Highlights

Hiveage Website

Hiveage is an online invoicing and billing platform designed to streamline finances for freelancers and small businesses. This cloud-based service helps you send invoices, accept payments, track time and expenses, and manage basic financial tasks without the complexity of full-scale accounting software.

Launched in 2014 as the successor to Curdbee, Hiveage has grown to serve over 75,000 freelancers and small businesses across 150+ countries. This widespread adoption demonstrates its reliability and focus on simplicity.

From the first login, Hiveage impresses with its polished, user-friendly interface. Many user reviews praise how easily they can create invoices and monitor payments, with one reviewer noting, “Hiveage has made my life so much easier.” Even if you’ve never used invoicing software before, the learning curve is minimal.

Hiveage’s core purpose is to handle your billing tasks efficiently so you can focus on running your business. Let’s examine if it’s the right online invoicing tool for your small business in 2026.

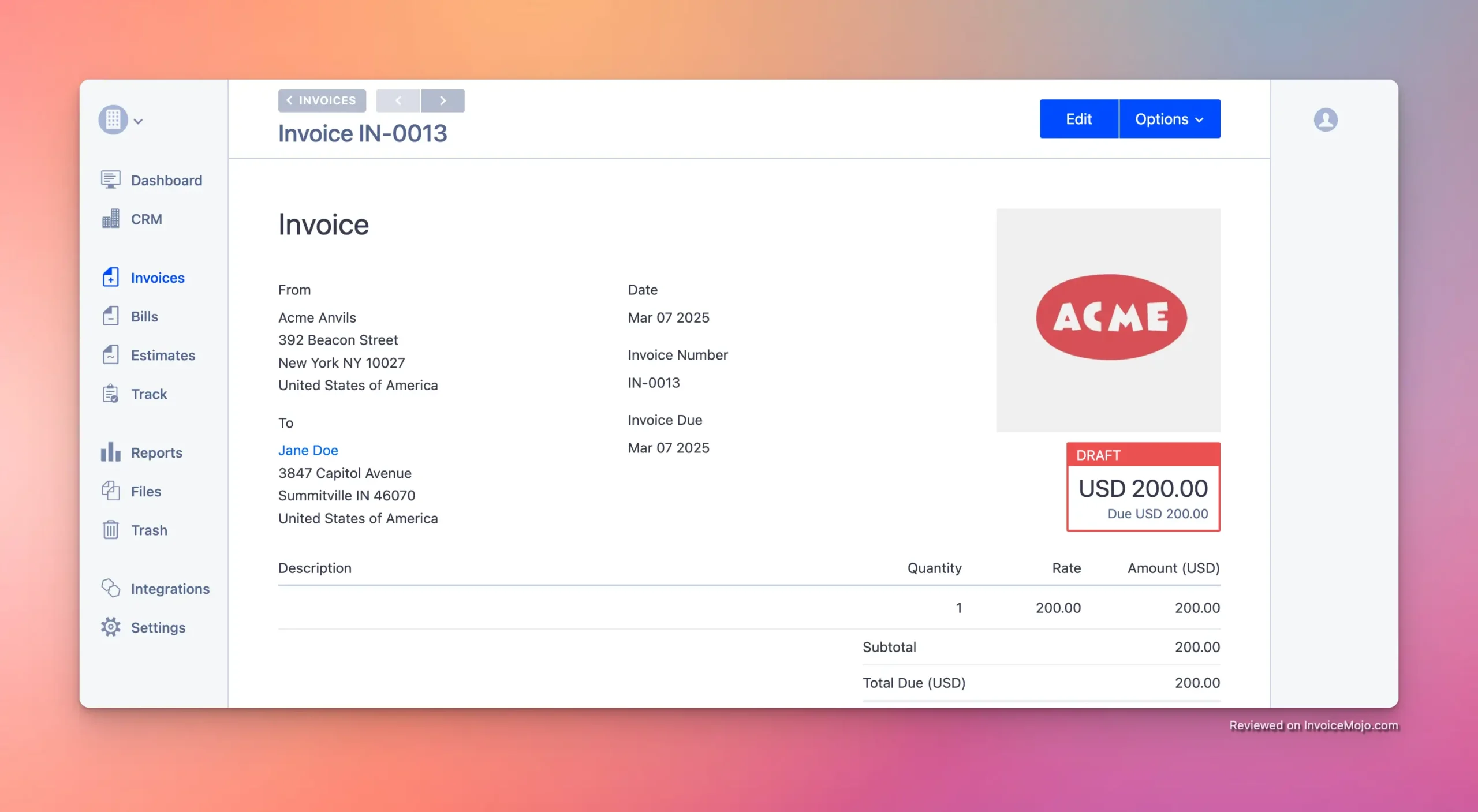

Creating invoices in Hiveage is quick and straightforward. The platform provides three clean invoice templates which you can personalize with your company logo and business details.

