Highlights

Freshbooks Website

Freshbooks Website

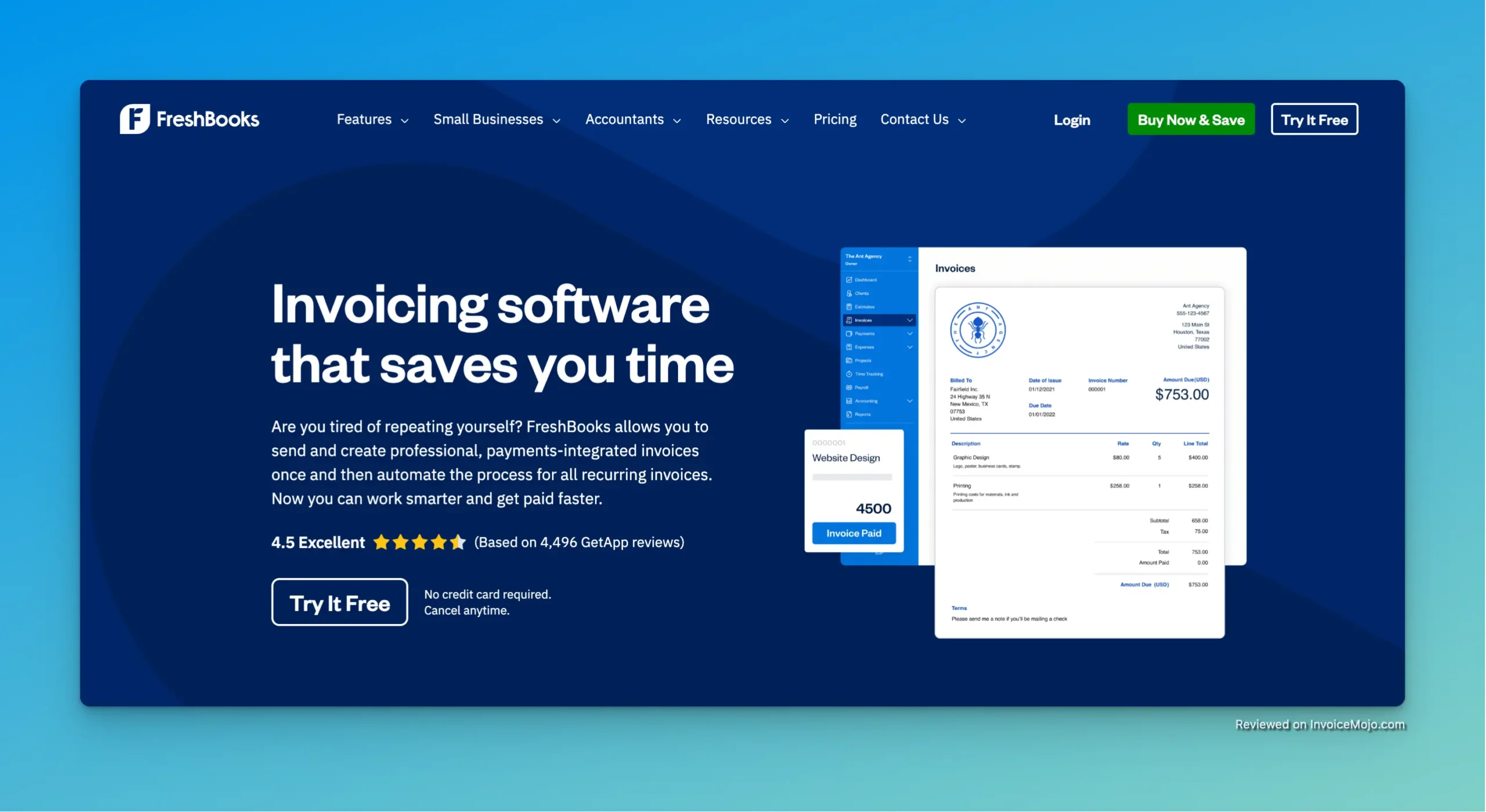

FreshBooks began as a simple invoicing tool but has grown into a complete accounting software solution that caters primarily to service-based small businesses and freelancers. With its straightforward interface and rich feature set, it’s become a popular choice for professionals who want to simplify their financial tasks. This detailed FreshBooks review 2026 looks at what FreshBooks offers, how much it costs, what works well, and where it falls short to help you decide if it fits your business needs.

