Highlights

Bill.com Website

Running a freelance or small business means wearing multiple hats, and financial management often becomes a time-consuming burden. BILL.com presents itself as a solution to this challenge by providing tools that automate accounts payable, accounts receivable, and document management.

The platform was created to help business owners spend less time on financial processes and more time growing their ventures. BILL aims to become the central hub for handling bills, invoices, payments, and financial records while reducing manual data entry.

This review takes a close look at what BILL.com actually delivers, including its capabilities, costs, and genuine feedback from real users. Whether you’re a solo freelancer managing a handful of monthly invoices or a growing company with multiple vendors, understanding if BILL aligns with your needs is crucial before committing to this financial operations platform.

BILL.com offers several core functionalities designed to streamline financial workflows. Let’s examine what the platform provides:

The accounts payable system transforms bill payment from a manual chore into a more efficient process:

Document Capture and Processing

Approval Workflows

Payment Methods

The system maintains complete records throughout the payment process, which helps with accountability and simplifies running reports.

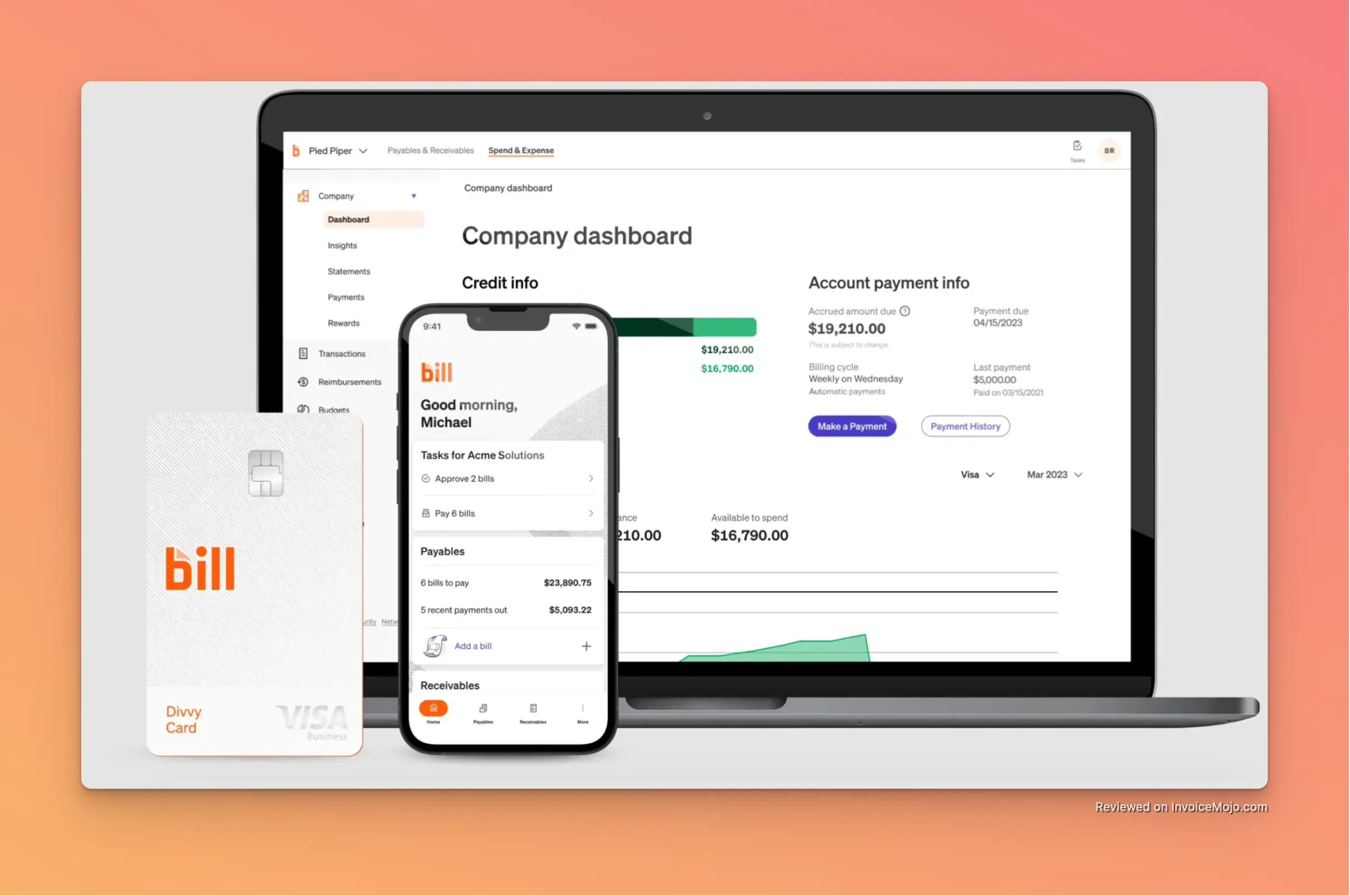

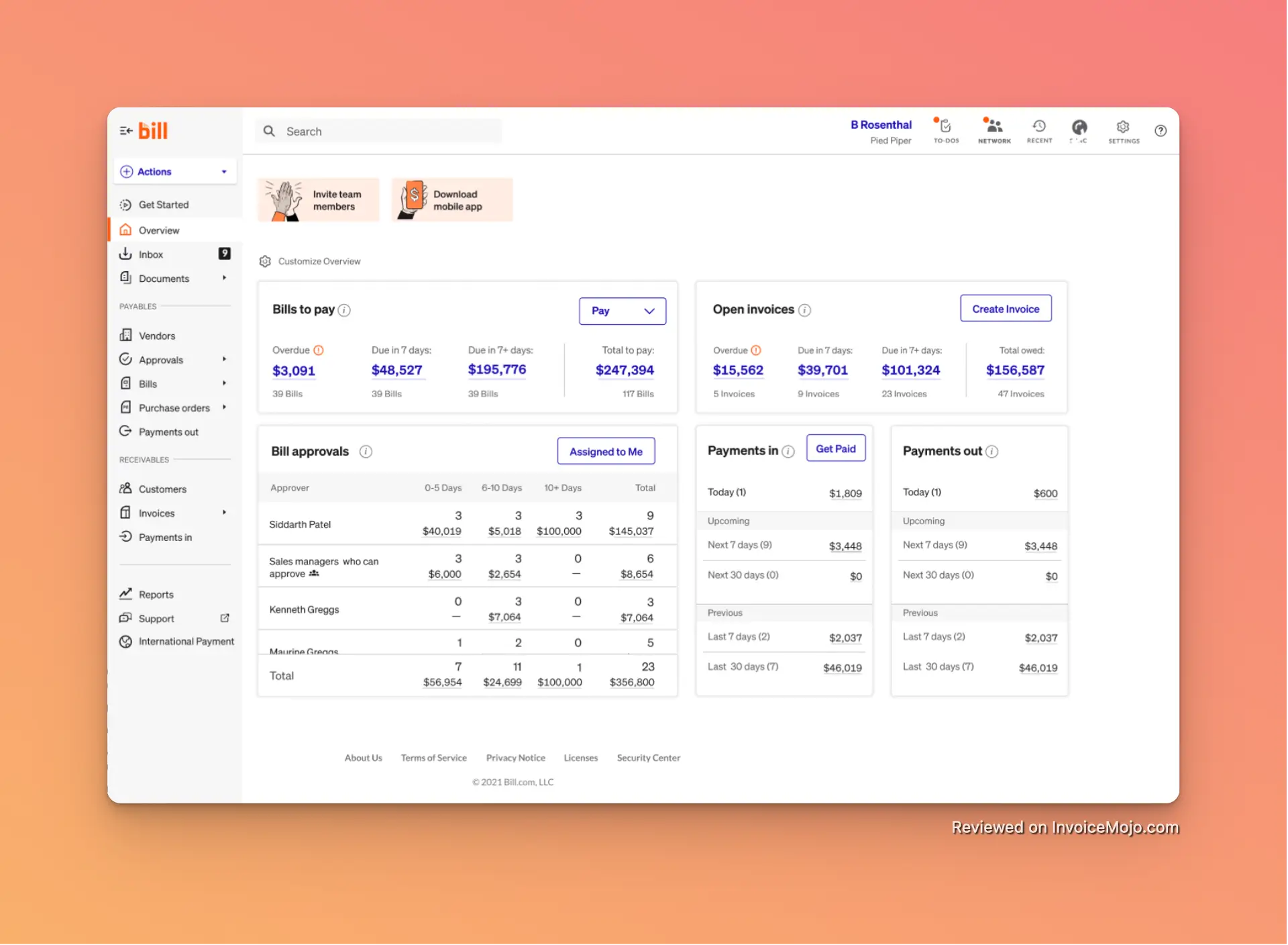

Accounts Payable Dashboard in Bill.com

BILL.com also helps businesses collect payments more efficiently:

Invoice Creation

Payment Collection Options

Receivables Monitoring

This streamlined approach to invoicing helps business owners get paid faster while reducing administrative work.

