Highlights

Invoicely Website

Invoicely is a cloud-based invoicing software designed to simplify billing for freelancers, entrepreneurs, and small business owners. This complete invoicing system enables users to create and send invoices, track time and expenses, and accept online payments from clients with ease. With over 100,000 users worldwide, Invoicely has gained popularity for its ease of use and generous free version.

What makes Invoicely stand out in 2026 is its balance of features and affordability. The platform supports multi-currency invoicing, letting you bill in any currency: ideal for global freelancers or businesses dealing with international clients. It also offers handy tools like time tracking features and expense management that integrate directly into your invoices, reducing the need for separate apps.

Because it’s a web-based app, Invoicely works on any device (Windows, Mac, or mobile) via your browser, and it also provides dedicated mobile apps for iOS and Android for invoicing on the go. Small businesses appreciate Invoicely’s straightforward dashboard and real-time reports, which give insight into income, expenses, and outstanding invoices at a glance. Using Invoicely helps businesses keep track of their financial health with minimal effort.

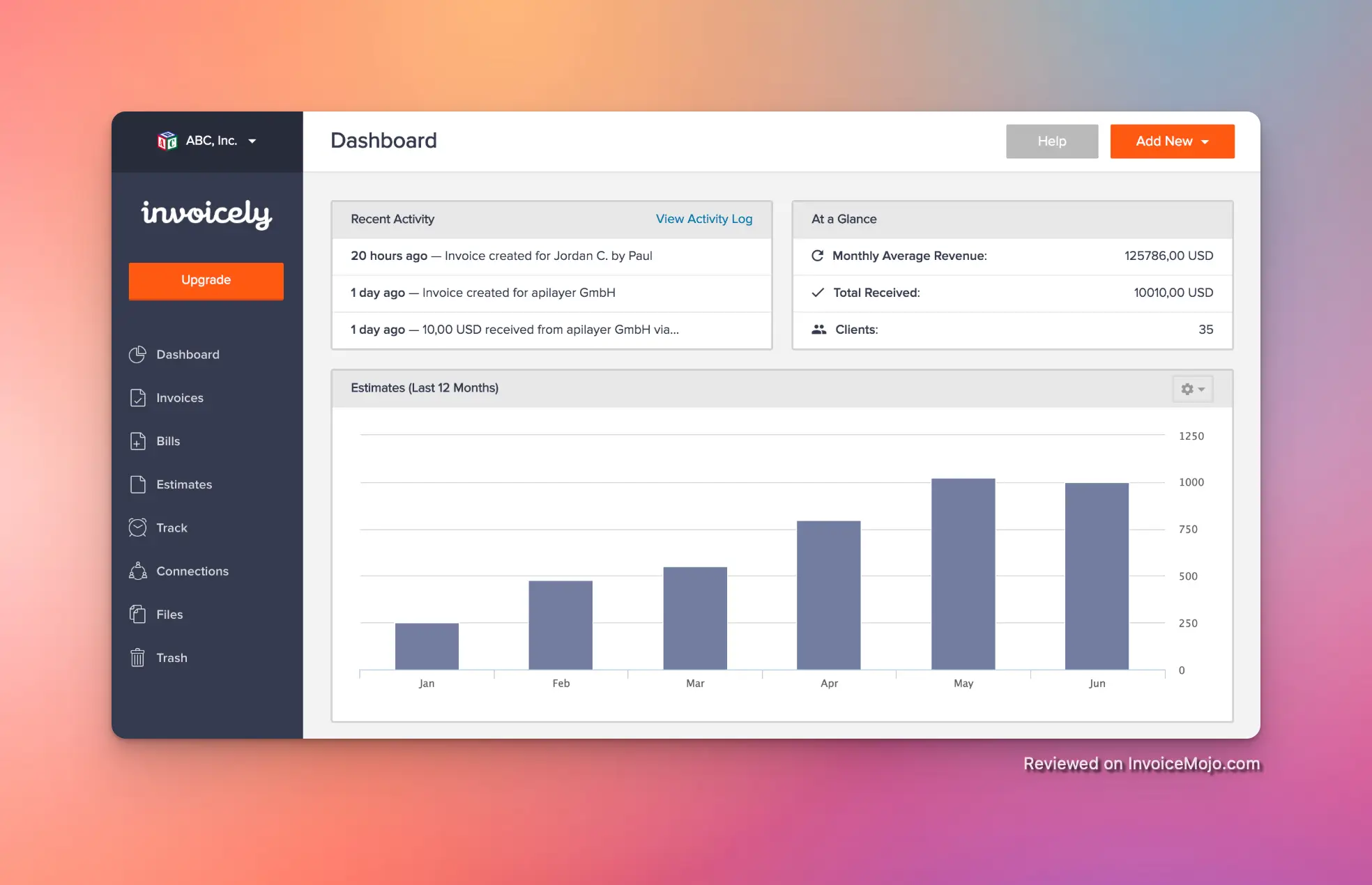

The Dashboard in Invoicely

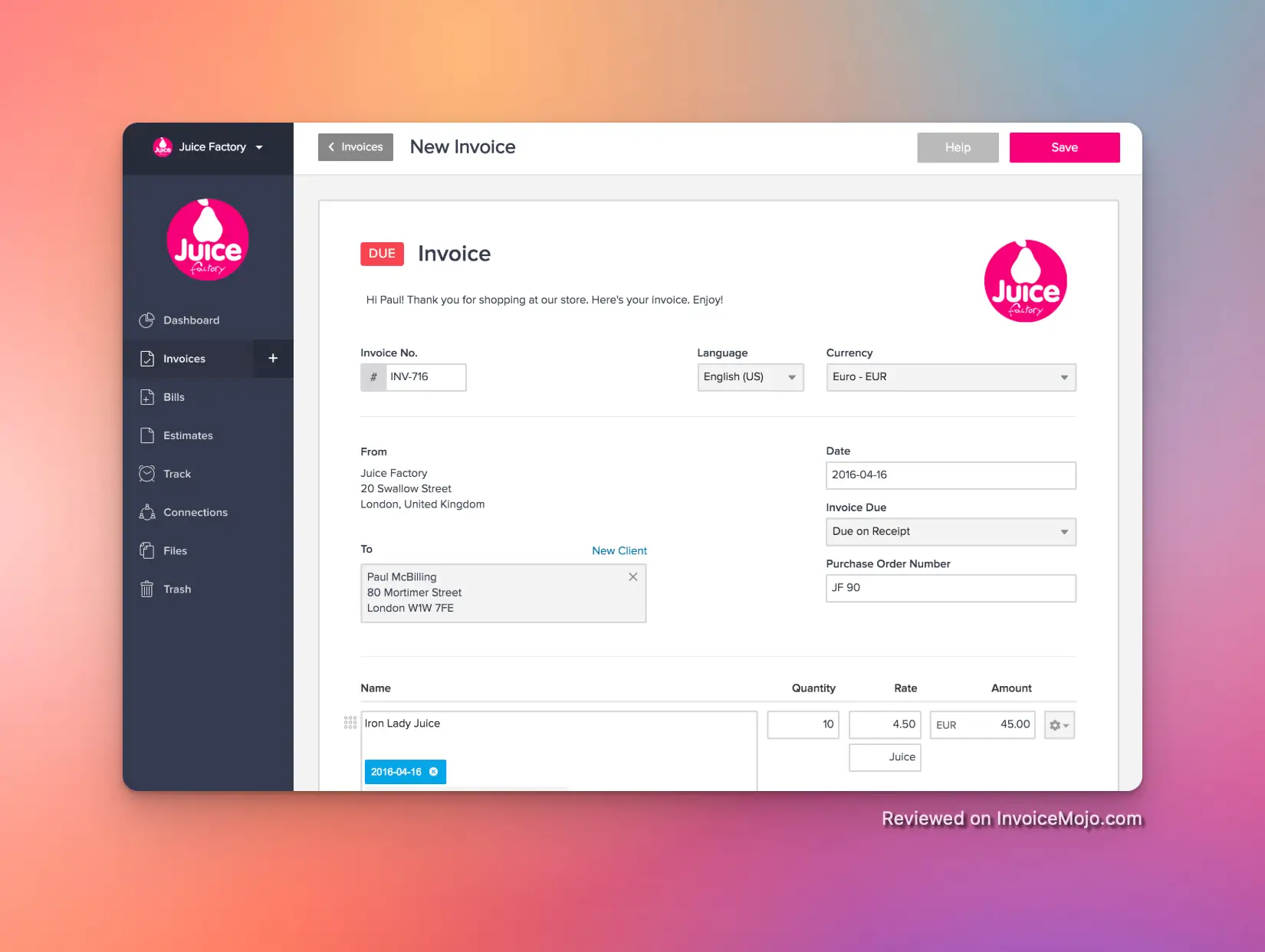

At its core, Invoicely excels at creating professional invoices and estimates quickly. You can create estimates/quotes and convert them to invoices with a click. The invoice editor lets you add your business logo, customize colors, and include details like itemized charges, taxes, shipping, and discounts.