Running a small business means wearing many hats, and accounting is often the least favorite one. FreshBooks accounting software aims to change that by making financial management more approachable for non-accountants. The platform combines professional-looking invoices, expense tracking, time tracking, and accounting tools in a package that doesn’t require a financial degree to use.

What sets FreshBooks apart is its focus on service providers rather than product-based businesses. While it includes inventory features, its speciality is in helping consultants, designers, marketers, and other service professionals manage their finances with minimal fuss.

Freshbooks Dashboard

Freshbooks Dashboard

In this FreshBooks review, we’ll take a close look at FreshBooks as it stands in 2026. The platform has a strong reputation for user-friendliness, but does it deliver the accounting power small businesses need? And does its value justify its price tag? Let’s find out.

FreshBooks began as an invoicing solution, and this remains one of its strongest areas. The platform offers:

Creating an invoice is remarkably simple. You can easily create a professional invoice in just a few clicks by selecting “Create New” and then “Invoice,” adding items, choosing a client, setting payment terms, and saving.

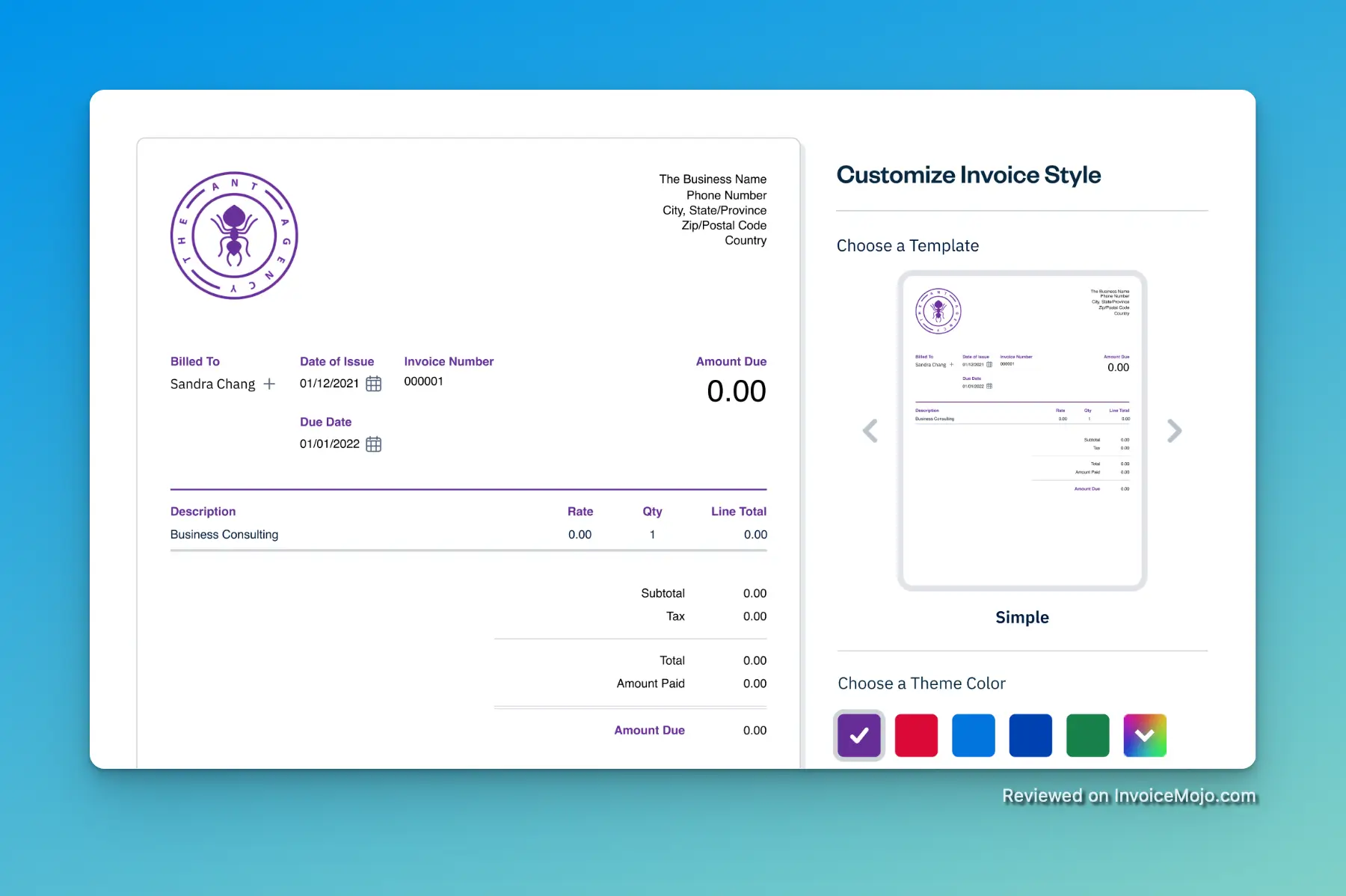

Customizing an invoicing template in Freshbooks

Customizing an invoicing template in Freshbooks

FreshBooks makes billing straightforward with:

Keeping track of business expenses becomes easier with:

![]() Expense tracking in Freshbooks

Expense tracking in Freshbooks

FreshBooks provides solid accounting functionality:

For service businesses, FreshBooks offers:

![]() Time tracking in Freshbooks

Time tracking in Freshbooks

FreshBooks provides strong mobile capabilities:

Other notable features include:

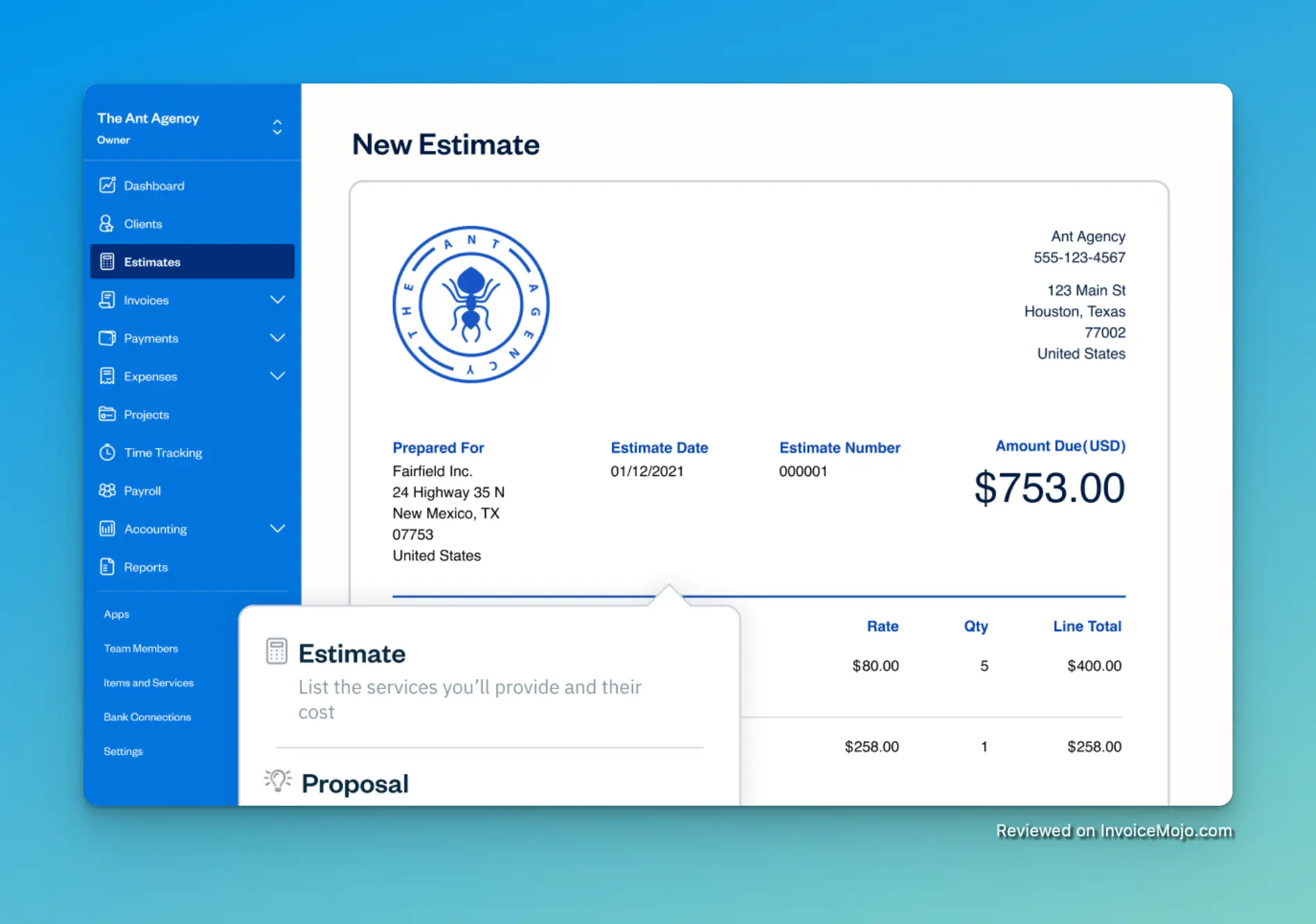

Creating estimates and proposals in Freshbooks

Creating estimates and proposals in Freshbooks

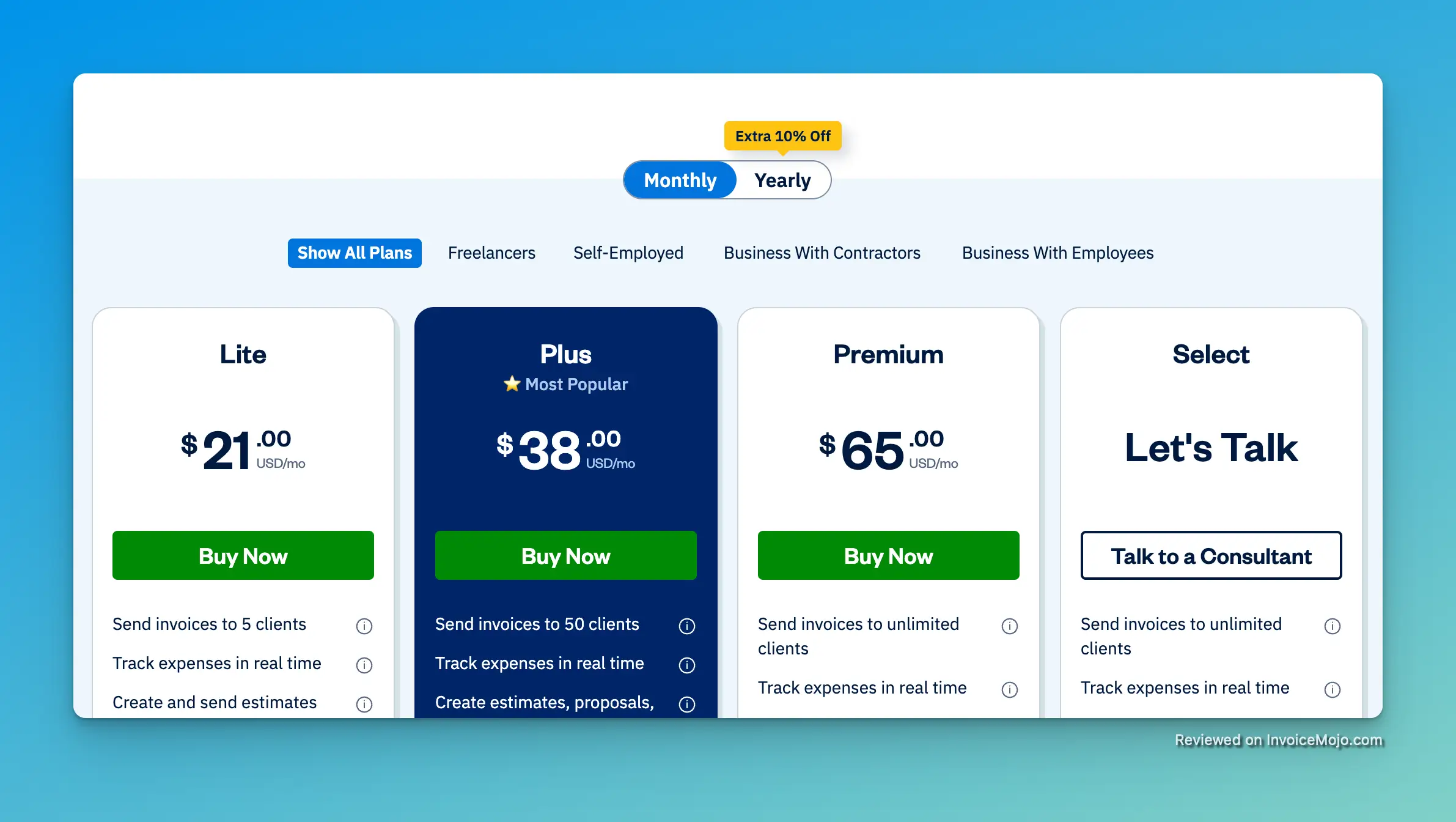

FreshBooks uses a tiered pricing structure with four main options, each offering increasing functionality. All plans include unlimited invoices and expense entries, but they differ in billable clients numbers and available features.

| Plan | Monthly Price | Annual Price (Save 10%) | Billable Clients | Key Features |

|---|---|---|---|---|

| Lite | $21 per month | $17.10 per month ($205.20/year) | 5 | Unlimited invoices, Basic reporting, Mobile app |

| Plus | $38 per month | $29.70 per month ($356.40/year) | 50 | Everything in Lite plan + Recurring invoices, Client retainers, Automated reminders |

| Premium | $65 per month | $54 per month ($648/year) | Unlimited | Everything in Plus + Custom email templates, Profitability tracking |

| Select | Custom pricing | Custom pricing | Unlimited | Everything in Premium + Dedicated account manager, Custom migration support |

Several add-ons may increase your total cost:

FreshBooks payroll integration helps you manage employee payments, though many small businesses might opt for standalone payroll solutions.

FreshBooks offers a free 30-day trial for all plans, giving you full access to test the cloud-based accounting software before committing to a subscription.

FreshBooks tends to cost more than some alternatives like Xero, particularly when adding multiple team members at $11 per month per user. However, its user experience and specific feature set may be worth the investment for many businesses.