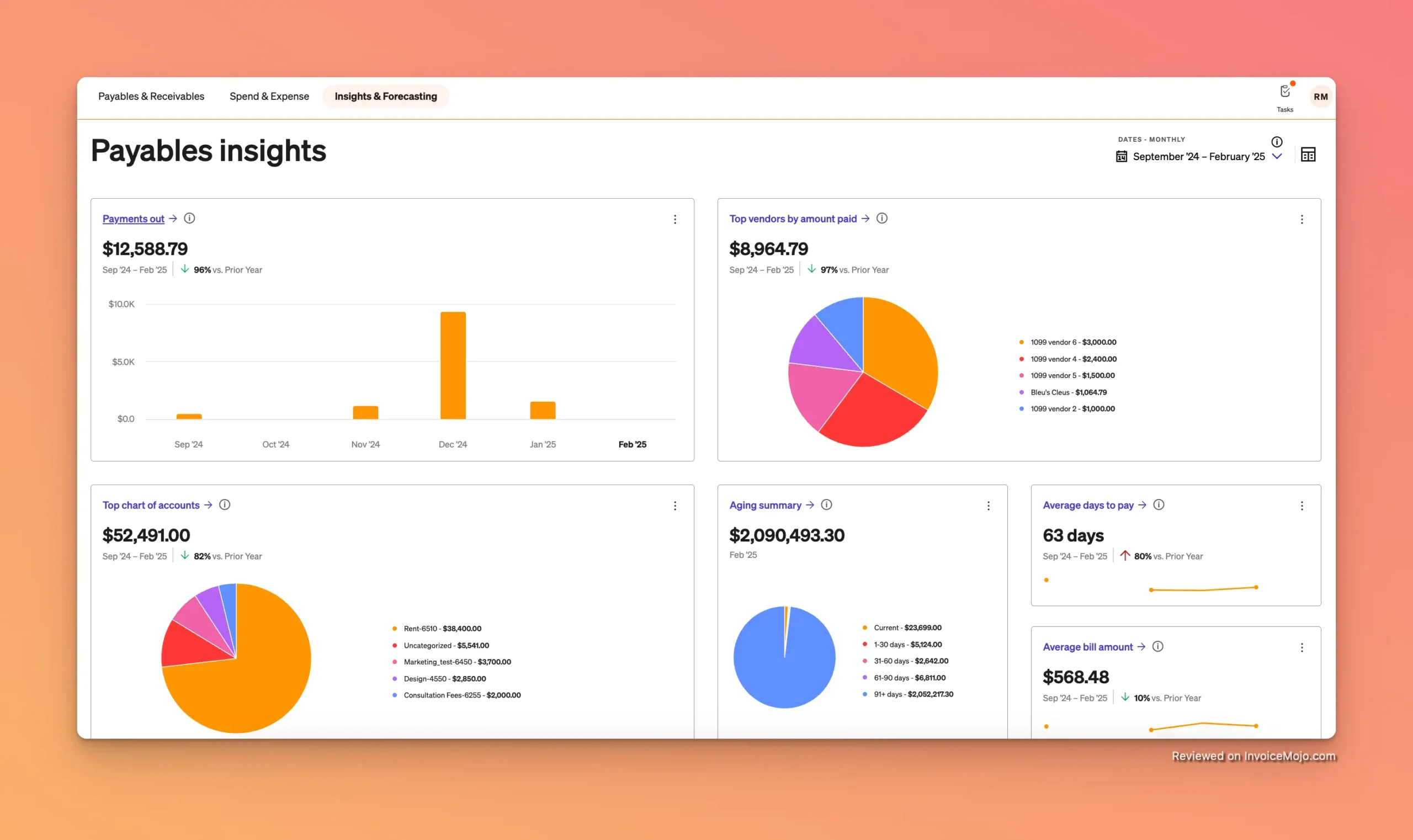

Accounts Payable Insights in Bill.com

BILL.com functions as a central repository for financial documentation:

This paperless approach eliminates physical filing and ensures easy access to important financial documents.

A major advantage of BILL.com is how it connects with popular accounting software:

Accounting Software Connections

These integrations allow automatic synchronization of vendor information, invoices, and payment status without duplicate data entry.