You add your line items (products or services, including billable hours or expenses), and Hiveage calculates totals automatically. The system supports flexible entries like taxes, discounts, and shipping charge entries, you can save unlimited tax rates or discount presets (as percentage or flat amounts) and add them to line items or subtotals with one click.

This works well for businesses in places like Canada or the UK that need to apply various taxes (e.g., VAT or GST) or offer discounts. The invoices appear professional and are clear to read, helping you maintain a polished image with clients.

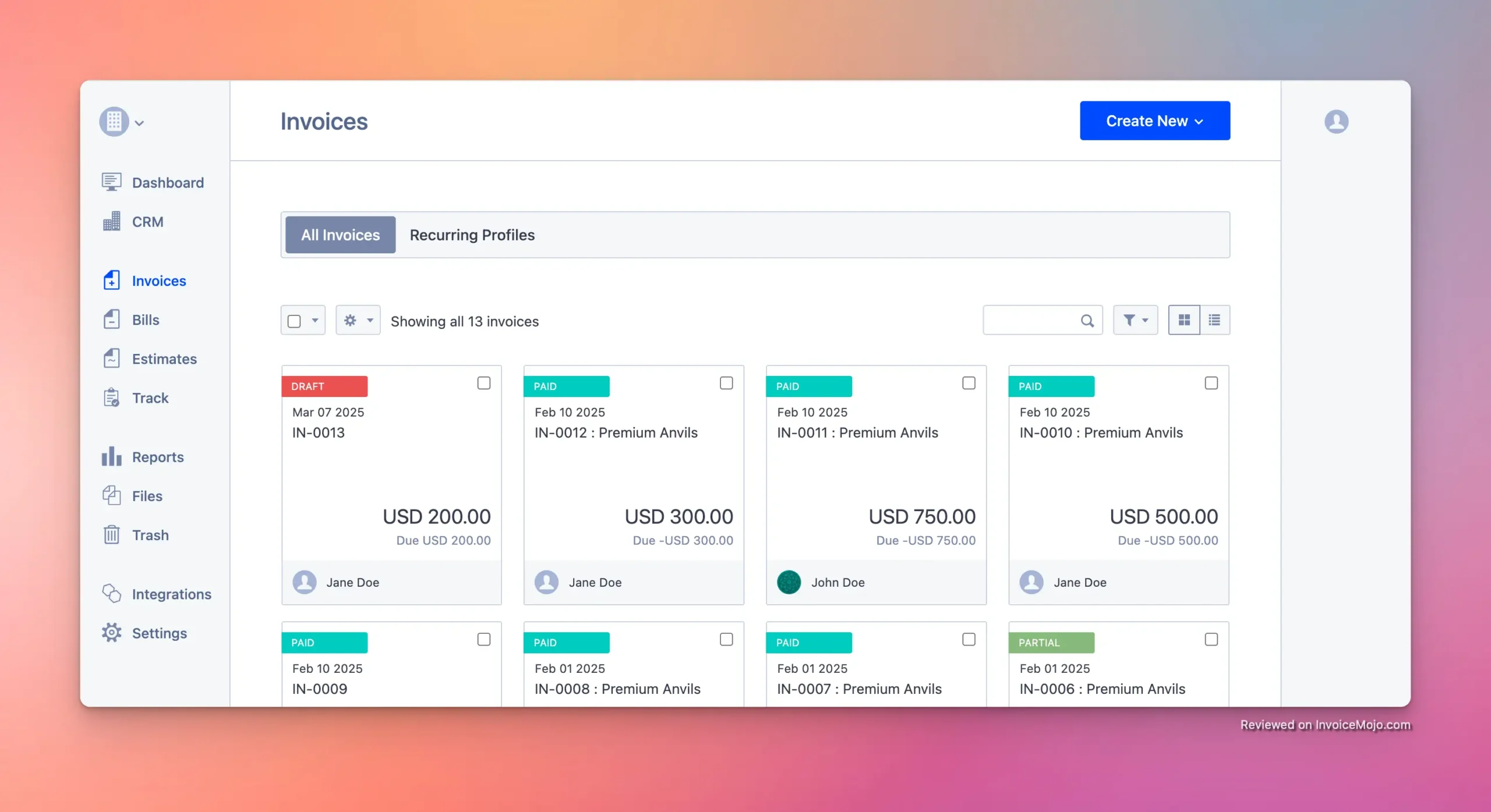

Hiveage also tracks each invoice’s status in real time. You can see whether an invoice is draft, sent, viewed by the client, or paid/partially paid with status indicators. For busy small business owners, this removes guesswork about whether a client opened your invoice.

To reduce payment collection problems, Hiveage lets you set up automatic payment reminders for overdue payments and can send thank-you receipts when invoices are paid. These automated features save time and help you get paid on schedule without manual follow-up.