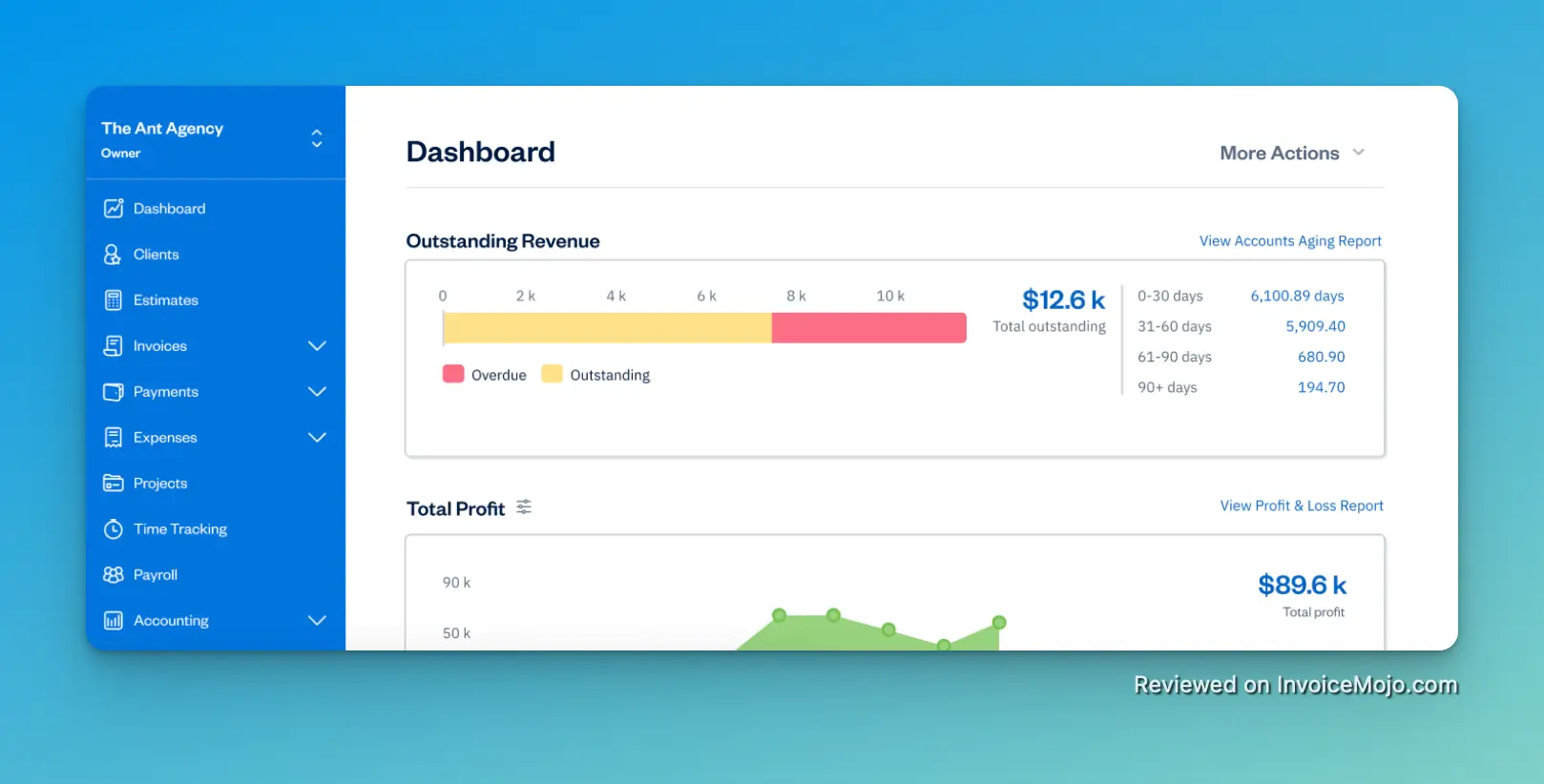

FreshBooks offers one of the most approachable interfaces in the accounting software market, making it accessible even for people without accounting background. The dashboard shows key financial information in a clean, visual format, and moving through the platform feels logical and straightforward.

As its original core function, FreshBooks shines at invoicing with customizable templates, automated reminders, and multiple payment options. Setting up recurring invoices and automating payment reminders saves valuable time for busy business owners.

The built-in time tracking and project management tools are especially valuable for service-based businesses, allowing easy conversion of tracked time into billable invoices. This smooth integration helps ensure you capture all billable hours.

FreshBooks’ mobile apps for iOS and Android deliver solid functionality, including invoice creation, expense tracking, time recording, and mileage tracking. This lets business owners handle their finances while on the move without losing capabilities.

The expense tracking features, including receipt photos and bank account integration, help simplify financial management and tax preparation. Capturing receipts with the mobile app prevents lost documentation and makes expense reporting easier.

The client portal and customizable communication tools help maintain professional relationships with customers. Clients can see their billing history, pay invoices, and provide feedback without needing to create accounts.

FreshBooks continuously improves its platform, with recent enhancements including expanded bank transaction importing capabilities and better reporting options.

FreshBooks costs more than some competitors like QuickBooks Online, especially considering the additional $11 per month fee for each team member. This can make it costly for growing businesses with multiple staff.

Multiple users report ongoing issues with bank connectivity, resulting in missing transactions and reconciliation challenges. These problems appear to persist for some users despite customer support help.

The restriction to just 5 billable clients in the Lite plan may force new businesses to upgrade sooner than they’d like. This limitation seems unnecessarily restrictive compared to some competitors.

While the platform offers good accounting reports capabilities, some users find the customization options for reports less flexible than they’d prefer. This can make creating specialized financial reports challenging.

The base subscription price can quickly increase with add-on extras for team members, advanced payments, and integrations. This scalability issue particularly affects growing businesses.