Invoices can be created in any language or currency, which is great for bilingual businesses or those billing internationally. Each invoice can be delivered to clients via email or a shareable link, and clients can even view and pay invoices online with credit card payments or other methods.

Invoicely allows partial payments, so clients can make deposits or pay in installments, and it automatically records payment status. You can also issue payment receipts and set up automatic invoice reminders to nudge clients about overdue bills with a due date approaching.

Even on the free plan, you can send up to 5 invoices per month, which is often enough for freelancers with a few clients. All paid plans expand the invoice limits (up to unlimited on Enterprise) and allow attaching PDF copies of invoices to emails for a polished touch.

For estimates and quotes, Invoicely lets you create estimates for clients and then easily convert approved estimates into invoices, saving time. You can send unlimited estimates on all plans, including free. You’re also able to track estimate views and verify acceptance by clients, and even set automatic reminders for estimates that haven’t been responded to.

Creating an invoice in Invoicely

For service-based businesses and freelancers, time tracking is a critical feature, and Invoicely has it built in. You can log hours worked on projects and then seamlessly convert those hours into invoice line items. The platform includes a timer function as well, so you can start a stopwatch for a task and have the time automatically recorded to a project or invoice.

In addition, Invoicely provides expense tracking and even mileage tracking. You can record business expenses and categorize them, then choose to add billable expenses to client invoices with one click. If you drive for work, you can log mileage and apply a reimbursement rate that can flow into an invoice.

These features give Invoicely an edge as an all-in-one invoicing software: you’re not just sending bills, but also keeping tabs on your costs and billable time within the same app. While time and expense tracking are available on all paid plans, the Free plan has some limitations. The free version does allow tracking and managing expenses to some extent, but advanced tracking and reporting features are unlocked with paid subscriptions.

![]()