The simple layout makes it easy for non-accountants to create professional invoices. Converting estimates to invoices with one click saves time when a project is completed, no need to re-enter all the details.

Invoices in Hiveage

If your business charges clients on a recurring basis (monthly retainers, subscription, maintenance fees), Hiveage has you covered. The recurring billing feature allows you to set up profiles for automatic invoices or auto-charges on a schedule you define.

You can choose a billing frequency: daily, weekly, monthly, yearly, or any custom interval, and Hiveage will generate and send invoices automatically. For example, a marketing agency could set a client’s retainer to bill on the first of every month without manual effort. This ensures consistent cash flow and prevents forgotten invoices.

Hiveage offers flexibility in how recurring invoices are handled. You can have the system email the invoice to the client on each recurrence, or automatically charge the client’s saved credit card (through supported payment gateways). The latter works well for subscription services, your client opts in once, and billing happens seamlessly.

If you prefer oversight, there’s an option to have recurring invoices saved as drafts for your review before sending. This level of control can be reassuring for small businesses that want to double-check invoices before clients see them.

You can also turn any regular invoice into a recurring profile with a single click, a convenient feature when you realize an ongoing job needs automated billing.

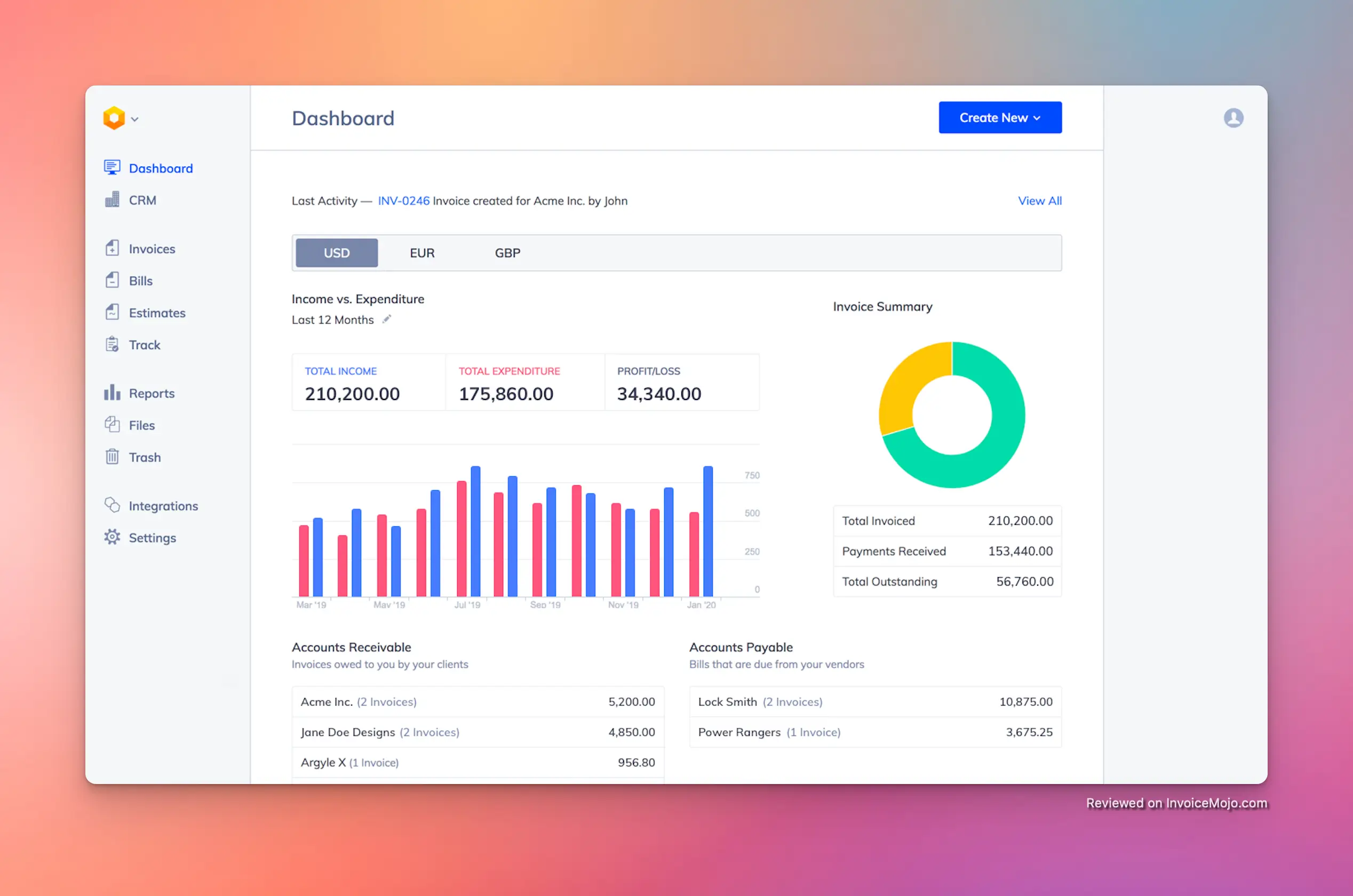

Hiveage Dashboard

Beyond invoicing, Hiveage includes basic expense tracking tools to help you record and rebill costs. This is useful for freelancers and agencies who incur project expenses (materials, travel costs, subcontractors) that need to be charged back to the client.