Unlike competitors like Wave, FreshBooks doesn’t offer a permanent free version, only a 30-day trial. This limits options for very small businesses or those just starting out.

While the interface is user-friendly, some users report a learning period when moving from the invoicing-focused approach to using the full accounting capabilities, including double-entry accounting reports.

To provide a balanced view, here’s feedback from actual FreshBooks users across various platforms.

Many users appreciate FreshBooks for its simplicity and time-saving features:

“It has all of the basics and none of the fluff. When I was a paying customer of Quickbooks, I felt like they were always trying to sell me extra stuff I didn’t really need. Freshbooks treats me like the paying customer I am, and not a sales lead for extra junk.”

“Freshbooks has all the integrated functions I need to manage the financial aspects of my small business. Time entry and invoicing is a breeze. App based expense capture means I never lose a receipt. And decent financial reporting keeps track of my performance throughout the year.”

“The ongoing reconciliation process makes it really efficient and customer support has been outstanding! I also love how good-looking the program is.”

“I’ve been using FreshBooks since I started my business over 12 years ago. The support is excellent and it’s easy to use. It has cut my accounting time down significantly so I can focus on my business.”

User reviews frequently mention how much they like that FreshBooks simplifies what would otherwise be complex bookkeeping tasks.

However, some users report significant challenges when using FreshBooks:

“The worst issue has been since day one, they cannot seem to permanently fix issues importing my bank account. VERY slow responses from support and takes days and weeks to get their ‘process partner’ to fix it.”

“They are terrible. I need to migrate away from them ASAP… I’ve been struggling with my Freshbooks account for a week–transactions refusing to import, weird tangles, much frustration.”

“I just wanted to share my recent, absolutely nightmarish experience with FreshBooks. Honestly, I’m still in disbelief over how bad it was… Importing bank transactions was a disaster. It kept breaking, and the ‘solutions’ from support were a joke.”

“Three years in and I’m on my second embedded processor. The second embedded processor has now had created a second, separate, account for literally no reason… Their banking connections just don’t work sometimes, and they’ll not be helpful nor when communicative trying to get that fixed.”

Some users acknowledge both strengths and weaknesses:

“FreshBooks has simplified my invoicing process significantly, reducing the time I spend on administrative tasks and giving me more time to focus on my work. While it’s not perfect, the platform offers a solid set of features that work well for small businesses and freelancers. The occasional limitations are outweighed by the convenience and time savings it provides.”

“I do like the interface, and about 80% of its features are pretty good. But I really need the other 20%. The reports and the Analytics need a lot of work… The reports are only good for the smallest of business.”

“My biggest complaint is that when I create an estimate for say $100,000 and want my initial invoice to be 10% of the estimate the program calls it a deposit then requires that I set up a pay schedule which I always have to go in later to edit. So Progress Billing isn’t as functional as it could be.”

Based on verified reviews across platforms:

| Platform | Overall Rating | Number of Reviews | Notable Trends |

|---|---|---|---|

| G2 | 4.5/5 | 4,498 | Strong praise for UI and invoicing, concerns about bank connections |

| Capterra | 4.5/5 | 4,496 | High marks for ease of use, mixed feedback on support quality |

| PCMag | Editor’s Choice | Professional review | Praised for customizable tools and design |

| Mixed | Various threads | More negative experiences, particularly with bank connections |

Is FreshBooks good for freelancers?

Yes, FreshBooks is well-suited for freelancers and independent contractors, particularly with its Lite plan ($19 per month) which includes unlimited invoices for up to 5 clients. The platform’s strengths in time tracking, expense management, and professional invoicing align well with freelancer needs. However, freelancers with more than 5 active clients will need to upgrade to a more expensive plan.

How does FreshBooks compare to QuickBooks Online?

FreshBooks offers a more intuitive interface and is better at service-based business features like time tracking and project management. QuickBooks Online provides more thorough accounting tools, better inventory management, and built-in payroll options. FreshBooks starts at a lower price point but can become more expensive when adding multiple users. QuickBooks generally works better for product-based businesses, while FreshBooks often suits service providers better.

Can I accept online payments through FreshBooks?