Time tracking in Invoicely

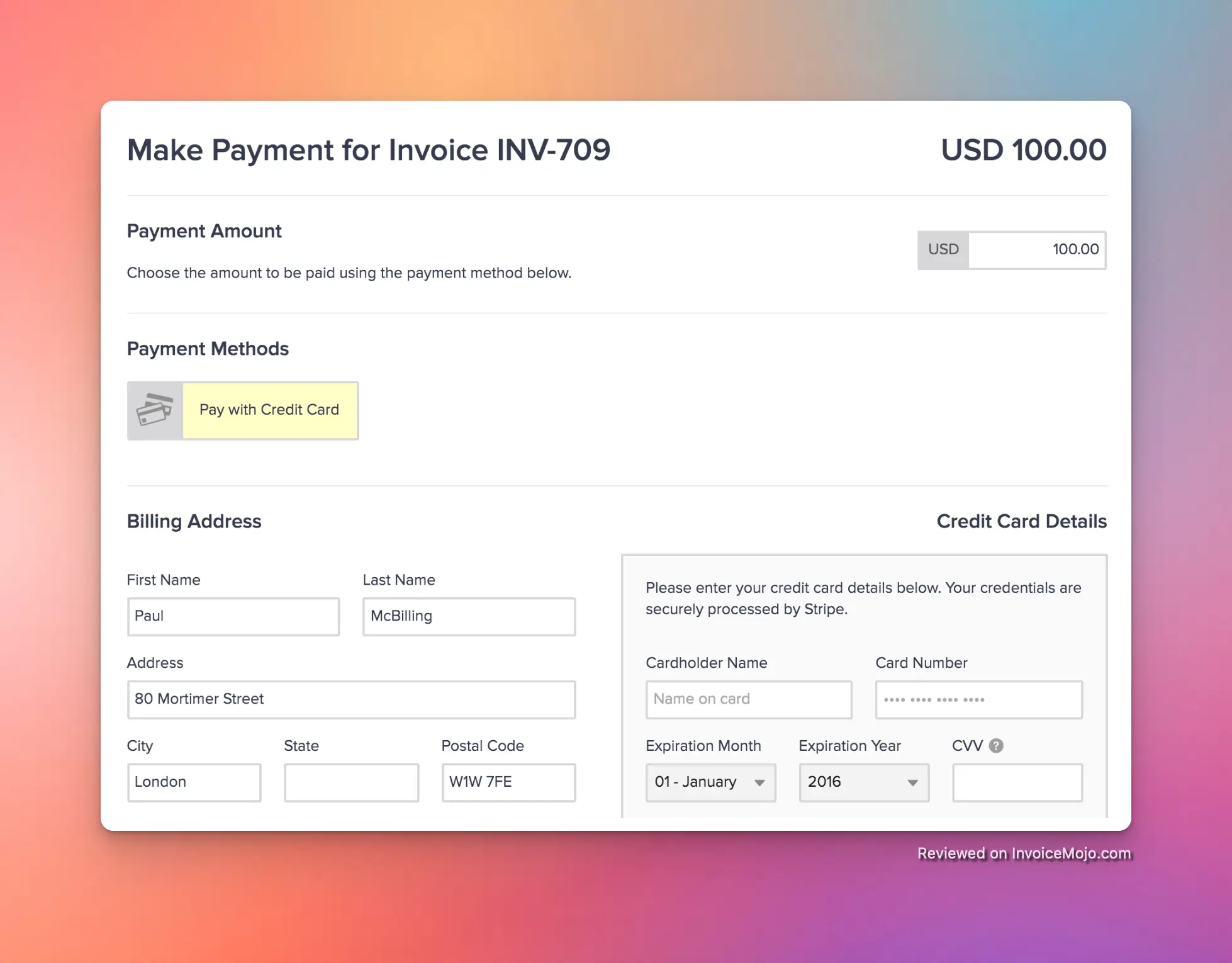

One of Invoicely’s strongest value propositions is the ability to accept online payments directly through your invoices. This means when you send an invoice to a client, they can click a payment link and get paid immediately via credit card or other methods, without cumbersome bank transfers.

Invoicely integrates with popular payment gateways including:

Setting up a payment gateway in Invoicely is straightforward. You just link your PayPal or Stripe account in the settings. Once enabled, every invoice you send can include a “Pay Now” button. Payments received are logged in Invoicely so you can verify which invoices are paid, partially paid, or overdue.

Accepting online payments in Invoicely

Invoicely also supports multiple currency payments, meaning you can invoice a client in their currency and still receive the money in your own (the conversion is handled by the payment processor at the time of payment).

Another convenient feature is the ability to enable partial payments on invoices. If you allow it, clients can make a payment of any amount (up to the invoice total) and Invoicely will record it, so you can invoice in installments or take deposits. You can also mark invoices as paid if you receive offline payments (cash, check, bank transfers) and even record details like check numbers.

For businesses that bill clients on a regular schedule (e.g., monthly retainers, subscriptions, or maintenance fees), Invoicely offers robust automation features. You can set up recurring invoices to be generated and sent automatically at chosen recurring frequency intervals (weekly, monthly, yearly, etc.).

In addition to recurring billing, you can schedule automatic payment reminders for invoices that haven’t been paid by their due date. Invoicely’s system can send out a polite reminder email to the client, which you can usually customize with your message. This recur feature helps ensure you get paid on time.

Another form of automation is using saved items and clients. Invoicely allows you to save commonly used line items (descriptions, rates) and client details, so creating a new invoice can be as quick as selecting the client and adding saved items, rather than typing everything from scratch. The free plan allows up to 3 saved clients and 10 saved items, while paid plans increase those limits or remove them entirely.