In Hiveage, you can log expenses with details like category tags, descriptions, amounts, and even attach receipt files for records. You can also specify taxes on expenses and mark whether an expense is billable to a client or just an internal cost.

For mileage expenses, Hiveage has a built-in mileage tracker where you can record trips in miles or kilometers and set reimbursement rates, helpful for businesses that bill per mile or need to deduct travel costs for taxes.

When it’s time to invoice a client for incurred costs, you simply select the relevant unbilled expenses and convert them into invoice line items. This saves considerable time compared to manually copying amounts into an invoice.

For service businesses that bill by the hour, Hiveage offers a simple built-in time tracking tool. You can create tasks and use a timer to record how long you spend on each task or project. You can set billable rates for each task category, so Hiveage will automatically compute the monetary value of the time logged.

After tracking time, you can review all your entries and with a couple of clicks convert selected entries into an invoice. This seamless conversion ensures that no billable hour falls through the cracks.

For a small team or solo professional, having time tracking integrated means you don’t need a separate time-tracking app, it’s all part of your invoicing workflow. It directly ties your timesheets to your billing, which improves accuracy and saves effort.

One limitation to note is that the mobile app currently does not have a receipt scanning/capture feature for expense management. Some competing expense tracking apps let you snap a photo of a receipt and automatically parse the details, but Hiveage requires manual entry.

![]()

Time tracking in Hiveage

The Estimates feature lets you create detailed quotes that you can send to clients for approval before any invoice is issued.

The interface for making an estimate is very similar to invoicing, you list proposed items or services, quantities, prices, and taxes or discounts as needed. Clients can view and even accept the estimate online with one click, which streamlines the approval process.

You can set an expiration date on estimates to encourage timely responses and even have Hiveage send automatic payment reminders before a quote expires. This is useful for gently nudging a prospective client to make a decision.

Once an estimate is accepted, Hiveage stands out by letting you convert it into an invoice instantly. With a single button click (“Convert to Invoice”), all the items and details from the quote are turned into a ready-to-send invoice. This is a major time-saver and also reduces errors.

For small businesses, the Estimates module means you can manage the full sales cycle (quote → job → invoice) in one software. It helps you appear more professional to clients by providing formal quotations and helps you get paid faster by eliminating friction between project completion and billing.