Yes, FreshBooks connects with payment processors to enable payments through FreshBooks directly via invoices. The platform supports credit cards, ACH bank transfers, and other payment methods. Processing fees apply, typically around 2.9% + $0.30 per transaction for credit cards.

Is there a free trial available for FreshBooks?

Yes, FreshBooks offers a free 30-day trial for all its plans (Lite, Plus, and Premium). The trial gives full access to features without requiring credit card information upfront.

How secure is FreshBooks?

FreshBooks uses industry-standard security measures, including 256-bit SSL encryption for data transmission and regular server vulnerability scanning. The platform uses multi-factor authentication, copies data across multiple servers in different locations, and maintains compliance with relevant security standards.

Can I track time with FreshBooks?

Yes, FreshBooks includes robust time tracking features that allow you to track time using a timer, enter time manually, or use the mobile app. Tracked time can be easily added to invoices and linked to specific projects or clients.

Does FreshBooks offer multiple currency support?

Yes, FreshBooks supports multiple currencies, allowing you to send invoices to international clients in their local currency. The platform automatically handles currency conversion for reporting purposes.

Is FreshBooks right for product-based businesses?

While FreshBooks does offer inventory tracking features, it’s mainly designed for service-based businesses. Product-based businesses with complex inventory needs or manufacturing requirements might find platforms like QuickBooks or Xero more suitable for their specific needs.

Can I add my accountant to my FreshBooks account?

Yes, FreshBooks allows you to add your accountant to your account at no additional cost (except in the Lite plan). This gives them access to your financial data for tax preparation and financial guidance.

What happens if I exceed my client limit in FreshBooks?

If you exceed the client limit for your plan (e.g., 5 clients in the Lite plan), FreshBooks will prompt you to upgrade to the next tier. You cannot add additional clients beyond your plan’s limit without upgrading.

After thoroughly evaluating FreshBooks, it’s clear that the platform works best for:

Freelancers and Small Businesses who need professional invoicing, time tracking, and basic expense management. The streamlined interface and automation features save valuable time that can be used for billable work instead.

Service-Based Small Businesses with straightforward accounting needs and a focus on project billing. The project management features and time tracking integration create a smooth workflow from completing work to getting paid.

Businesses That Value Simplicity over advanced accounting features. FreshBooks creates an intuitive, visually appealing interface that doesn’t require accounting expertise to use effectively.

Organizations With Fewer Than 10 Team Members who can handle the additional per-user costs without significantly impacting their budget.

FreshBooks is an accounting software that’s particularly well-suited for service providers who need strong invoicing and time tracking capabilities.

FreshBooks might not be the best choice for:

Product-Based Businesses with complex inventory management needs. While FreshBooks offers basic inventory tracking, it lacks the depth found in platforms specifically designed for retail or manufacturing.

Growing Companies With Large Teams due to the $11 per month per-user fee, which can quickly add up compared to competitors offering unlimited users.

Businesses Needing Advanced Report Customization for accounting reports and financial statements. The somewhat limited reporting customization may frustrate businesses with specialized reporting needs.

Budget-Conscious Small Businesses who might find better value in lower-cost or free alternatives like Wave.

FreshBooks earns a 4.4/5 star rating based on its exceptional invoicing capabilities, user-friendly interface, and strong mobile functionality. The platform makes accounting accessible to non-accountants while providing professional-grade features.

The main drawbacks, banking connectivity issues, higher pricing compared to some competitors, and additional per-user costs, prevent it from getting a perfect score. However, for its target audience of service-based businesses and freelancers, FreshBooks remains one of the most compelling options in the accounting software market.

The platform’s ongoing improvements suggest that many current limitations may be addressed in future updates. FreshBooks’ growth from a simple invoicing tool to a comprehensive cloud-based accounting software shows the company’s commitment to meeting the changing needs of small businesses.

For businesses that prioritize ease of use, professional invoicing, and integrated time tracking, FreshBooks provides a solid solution despite its premium pricing. New users should take advantage of the 30-day free trial to thoroughly check whether the platform’s strengths match their specific business requirements.

FreshBooks vs. other accounting software companies often comes down to your specific needs: if you value user experience and strong invoicing capabilities, FreshBooks deserves serious consideration as one of the best accounting software options for service-based businesses in 2026.