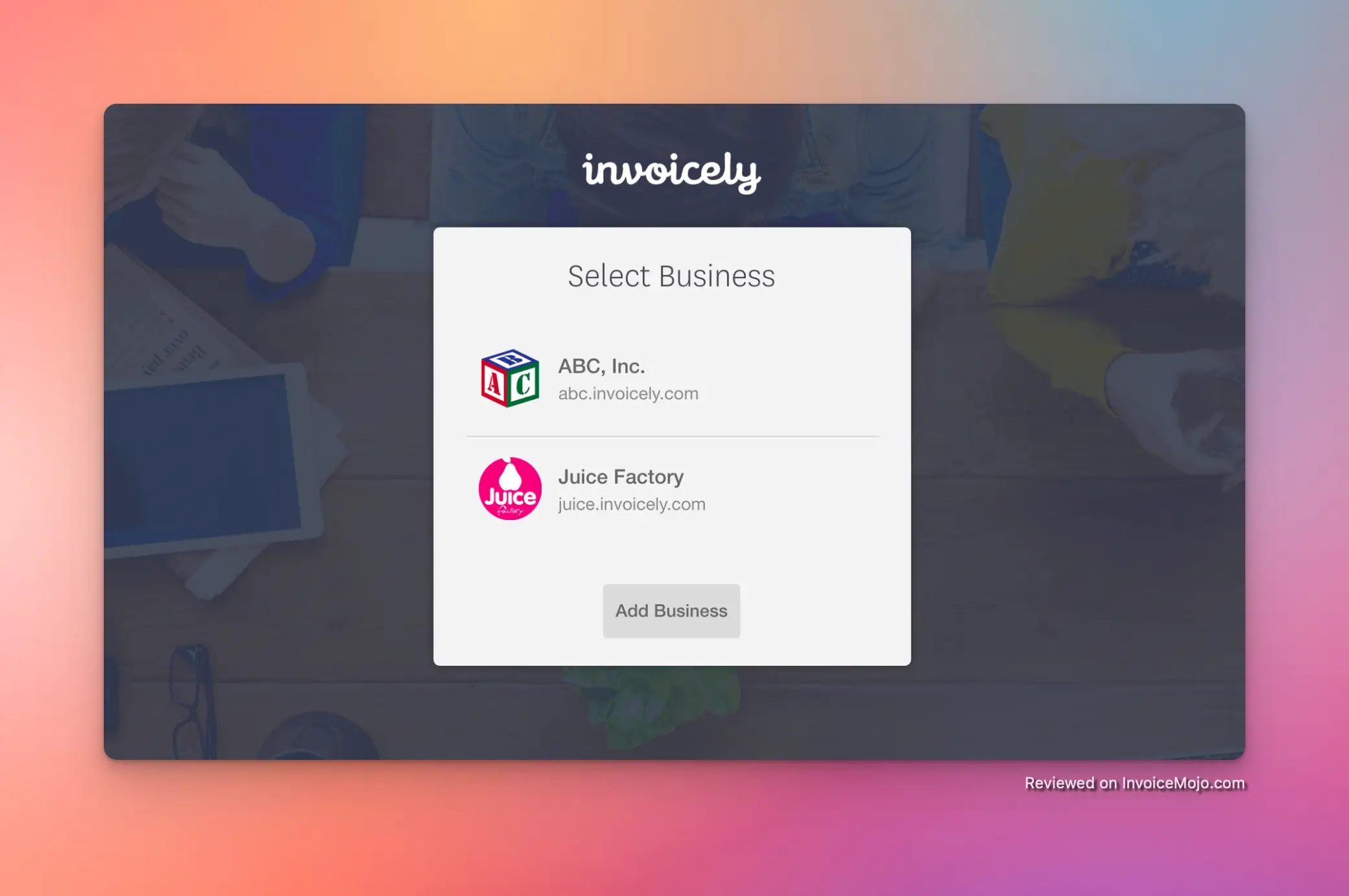

Managing multiple businesses in Invoicely

If you juggle multiple businesses or income streams, Invoicely has you covered. Even on the free plan, you can create an unlimited number of business profiles under one account. This means if you operate two companies (say a freelance design business and a small retail shop), you can manage invoices for both with the same login, each with its own branding, client list, and settings.

Each business can have its own set of invoices and reports. The interface makes it simple to switch between business accounts, and you won’t mix up records since they’re separated logically.

Multi-currency support is another key feature. You can bill in any currency you need by simply selecting the currency when creating an invoice or estimate. Invoicely will format the currency symbols and number formatting accordingly, and it even supports invoices in any language (you can customize labels like “Invoice”, “Item”, etc., or choose from preset languages).

Staying on top of your finances is easier with Invoicely’s dashboard and reporting tools. The app offers a central dashboard that gives you a clear financial overview of your business: you can instantly see metrics like total outstanding invoices, paid invoices, recent activities, and income for the current month or year.

Graphs and charts display trends in revenue over time, which clients owe you the most, and other useful insights. This helps small business owners gauge cash flow and performance at a glance.