Additional Business Tool Connections

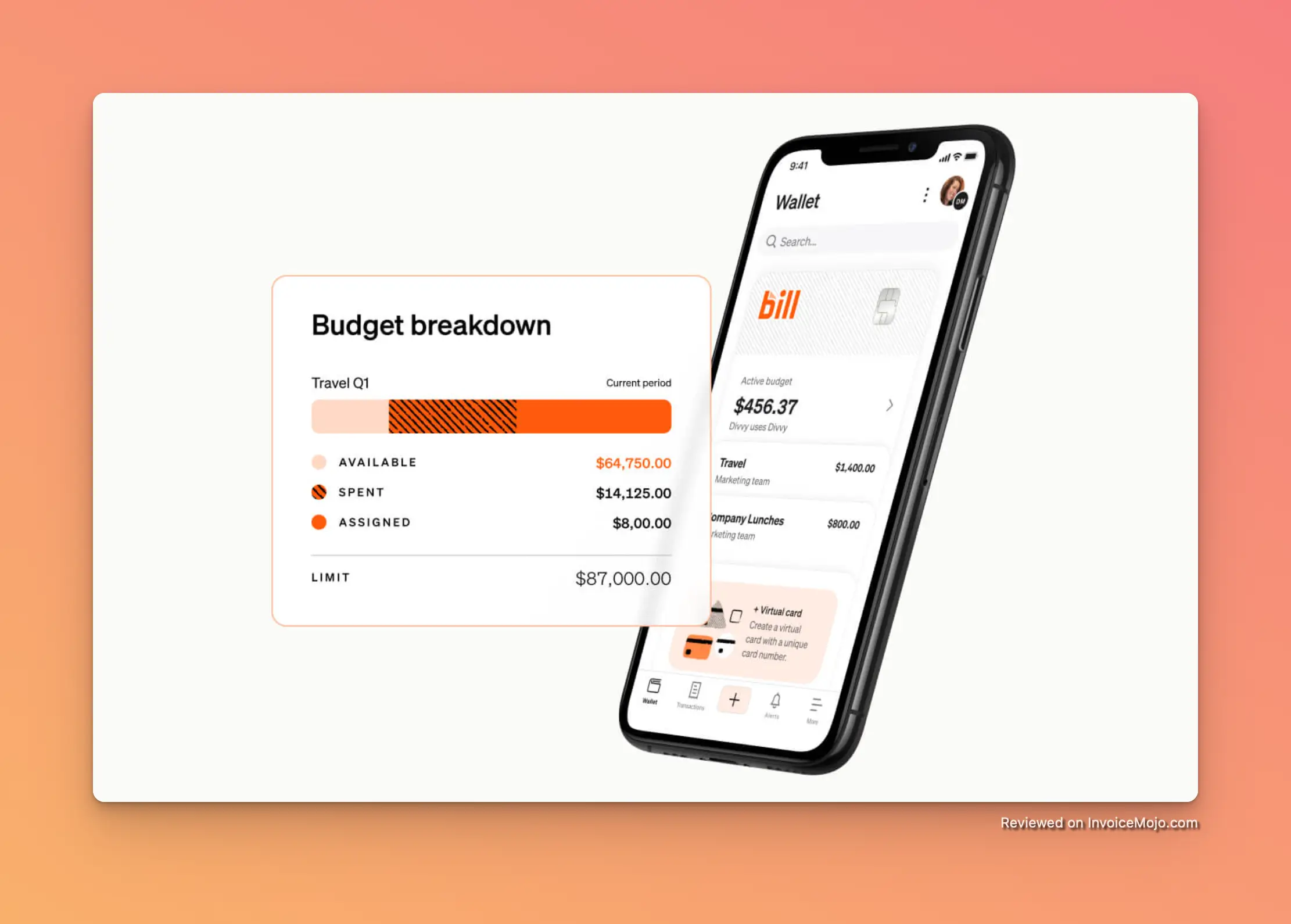

BILL.com’s mobile app extends functionality beyond the office:

This mobile app benefits professionals who need financial visibility while away from their desk.

BILL implements strong security measures:

These security features provide confidence when handling sensitive financial information.

Budgeting with Bill.com

Understanding the cost structure is important for determining if BILL.com offers good value for your specific situation:

| Feature | Essentials | Team | Corporate | Enterprise |

|---|---|---|---|---|

| Monthly Price | $45 per user | $55 per user | $79 per user | Custom pricing |

| Accounts Payable | Yes | Yes | Yes | Yes |

| Accounts Receivable | Yes | Yes | Yes | Yes |

| Unlimited Document Storage | Yes | Yes | Yes | Yes |

| Standard Approval Workflows | Yes | Yes | Yes | Yes |

| Mobile App Access | Yes | Yes | Yes | Yes |

| User Roles | 5 standard roles | Custom roles | Custom roles | Custom roles |

| Accounting Software Integration | No | Yes | Yes | Yes |

| Cash Flow Management | No | Yes | Yes | Yes |

| Invoice & Payment Automation | No | No | Yes | Yes |

| Discounted Approvers-Only Users | No | No | Yes | Yes |

| Custom Approval Limits | No | No | Yes | Yes |

| Dedicated Account Manager | No | No | No | Yes |

| API Access | No | No | No | Yes |

Beyond monthly subscription costs, BILL.com charges per-transaction fees:

BILL.com does offer a free Spend and Expense Management plan with limited features for very small operations or businesses just starting out.

For Freelancers: The Essentials plan ($45/month) typically works well for solo entrepreneurs handling a moderate number of invoices and bills.

For Small Businesses (2-10 employees): The Team plan ($55/month) provides a good feature balance, especially with accounting software integration, which becomes more important as transaction volume increases.

For Growing Businesses (10-50 employees): The Corporate plan ($79/month) adds automation features and customizable approval and payment workflows that help as financial operations become more complex.

For Larger Organizations: The Enterprise plan with custom pricing offers the highest level of customization, dedicated support, and advanced features for sophisticated financial needs.

When calculating total BILL.com costs, remember to include both the monthly subscription and anticipated transaction fees based on your typical payment process volume, as these can significantly impact overall expense.

A balanced assessment of BILL.com’s strengths and limitations based on feedback from real users and platform capabilities:

Time Efficiency

The automation significantly reduces hours spent on financial tasks. Using BILL.com, business owners consistently report that automated data entry, payment scheduling, and approval workflows free up valuable time that can be directed toward core business activities.

Financial Visibility

The centralized dashboard shows pending bills, upcoming payments, and receivables status. This improved oversight helps business owners make better-informed financial decisions and avoid surprises.