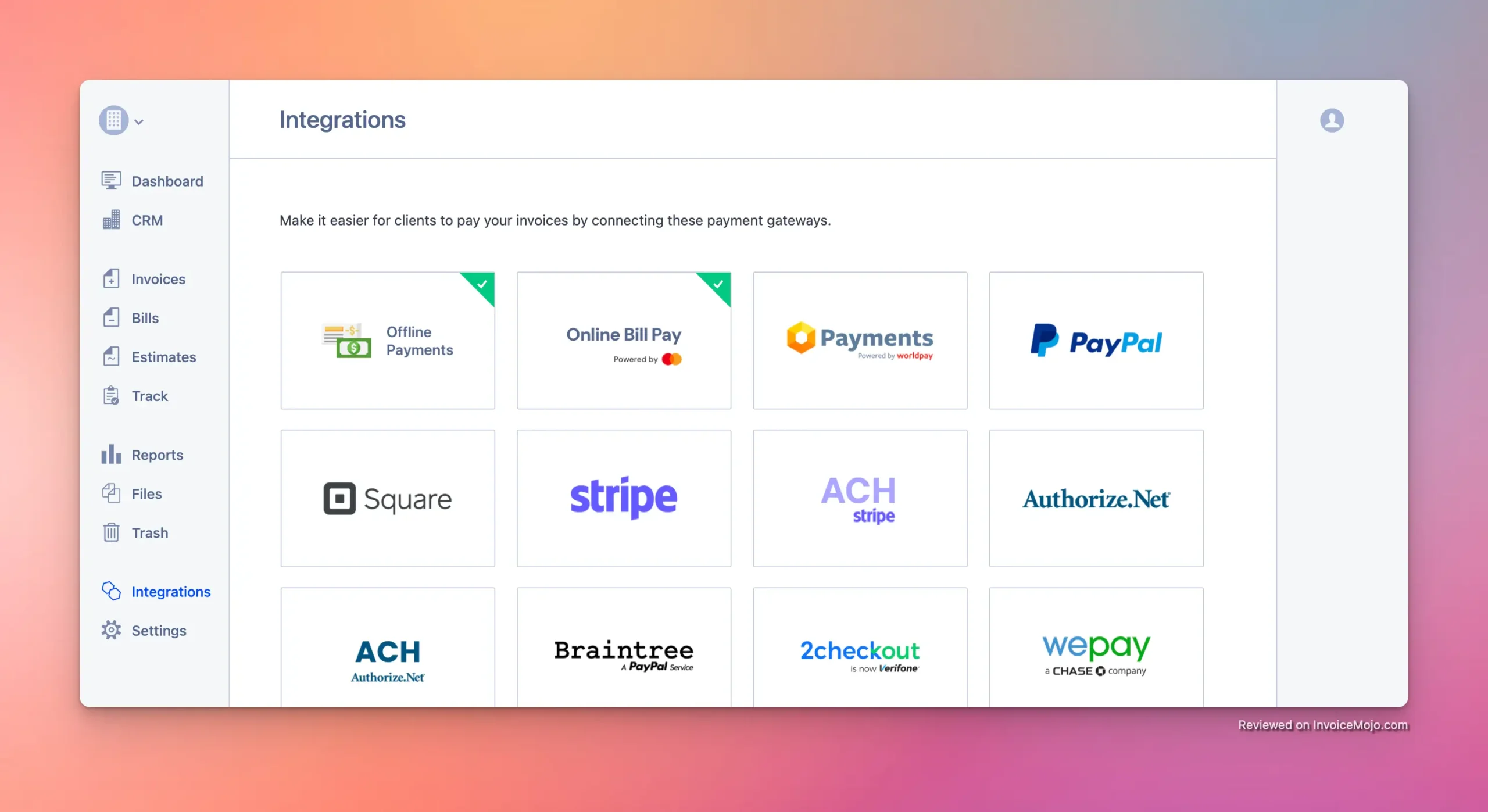

Hiveage supports online payments through dozens of popular online payment gateways. You can integrate your account with services like PayPal, Stripe, Square, Authorize.Net, Braintree, 2Checkout, Mollie, and more.

For example, you could enable both PayPal and Stripe on an invoice, so the client can choose their preferred payment method. Offering these convenient options can help small businesses get invoices paid quicker.

Setting up a gateway in Hiveage is as simple as entering your credentials/API keys. Once connected, payment buttons for those gateways will appear on the invoices you send out.

The client just clicks “Pay Now” and completes the transaction online. Hiveage even supports partial payments, meaning if you allow a client to pay in installments or a deposit upfront, the system can handle that, it will record a partial payment and update the remaining balance.

If you’re in the United States, Hiveage has an extra perk: through a partnership with Worldpay, you can process credit and debit card payments directly within Hiveage (without needing a third-party gateway like Stripe). This feature is currently only available to U.S.-based users, businesses elsewhere would use gateways like Stripe or PayPal for card payments.

By removing barriers to payment, Hiveage helps improve your cash flow and reduces the time spent chasing checks or bank transfers.

Payment gateway integrations in Hiveage

Nowadays many small businesses deal with international clients. Hiveage handles this with its currency and tax features.

You can invoice in different currencies, set a default currency and assign specific currencies to different clients. For example, a US-based graphic designer could bill domestic clients in USD, invoice a UK client in GBP and a European client in Euros, all from one Hiveage account.

The software will keep track of each invoice in its respective currency and the dashboard can display summaries per currency. This eliminates the hassle of manual currency conversion, you just input amounts in the currency of choice and Hiveage handles them separately. (Note that Hiveage doesn’t convert between currencies on the fly; it simply lets you bill in different currencies and reports on each.)

On the tax front, Hiveage supports unlimited taxes and types. You can create any number of tax profiles (like VAT 20%, GST 5%, PST, etc.) and apply them to line items or entire invoices as needed.

You can also mark taxes as compound if one tax applies on top of another (a scenario that Canadian businesses might recognize with GST and PST in certain provinces).

Hiveage’s flexibility with taxes means it’s equipped to handle US sales tax (which varies by state/county), Canadian GST/HST/PST setups, UK VAT, or no tax at all for tax-exempt items. For a small business owner, this is a relief, once you configure your tax rates in settings, you can just select them when creating an invoice.

Additionally, Hiveage supports multi-language invoicing (over 30 languages) for the interface, which can be beneficial if you or your team prefer a language other than English.

Hiveage isn’t just for solo entrepreneurs, it includes features for team collaboration and even managing multiple business entities. If you have a team, Hiveage allows you to add team members to your account (depending on your plan) and set granular permission levels for each person.

You can designate roles such as Admin, Manager, Staff, or Contractor, each with different access rights. For instance, you might allow a staff member to create invoices but not see financial reports, or let a contractor log their time and expenses but not access other clients’ data.