In addition to the dashboard, Invoicely can generate reports such as:

These reports are dynamically generated and give you actionable analytics on your business health. Even on the Free plan, you have access to basic real-time reports to monitor how your business is doing. Paid plans enhance the reporting with more detail and the ability to export data. The dashboard tab allows you to quickly access all the information you need to keep track of your invoicing needs.

Maintaining a professional image is important when billing clients, and Invoicely provides tools to ensure your invoices reflect your brand. You can customize your invoice templates by adding your company logo, choosing your brand colors, and adjusting the layout to some extent.

Higher-tier plans allow full business branding, which means you can remove Invoicely’s logo and use your own branding completely on invoices/emails. On the Free plan, branding is limited: typically the invoices will mention or subtly show “Powered by Invoicely” or similar, and your customization options might be fewer.

Customization isn’t just about logos; Invoicely also lets you customize invoice fields. You can also add custom notes or terms to invoices (like a thank-you note, or payment instructions). Email templates and email options can be customized on paid plans as well.

Beyond invoices, control panel branding is available too (in higher tiers you can even brand the dashboard interface if you use Invoicely with team members or want clients to log in to a portal). Many users have found Invoicely’s customization capabilities to be one of its strongest features.

If you’re not a solo user, Invoicely accommodates team collaboration as well. Paid plans (Basic and above) allow adding team members to your account with role-based permissions. For example:

You can assign different permissions to each team member, such as who can only create invoices but not send them, or who can view reports, etc. This way, sensitive info is controlled while still letting your team help with the invoicing workflow. Collaboration can also come into play with the client portal features. Invoicely allows you to enable a client portal where your clients can log in to view their invoices, estimates, and payment history. Clients can even comment on invoices (there’s a “statement discussions” feature in higher plans), which can streamline communication.

Recognizing that business owners are often on the move, Invoicely offers mobile accessibility to manage invoices anytime, anywhere. There are mobile apps for iOS and Android available for download from the App Store, allowing you to create invoices and send invoices from your smartphone, record expenses on the go (take a photo of a receipt and attach it, for example), or check who has paid you in real time.

If you prefer not to install the app, Invoicely’s web app is mobile-friendly as well. You can log in through your phone’s browser and access your account, since the application is web-based.

According to Invoicely reviews, some users have pointed out a few limitations of the mobile experience: a couple of users felt the mobile app was a bit limited in terms of template choices and that some settings were hard to find on mobile. There were also occasional sync delays reported (where the mobile app took time to update an invoice status). However, many users appreciate the flexibility the mobile app provides for managing their invoicing system on the go.

Invoicely offers a range of pricing tiers that cater to different invoicing needs, including a forever Free Plan and three paid plans with increasing levels of features. All paid plans can be billed monthly or annually (with a discount for annual subscriptions).

| Plan | Price (Monthly) | Monthly Invoice Limit | Client Limit | Team Members | Key Features |

|---|---|---|---|---|---|

| Free Plan | $0/month | Up to 5 invoices/month | Up to 3 clients | 1 (just you) | Basic invoicing, 1 business, PayPal payments only, basic branding, reports |

| Basic Plan | $9.99/month (~$7.99/mo if billed annually) | Up to 100 invoices/month | Up to 25 clients | Up to 2 users | Everything in Free, plus PDF invoice downloads, unlimited estimates & bills, recurring invoices, multiple payment gateways (PayPal, Stripe, Authorize.net, Mollie), time tracking feature, expense & mileage tracking, 2 businesses, basic custom branding |

| Professional Plan | $19.99/month (~$15.99/mo if billed annually) | Up to 250 invoices/month | Up to 100 clients | Up to 10 users | All Basic features, higher limits, advanced reports, up to 10 businesses, more team roles/permissions, priority technical support |

| Enterprise Plan | $29.99/month (~$23.99/mo if billed annually) | Unlimited invoices | Unlimited clients | Up to 25 users | All Professional features, unlimited everything, full branding (remove Invoicely logo), up to 25 businesses, highest support level |

The Free Plan is quite generous for getting started: it costs nothing and includes the ability to send up to 5 invoices per month to up to 3 clients. You also get unlimited business entities even on free, which is rare. However, free users are limited to PayPal for accepting payments (no direct credit card integration), and branding/customization is limited (your invoices will have Invoicely’s branding).

The Basic Plan at $9.99/month is the entry-level paid tier and unlocks a lot of value. Here you jump to 100 invoices per month and 25 clients, which covers many small businesses. Importantly, Basic removes the payment gateway limitation. You can connect Stripe, Authorize.net, and others in addition to PayPal.