Error Reduction

By minimizing manual data entry and adding verification steps, BILL helps prevent common accounting mistakes like duplicate payments, incorrect amounts, or missed due dates.

Smooth Integration

The platform connects well with popular accounting software like QuickBooks, ensuring data consistency without requiring duplicate entries and creating a more unified financial management approach.

Digital Document Management

BILL.com’s document system eliminates physical filing, reducing office clutter and making documentation accessible from anywhere with internet access.

Growth Accommodation

The pricing tiers and feature structure allows the platform to adapt as your business grows, making it suitable for both freelancers and small and midsize businesses.

Mobile Flexibility

The mobile app gives business owners flexibility to handle financial tasks while away from their desk, allowing approval workflows to continue regardless of location.

![]()

Expense tracking with Bill.com

Support Issues

A common theme in negative reviews involves customer support challenges. Real users mention difficulties reaching representatives, language barriers with international support staff, and takes a long time to resolve issues.

Initial Complexity

Despite being user-friendly, some users report it takes time to fully understand all platform features, particularly when configuring approval workflows and integrations.

Cost Considerations

The combination of monthly fees and per-transaction charges can add up quickly, making BILL.com potentially expensive for businesses with high transaction volumes.

Verification Delays

Multiple reviews mention frustration with BILL.com’s verification processes, which sometimes result in payment holds or account restrictions that impact business operations.

International Payment Challenges

While international payments are supported, users report longer processing times and occasional challenges with international vendors and banking connections.

Syncing Glitches

Though integration with major accounting software providers is important, some users experience occasional synchronization issues that require manual fixes.

There’s notable variation in ratings across platforms, with significantly lower scores on TrustPilot and G2 compared to other review sites. This suggests users with negative experiences may be more likely to share feedback on certain platforms.

Efficiency Improvements

“BILL automates accounts receivable and payables processes by helping through invoice processing and syncing with other accounting software. It also allows to have approvers to verify the transactions/invoices which helps in ensuring maximum accuracy.” – Cheshire, G2 Review

“Bill.com is very user-friendly software. It’s very easy and quick to pay vendors using Bill.com. It’s very user-friendly for tracking vendor ledger records in Bill.com, and it saves users a lot of time and money.” – Verified Reviewer, G2

Integration Benefits

“I use Bill mainly for AP software. It does its job tremendously well… I have integrated Bill with Web UI and it does its job, especially user interface is good, the process from start to end bill process is good and even a person who is not an accountant can also process bills easily.” – Ranjith, G2 Review

“Big timesaver in terms of sending invoices and business payments. Sync with Quickbooks Desktop. Makes it easy to send an invoice and pay vendors.” – Maureen, Software Advice Review

Non-Financial Staff Accessibility

“Overall, I have been extremely happy using BILL.com. My clients are easily able to access and receive payments, and I am able to set up my clients with recurring invoices, to alleviate extra work for me.” – Christian, Software Advice Review

“I have been using bill.com for quite some time now and love it. Payments get to my customers on time with no problems. I love it!” – Jennefer C, BBB Review

Account overview in Bill.com

Customer Support Frustrations

“Their customer support is ATROCIOUS at best. I’m currently trying to figure out how to work their app to receive payments from a company. Contacted customer service, their chat bot said ‘nobody is available… hours are… PST’ I tried to contact them at 10:57am PST.” – Billy B, BBB Review

“Save yourself the time and trouble and DO NOT process with bill.com. You cannot speak with a representative at all. You can chat with someone and out of all of my experiences they are not helpful at all and don’t care about your issues.” – Madie O, BBB Review

Account Hold Problems

“HORRIBLE! BILL.COM HAS HAD MY ACCOUNT ON HOLD TO SUPPOSEDLY DO A VERIFICATION FOR OVER A WEEK. THEY HAVE LITERALLY BROUGHT MY BUSINESS TO A HALT AS I CAN’T MAKE ANY PAYMENTS. SENT THE DOCUMENTS REQUESTED OVER 6X, PROMISES OF RESOLUTION AND NOTHING! STAY AWAY!” – Marsha W, BBB Review