With multiple team members, you can delegate billing and invoicing tasks easily. Hiveage’s interface lets team members collaborate by sharing invoices, estimates, and bills with each other within the system.

There’s even a commenting system inside Hiveage, so your team can discuss specific invoices or client accounts right on the platform. Think of it like leaving an internal note or question on an invoice that your colleague can see and respond to, keeping communications in context rather than lost in email threads.

Hiveage also supports multiple businesses under one login. If you happen to run more than one small business or have subsidiaries, you can manage all their invoicing from a single Hiveage account and easily switch between business profiles.

Each business can have its own branding, client list, and settings, but you won’t need to log out and in, it’s all accessible with one username. This is a niche feature, but for the entrepreneurs who need it, it’s extremely useful.

![]()

Expense tracking in Hiveage

Hiveage offers useful reporting tools and analytics. The dashboard shows simple charts summarizing your income and expenses.

You’ll find an “Income Over Time” bar chart displaying the last 12 months of revenue, plus tables for accounts receivable (outstanding invoices) and accounts payable (if you record any bills you owe).

A monthly summary view and year-to-date income vs expenditure snapshot are also included. These visuals help you quickly check your financial performance, letting small business owners see at a glance how current months compare to previous ones.

For more detailed analysis, Hiveage’s paid plans allow you to generate a few financial reports on demand:

These five reports cover the basic needs of a small business. Hiveage also lets you export your data as CSV files anytime, so if you want to do deeper analysis or import into another system, you can.

Hiveage’s reporting isn’t as comprehensive as what you’d find in QuickBooks or other dedicated accounting programs. Advanced reports (like profit/loss statements, balance sheets, or custom analytics) aren’t available since Hiveage focuses on invoicing rather than full accounting.

For a small operation mainly needing invoicing tools, though, Hiveage provides enough insight to monitor receivables and basic revenue data. Many small business owners actually prefer these simpler reports compared to navigating through numerous complex financial statements.

Hiveage employs bank-level security measures to protect your data. All communication between you (or your clients) and the Hiveage servers is encrypted using SSL/TLS, the standard used by online banking.

The company emphasizes that your data is your own, they won’t access or modify your information without permission, and you can export your data at any time if you choose to leave the service.

Given the integration with payment gateways, Hiveage itself doesn’t store your clients’ credit card data: that’s handled by secure payment processors like Stripe or PayPal, which are PCI-DSS compliant.

For mobile usability, Hiveage offers apps for iOS and Android, letting you manage your invoicing from your smartphone or tablet anywhere. The mobile app helps you create and send invoices and estimates, record expenses, and check invoices’ status.

Imagine finishing a job at a client’s site and sending the invoice before you even leave, Hiveage’s mobile capability makes that possible. The apps are user-friendly and sync with your account in real-time, so anything you do on mobile appears when you log in on a desktop later.

Hiveage’s pricing plans are straightforward and designed with small businesses in mind. There is a free plan and several paid tiers.

| Plan | Monthly Price | Number of Clients | Team Members | Notable Features |

|---|---|---|---|---|

| Free | $0 | 5 | 1 | Unlimited invoices, estimates, expenses, time tracking |

| Basic | $16 per month | 50 | 1 | + Recurring billing, plus financial reports |

| Pro | $25 per month | 250 clients | 5 | + Custom domain, email, notifications |

| Plus | $42 per month | 1,000 | 10 team members | + Priority support, API access |

| Enterprise | Custom | Custom | Custom | Custom features |

The Free plan is ideal for solo entrepreneurs just starting out. You can invoice up to five clients with unlimited invoices and estimates, track expenses and time entries, and use all payment gateway integrations. It’s generous for testing out the platform or for freelancers with just a few repeat clients.

The Basic Plan ($16 per month) expands the client limit to 50 clients and adds recurring billing and financial reports functionality. This tier is perfect for freelancers with more clients.

The Pro Plan ($25 per month) boosts the client limit to 250 clients and allows 5 team members to collaborate. It adds the ability to use your own domain and branding, send invoices from your own email domain, and customize email notifications.

The Plus Plan ($42 per month) allows 1,000 clients and up to 10 team members. It includes priority support for migrating data from other services and API access for more technical integrations.

All paid plans come with a 14-day free trial, and Hiveage does not require long-term contracts, you can cancel or change your plan at any time.

In terms of cost-effectiveness, Hiveage is positioned well for small businesses. The functional free plan is a huge advantage for tiny companies or freelancers on a tight budget. The Basic plan at $16 is in line or cheaper than many rivals, for example, FreshBooks “Lite” is around $17/month but limits you to 5 billable clients (versus Hiveage Basic’s 50 clients).

Compared to full accounting software like QuickBooks Online (starting around $30/mo) or Xero (~$13-37/mo), Hiveage is cheaper but also narrower in scope. For small businesses that already handle accounting separately or don’t need advanced accounting yet, Hiveage lets them avoid overpaying for features they won’t use.