The Professional Plan at $19.99/month is aimed at growing businesses. It further raises your limits to 250 invoices/month and 100 clients, and allows up to 10 team members with roles: great if you have a small team or multiple departments accessing the system.

The Enterprise Plan at $29.99/month is the top tier and removes virtually all limits: you get unlimited invoices and clients, and up to 25 team members. This plan is for businesses that have outgrown the “small” definition, perhaps a larger agency or a company with multiple branches.

All paid plans also come with the ability to upgrade, downgrade, or cancel at any time without long-term contracts, so you’re not locked in if your needs change. There isn’t a separate free trial since the Free plan itself acts as a trial (no credit card required to sign up).

Robust Free Plan: Invoicely’s free tier allows small users to send invoices at no cost, making it ideal for freelancers or new businesses to try out. Unlike many competitors, it includes multiple businesses and basic features without a trial period.

Affordable Paid Plans: The paid plans are reasonably priced (starting at $9.99/month) and offer great value. Users often cite the cost as a big pro, especially compared to more expensive invoicing apps.

Easy to Use Interface: The platform is generally intuitive and simple to navigate. Many users report that it’s quick to learn and they can create and send invoices within minutes of signing up.

Professional-looking Invoices: Invoicely provides polished invoice templates that you can brand with your logo, resulting in documents that look professional and instill trust.

Time & Expense Tracking Built-In: You don’t need a separate tracker. Invoicely lets you log hours, expenses, and mileage and convert them to invoices easily.

Recurring Invoices & Automation: Support for recurring billing and automatic reminders means you can “set it and forget it” for ongoing invoices, reducing manual work.

Online Payment Integration: Invoicely makes it simple to accept online payments via PayPal and credit cards (through Stripe, etc.), helping you get paid faster.

Multi-Currency and Multi-Language: You can invoice in any currency and language, which is beneficial for international business.

Multiple Businesses in One Account: Manage multiple business entities or brands under one login, even on the free plan.

Team Collaboration: Paid plans allow multi-user access with permissions, so you can safely delegate invoicing tasks to staff or accountants.

Real-Time Dashboard & Reports: The dashboard gives a quick view of your financial status and reports help in understanding income over time, client activity, and more.

Accessible Anywhere: Being web-based, you can use Invoicely on any device with an internet connection, and there are mobile apps for iOS/Android for true on-the-go invoicing.

Free Plan Limitations: The free plan, while useful, is limited to 5 invoices/month and 3 clients, which many will outgrow. Some users also note that the free version lacks customization.

Feature Paywalls & Upgrade Prompts: Certain features are locked behind paid tiers, and the interface may show icons indicating you need to upgrade to access them.

Learning Curve for Advanced Features: While basic invoicing is easy, some advanced settings or less common features can be hard to find at first.

Limited Integrations: Invoicely does not have deep integrations with external accounting or project management software. For example, there’s no native sync to QuickBooks or Xero, and no built-in integration with time tracking apps like Toggl.

Basic Accounting Features Only: While it tracks income and expenses, Invoicely isn’t a full accounting package. You won’t get balance sheets or double-entry bookkeeping.

No Automatic Currency Conversion: If you deal in multiple currencies, Invoicely won’t convert or summarize across currencies. It treats each currency in silo.

Mobile App Could Improve: While having a mobile app is great, some users have reported issues with syncing or difficulties using certain features on mobile.

Email Delivery Quirks: Some users observed that invoice notification emails to clients sometimes went to spam folders or that the sender email was a generic Invoicely address that confused clients.

Customer Support via Email: Invoicely’s support is primarily through email and an online help center. There’s no mention of phone or live chat support widely available.

To get a real-world perspective, let’s look at feedback from users who have found Invoicely across various review platforms like Capterra and SoftwareAdvice. The general sentiment in these Invoicely software reviews is largely positive, with Invoicely earning high marks for value and functionality.

A recurring theme is that Invoicely is easy to use and saves time when sending invoices. Many freelancers love that they can sign up and start invoicing in minutes without a steep learning curve. Some advisors strongly recommend it to their clients for this reason.

Value for money is another big positive. Several users report switching to Invoicely from pricier competitors (like FreshBooks) mainly due to cost, and being very happy with the decision. At ~$10-$20 a month for most features, people feel they’re getting a great deal. Many consider it an affordable option for small business invoicing needs.

