unlike some dedicated invoicing platforms.

Transaction Fees Can Add Up

While there’s no monthly fee, the transaction fee structure (3.49% + $0.49 for PayPal payments, 2.99% + $0.49 for cards) can become substantial for businesses with high transaction volumes or large invoice amounts. Many PayPal invoicing reviews cite this as a major drawback compared to flat-rate invoicing software that charges a set monthly fee regardless of transaction volume.

Limited Customization Options

Though PayPal allows basic branding with logos and color schemes, it offers fewer customization options compared to dedicated invoicing software. Users looking for highly personalized invoice designs may find the options restrictive.

Inconsistent Customer Support

Many users report challenges with PayPal’s customer service, citing slow response times and difficulty resolving issues.

Potential for Held Funds

PayPal sometimes places holds on payments, which can create cash flow problems, especially for new businesses. Several reviewers mentioned issues with delayed access to funds.

Limited Accounting Integration

While PayPal Invoicing provides basic financial tracking, it lacks the comprehensive accounting features or robust integration capabilities found in dedicated invoicing software and accounting software like QuickBooks, Xero, or FreshBooks. This is another common complaint in user reviews, highlighting the need for better integration with popular accounting platforms.

Recurring Invoice Limitations

Some users report difficulties setting mup effective recurring invoices that automatically send after each interval.

Higher International Transaction Fees

Businesses working with international clients face additional percentage-based fees for international transactions and potentially unfavorable currency conversion rates. When sending an invoice in a different currency, these fees can significantly impact profit margins. Many users who use PayPal for global transactions mention this as a drawback despite the platform’s excellent global reach.

Limited Reporting Features

While PayPal offers basic sales analytics, it lacks the in-depth financial reporting capabilities that some businesses may require for comprehensive financial management.

Invoice Cancellation Issues

Some users report that PayPal may occasionally cancel invoices unexpectedly.

Account Stability Concerns

PayPal accounts can sometimes be frozen if the system flags potential fraud, which can disrupt business operations.

To provide a balanced view of PayPal Invoicing, we’ve gathered feedback from various review platforms. Based on over 945 user reviews from 2 recognized software review sites, PayPal Invoicing reviews from 2026 present a mixed bag of opinions. Here’s what real users have to say about their experiences:

Small business owners consistently praise PayPal Invoicing for its ease of use and straightforward approach: “PayPal Invoicing streamlines the billing process by allowing businesses and individuals to create and send professional invoices. It helps track transactions, manage payments, and provides a secure platform for financial transactions. The benefits include faster payments, improved record-keeping, and a convenient way to conduct online transactions, ultimately enhancing efficiency and financial management.”

Freelancers particularly value how PayPal Invoicing helps them present a professional image to clients: “What I like best about PayPal Invoicing is its seamless and user-friendly interface. Creating and sending invoices is a breeze, and the platform provides a professional touch to the whole process. The customization options for invoices allow me to tailor them to my brand, giving off a polished and organized image to clients.”

Businesses operating internationally find significant value in PayPal’s global capabilities: “Because we work with international clients, finding a convenient means of payment was quite a hurdle. I was especially looking for a medium that kept track of work done and the payments for each task. This record should be available to both parties and this is how PayPal invoicing has worked efficiently for our usecase.”

Many users highlight the reliability of PayPal’s payment processing: “For business that is having international clients but does not have international presence, it is a challenge to do financial transaction. This is where paypal bridges the gap, and helps individuals and business provide service across geographies, and raise invoices/bills and accept payment in such a seamless and smooth manner.”

Transaction fees are a common point of criticism among users: “The biggest complaint I have about PayPal invoicing is the fee structure. While the convenience is undeniable, the transaction fees can add up, especially for larger invoices. It would be great to see more competitive pricing or transparent fee structures that make it easier for small businesses or freelancers to manage their finances without worrying about significant deductions.”

Some users report significant problems with customer support: “Nothing. It was difficult to use, interface was not intuitive and worst of all the invoice that was paid was not transfered to my account within 2 weeks of payment. I worked with Customer Support for several weeks to try and resolve the issue to no avail. Complete disaster. If you are considering Paypal Invoicing, RUN, this is a terrible product.”

More advanced users sometimes find PayPal Invoicing’s features too limited for their needs: “I have not yet been able to set up a recurring invoice that’s sent after each interval. I have to manually create the same invoice every week or fortnite even though the details are always the same.”

International users express frustration with currency conversion rates: “The service fees is bit on the higher side, and also the conversion rate offered is bit inferior compared to the prevalent market rates.”

PayPal Invoicing has no setup or monthly fees. Instead, fees are charged only when you receive payments. For US-based transactions, you’ll pay 3.49% + $0.49 for payments made through PayPal and 2.99% + $0.49 for payments made with credit/debit cards or alternative payment methods. International transactions incur additional fees, and rates may vary by country.

No, in most countries, customers don’t need a PayPal account to pay your invoices. They can pay using a credit card, debit card, or other payment methods like Venmo (where available). PayPal accounts are optional, which makes it easier for clients to complete payments.

Yes, PayPal allows basic customization of your invoices. You can add your company logo, choose from a few invoice templates, and customize certain fields with additional information. While the customization options aren’t as extensive as some dedicated invoicing software like FreshBooks or Zoho, you can create and send professional invoices that include your branding elements. Some users find the customizable invoice options sufficient, while others would prefer more advanced template design capabilities.