When looking at cost, also consider that Hiveage could replace a combination of tools (invoicing software, time tracker, expense tracker) which might otherwise each have their own fee.

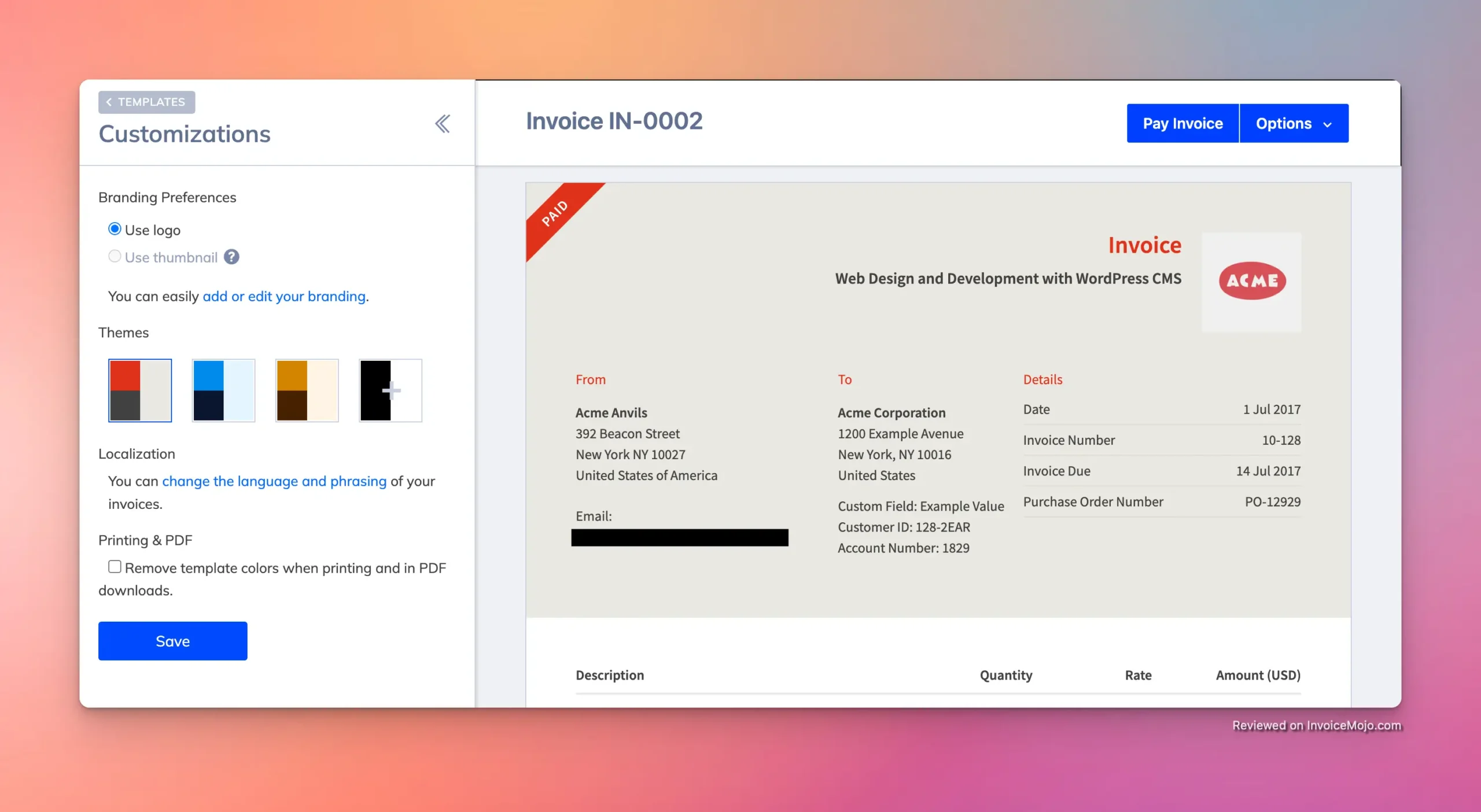

Invoice template customization in Hiveage

Creating an invoice in Hiveage

Generally, Hiveage enjoys very positive feedback, with a high recommendation rate. An aggregate analysis shows 98% of users would recommend Hiveage. Here’s what stands out in user reviews:

Ease of Use: Users consistently highlight Hiveage’s simplicity. One reviewer writes, “It’s not loaded with features that no one will use, just the core of what you need to invoice clients and get paid.” Users appreciate not being overwhelmed, especially small business owners who aren’t accountants or tech experts.

Professional Features: Many praise the invoice quality and features, with comments about “creating clear and concise invoices that look professional.” Others highlight the multi-currency support and mobile app, which meet the needs of international businesses.