Users also appreciate the feature set given the pricing. The fact that the free version exists and is usable is a plus for many starting out. Some reviews mention “I’ve found Invoicely to be easier to use than other platforms I’ve tried.” Reviewers frequently call out features like multiple businesses and multi-currency support as very useful.

The ability to customize and brand invoices in the paid versions contributes to a professional appearance that users like. Another commonly praised aspect is improved efficiency in billing and tracking. One reviewer named Val noted that “Invoicely makes it simple to keep track of all my client billing.”

A notable complaint is about the limitations of the free plan and the push to upgrade. As one long-term user observed, the product now has a lot of features with a “lightning bolt” indicating they are for premium users only, which can be frustrating for free users. One reviewer named Katie said, “I can’t do anything substantial without upgrading.”

Another common negative theme is minor UI/UX hiccups. A few users found certain tasks not immediately obvious, such as editing an invoice that’s saved as draft or using the reset function. A reviewer mentioned there can be “a bit of confusion when first discovering how to use certain features.”

Lack of integrations was pointed out by some, especially those who tried to tie Invoicely with project management or time tracking tools. Also, not having an official integration with accounting software means extra steps for businesses that later need to do bookkeeping.

Mobile app limitations came up in a couple of reviews. Some users reported the mobile app can sync slowly and had limited template options compared to using Invoicely through a browser. A few tough reviews mentioned “would not use the app again” or even “worst support ever – nobody is responding after one week since I lost the access to my account,” though these appear to be rare exceptions in otherwise positive Invoicely software reviews.

Is Invoicely really free? What’s the catch with the Free plan?

Yes, Invoicely offers a truly free plan with no trial period. The catch is limited to 5 invoices/month, 3 clients max, PayPal-only payments, and Invoicely branding on documents. Perfect for freelancers just getting started, but growing businesses will need to upgrade to a paid plan.

Can I customize my invoices and use my own branding?

Yes, all plans allow adding your logo and basic customization. Paid plans offer more options with custom invoice branding, including removing Invoicely’s logo, custom email templates, and more template choices. The Enterprise plan provides complete white-labeling for a professional look.

Does Invoicely integrate with accounting software or CRMs?

Invoicely has limited direct integrations. There’s no built-in connection to QuickBooks, Xero, or popular CRMs. It does offer an API for developers to build custom integrations, and it integrates with payment gateways like PayPal and Stripe for accepting online payments.

Can I use Invoicely on my phone?

Yes, Invoicely has iOS and Android apps available in the App Store, plus a mobile-responsive website. The mobile app lets you create and send invoices, track expenses, and verify payments on the go, though some users report limitations compared to using it through a browser on desktop.

After taking a look at all aspects of this invoicing software, Invoicely proves to be a powerful yet budget-friendly solution that covers the invoicing needs of freelancers and small businesses remarkably well. Its strengths lie in its ease of use, comprehensive feature set, and accessible pricing model that starts with a genuinely useful free version.

The platform’s popularity in 2026 stems from delivering solid value: you can start for free with real invoicing capabilities, then upgrade for just $9.99-$29.99 monthly to unlock features that rival more expensive competitors. Many who discovered Invoicely after trying other platforms strongly recommend it for its user-friendly interface that makes it quick to implement into your business routine, and its professional templates help you maintain a polished image with clients.

Particularly impressive are the multi-currency invoicing, multiple business profiles, and the ability to accept online payments directly through invoices, all features that directly address common needs of small businesses and freelancers. The billing automation features further reduce administrative workload through recurring invoices and automatic invoice reminders.

That said, Invoicely isn’t perfect. It’s not a full accounting system, has limited third-party integrations, and the free plan, while generous, has constraints most growing businesses will outgrow. Some users like Divan noted that the mobile experience could also use some refinement.

For freelancers, consultants, and small business owners who need a straightforward way to create invoices and send invoices, track time and expenses, and get paid online without breaking the bank, Invoicely offers an excellent balance of features and affordability. It’s particularly well-suited for those just starting out (thanks to the free plan) and small businesses with modest invoicing needs that don’t require complex accounting integrations.

In a competitive invoicing system market, Invoicely scores an overall rating of 4.2/5 by offering substantial functionality at every price point, making professional invoicing accessible to businesses of all sizes.