When a customer pays your invoice, the funds typically appear in your PayPal account immediately or within minutes. However, new PayPal accounts may experience temporary holds (up to 21 days) on their first payments until they establish a transaction history. The time to transfer these funds to your bank account can vary from 1-3 business days for standard transfers or within minutes for instant transfers (for an additional fee).

Yes, PayPal Invoicing allows you to set up recurring invoices, though availability and functionality may vary by region. You can schedule invoices to be sent automatically at regular intervals (monthly, weekly, etc.). This feature is particularly useful for subscription-based services or ongoing client relationships.

No, there’s no limit to the number of invoices you can create and send with PayPal Invoicing. Whether you’re sending one invoice a month or hundreds, the service remains free to use with fees applied only when payments are received.

Yes, PayPal Invoicing allows you to enable partial payments on your invoices. When creating an invoice, you can check the “Allow partial payments” option under payment settings. This feature is useful for deposits, installment plans, or situations where clients may not be able to pay the full amount at once. You can also set a minimum payment amount if needed.

You can send reminders for unpaid invoices both manually and automatically through PayPal. To send a manual reminder, find the unpaid invoice in your list, click the three-dot menu, and select “Remind.” You can also set up automatic reminders for unpaid invoices, which will be sent at predetermined intervals before and after the due date. These automatic reminders for unpaid invoices can be customized and are valuable for follow-ups and improving cash flow without requiring manual intervention.

Yes, PayPal Invoicing works internationally in over 200 markets and supports 25+ currencies. You can create invoices in your clients’ local currencies, making it easier for them to understand and pay. Be aware that international transactions incur additional fees and currency conversion charges.

After thoroughly examining PayPal Invoicing’s features, pricing, and user feedback, it’s clear that this solution is particularly well-suited for:

Freelancers and Solopreneurs: PayPal Invoicing offers an ideal balance of simplicity and functionality for independent professionals. With no monthly fees, easy setup, and straightforward invoice creation, it minimizes administrative overhead while providing basic invoicing capabilities. The mobile app makes it easy to create and send invoices on the go, perfect for busy freelancers juggling multiple responsibilities. For freelancers who prioritize simplicity and reliability over advanced features, PayPal Invoicing is an excellent choice.

Small Businesses with Modest Invoicing Needs: Companies that send a low to moderate volume of invoices (particularly those under $1,000 each) will find PayPal Invoicing cost-effective and sufficient for their needs. The transaction fee model works in favor of businesses with inconsistent invoicing patterns or seasonal operations.

Businesses with International Clients: PayPal’s global reach and multi-currency support make it exceptionally valuable for businesses working with international clients. The platform removes many barriers to cross-border commerce, allowing seamless invoicing and payment collection from customers worldwide. Despite higher fees for international transactions, the ability to easily send invoices in multiple currencies and accept payments from over 200 markets makes it a compelling choice for globally-oriented businesses.

New Businesses Looking for Simplicity: Startups and new business ventures benefit from PayPal Invoicing’s zero learning curve and immediate availability. There’s no need to research and implement complex systems when you’re just getting started—PayPal provides a ready-to-use solution that scales with your growth.

Online Sellers and E-commerce Businesses: Businesses already using PayPal for online sales will find the invoicing feature integrates seamlessly with their existing payment infrastructure, creating a unified system for managing all revenue streams.

Despite its strengths, PayPal Invoicing isn’t the ideal solution for everyone:

High-Volume Businesses: Companies that send numerous invoices monthly, particularly for large amounts, may find the percentage-based fee structure becomes prohibitively expensive compared to flat-rate invoicing software.

Businesses Needing Advanced Accounting Features: If your business requires comprehensive financial management beyond basic invoicing, including detailed reporting, inventory tracking, or tax preparation features, you’ll likely need dedicated accounting software like QuickBooks, Xero, or FreshBooks. PayPal Invoicing has limited accounting features compared to these specialized solutions.

Companies Requiring Extensive Customization: Businesses that need highly customized invoice designs or specialized invoice fields may find PayPal’s customization options too limiting for their brand presentation needs.

Businesses with Complex Workflow Requirements: Organizations with complex approval processes, detailed project tracking needs, or requirements for integration with other business systems may need more sophisticated solutions.

Growing Businesses Needing Scalable Solutions: While PayPal Invoicing works well for small operations, rapidly growing businesses may eventually outgrow its capabilities and need to transition to more comprehensive solutions.

PayPal Invoicing represents an excellent entry-level invoicing solution that shines in simplicity, global reach, and integration with PayPal’s trusted payment processing. Its greatest strengths lie in its accessibility—zero monthly fees, minimal setup requirements, and a user-friendly interface make it immediately usable for virtually any business owner who needs to quickly create, customize, and send invoices.

For freelancers and small businesses with straightforward invoicing needs, PayPal Invoicing offers considerable value, eliminating the need for separate invoicing and payment processing services. The mobile app further enhances its appeal for busy entrepreneurs who need to manage invoices on the go.

However, as businesses grow and their financial management needs become more complex, PayPal Invoicing’s limitations become more apparent. The transaction fee structure can become costly at higher volumes compared to flat-rate invoicing software, and the lack of advanced features may eventually necessitate a transition to more comprehensive solutions like QuickBooks or FreshBooks.

PayPal Invoicing earns our recommendation for freelancers, solopreneurs, and small businesses seeking a reliable invoicing solution with built-in payment processing. Its global capabilities make it particularly valuable for businesses with international clients who need to send invoices in multiple currencies. While not the most feature-rich option on the market, its combination of simplicity, trusted infrastructure for ensuring safe transactions, and zero monthly fees makes it a compelling choice for many small business owners looking to streamline their invoicing process.