Time-Saving Automation: The time-tracking and automation capabilities receive frequent praise. Users comment that these features save them significant time and allow them to focus on growing their business instead of chasing invoices.

Customer Support: Hiveage’s customer support team gets high marks, with reviews mentioning “excellent, hard to beat” customer support and quick help when needed.

Common Criticisms: Some users wish for more features or customization as their business grows. Specific requests include more invoice templates, better reports, and direct integrations with accounting software. A few users have mentioned support delays, though these appear to be exceptions rather than the rule.

Does Hiveage offer a free plan?

Yes, Hiveage offers a genuinely useful free forever plan that includes unlimited invoices, estimates, time tracking, and expense tracking for up to 5 clients. This makes it an excellent option for freelancers just starting out or very small businesses with a limited client base.

Is there a free trial available for paid Hiveage plans?

Yes, Hiveage offers a 14-day free trial of the Pro plan, allowing users to test all features before committing to a paid subscription. Additionally, all new Hiveage accounts come with a 60-day free trial of all features.

Can I use Hiveage on mobile devices?

Yes, Hiveage offers native mobile applications for both iOS and Android devices, allowing users to create and send invoices, track time and expenses, and monitor payments on the go. The platform is also accessible through any web-enabled device thanks to its responsive design.

What payment gateways does Hiveage support?

Hiveage integrates with more than a dozen online payment gateways, including popular options like PayPal, Stripe, and Square. Users in the United States can also process credit and debit card payments directly within Hiveage through their partnership with Worldpay. This integration accepts all major cards (Visa, Mastercard, Amex, Discover) with a 2.9% per transaction fee.

Does Hiveage offer multi-currency support?

Yes, Hiveage supports multiple currencies, making it suitable for businesses that work with international clients. You can set different currencies for different clients and invoice them accordingly.

Can I customize my invoice templates in Hiveage?

Hiveage offers three invoice templates that can be customized with your business logo, brand colors, and contact information. While this provides sufficient customization for most users, it offers fewer template options than some competitors.

Does Hiveage integrate with accounting software?

Hiveage does not offer native integrations with accounting software, but connections can be established through Zapier. For example, you can create a Zap to generate an invoice in QuickBooks Online whenever you create one in Hiveage. This requires a separate Zapier account and potentially additional subscription costs.

How secure is Hiveage?

Hiveage maintains a 99.9% average uptime and uses redundant storage and servers to keep data safe and available. The platform utilizes SSL security for data transmission and maintains regular backups of user data.

Can I track time and expenses in Hiveage?

Yes, all Hiveage plans (including the free plan) include time tracking, expense tracking, and mileage tracking capabilities. Users can track time and expenses for client projects, record expenses with detailed categorization, track business travel in miles or kilometers, and convert these items directly to invoice line items.

Is Hiveage suitable for teams?

Hiveage accommodates teams on its Pro and Plus plans, supporting up to 5 team members on the Pro plan and up to 10 team members on the Plus plan. Team members can be granted different permission levels, allowing for collaborative workflow while maintaining appropriate access controls.

Can I import data from other invoicing systems to Hiveage?

Hiveage supports data import and export in CSV format. The Plus plan includes personalized migration support, with the Hiveage team assisting in transferring data from other services. For users on other plans, self-service import tools are available.

What customer support options does Hiveage offer?

Hiveage provides customer support through in-app chat and email ([email protected]). Users report generally positive experiences with support responsiveness and helpfulness, though experiences may vary.

Does Hiveage offer recurring billing capabilities?

Yes, Hiveage includes robust recurring billing features that allow users to set up automatic recurring invoices at daily, weekly, monthly, yearly, or custom intervals. Users can also enable automatic credit card charging for subscription services and have the option to review recurring invoices before they’re sent.

Hiveage is an excellent choice for freelancers and small businesses that need a streamlined invoicing solution without the complexity of full accounting software.

It shines for service-oriented businesses, consultants, web designers, small agencies, contractors, that primarily need to send invoices and estimates, track time and expenses, and accept online payments. It’s particularly well-suited for businesses that:

Hiveage balances simplicity and functionality well. It provides the tools needed for professional invoicing without overwhelming users with complexity. The pricing structure works well, starting with a usable free tier and scaling affordably as your business grows.

For creating professional invoices and getting paid, Hiveage performs very well. If you need full accounting, inventory management, or advanced reporting, you might need to pair Hiveage with other software like QuickBooks or look for more all-in-one platforms.

With its intuitive user interface, strong feature set, and positive user reviews, Hiveage earns a 4.5/5 rating for small business invoicing. As one user succinctly put it, “Hiveage is a slick way to invoice simply.” That combination of simplicity and effectiveness makes it stand out in the crowded invoicing software market.

If you’re tired of clunky invoicing processes or paying for expensive software with features you won’t use, Hiveage is definitely worth trying. For most small businesses and freelancers, it hits the sweet spot of functionality, usability, and value.