Payment Processing Issues

“Terrible. The worst credit card processor I have ever used and I’ve been in business for 7 years. They continuously stall payments for various reasons. I’m still waiting almost a month for them to pay me for a credit card transaction for over $10k.” – Mark H, BBB Review

Technical Limitations

“The documents which are attached to Bill are not easily downloadable. I would like it to have an option to download the Bills related to a vendor in Bulk rather than one by one.” – Cheshire, G2 Review

“BILL.com is introducing many new features which is affecting to delay in vendor payments. Also now vendors are not getting connected to E-payment since they are using the same email ID for multiple network IDs.” – Lakshmi, G2 Review

These varied experiences highlight that while many users find significant value in BILL.com’s core functionality, others encounter frustrations, particularly with customer service and account management.

Which accounting software does BILL.com integrate with?

BILL.com integrates with several popular accounting solutions, including:

These integrations enable two-way data synchronization, reducing manual entry and helping maintain consistent records across systems.

How secure is BILL.com?

BILL implements bank-grade security measures including:

The platform meets industry security standards for financial data protection.

How long does it take for payments to process through BILL.com?

Payment processing times vary by method:

Can I use BILL.com for international payments?

Yes, BILL.com supports international payments in both foreign currencies and USD. Foreign currency exchange payments don’t incur additional fees beyond standard transaction costs, while USD wire transfers have a $14.99 fee per transaction. However, some users report international payment processing can sometimes take longer than domestic transactions.

How does BILL.com handle recurring bills and invoices?

BILL allows you to set up recurring payment schedules for both payables and receivables. You can specify:

This automation helps ensure consistent processing of regular financial transactions, reducing administrative burden.

What size business is BILL.com best suited for?

BILL is designed to adapt to different business needs:

The platform provides the most value for businesses processing at least 5-10 bills monthly, as automation benefits increase with higher transaction volumes.

Is there a contract requirement for using BILL.com?

BILL.com offers month-to-month service without long-term contracts for most plans. However, some users report difficulties canceling their service, so understanding the terms of use and cancellation process before signing up is advisable.

BILL.com earns a solid 4.2 out of 5 stars for its comprehensive approach to financial operations automation. The platform excels in streamlining accounts payable and accounts receivable processes, with particularly strong integration capabilities that make it valuable for businesses already using accounting software like QuickBooks.

The pricing structure, while not the most affordable option for very small businesses, delivers reasonable value for companies processing at least 10 bills monthly. The tiered plans allow for scaling as businesses grow, providing a solution that can evolve alongside your organization’s needs.

BILL.com is likely a good fit if you:

The Essentials plan could be worth the investment in these scenarios. The time saved on invoice creation, payment processing, and sending reminders can offset the monthly fee, allowing more focus on billable work.

However, BILL.com may not be ideal if you:

In these cases, BILL.com alternatives such as Wave or even PayPal invoicing might be sufficient without the higher monthly cost.

BILL provides significant value if your business:

The Team or Corporate plan typically provides the best balance of features and cost for established small and midsize businesses with regular bill payment needs.

BILL.com may present challenges if your business:

In these scenarios, BILL.com’s international payment limitations, customer support issues highlighted in reviews, or per-transaction fees might create problems in your financial operations.

BILL.com works best for automating routine financial tasks for businesses that have reached the point where manual processes are becoming burdensome but aren’t yet large enough to justify enterprise-level financial systems. The integrated platform creates structured, repeatable workflows for accounts payable and receivable while maintaining visibility over financial operations.

The main benefit, using BILL to save time and money through automation, is consistently mentioned in positive user feedback. However, concerns about customer experience quality and account verification issues suggest users should prepare for potential challenges, particularly during the onboarding process.

For most freelancers and small and midsize businesses with moderate financial transaction volumes, BILL.com offers an appealing combination of efficiency, professionalism, and control that can streamline financial processes. The key is to realistically assess your transaction volume to determine if the efficiency gains justify the combined subscription and per-transaction costs.

If you implement BILL.com, start with a clear onboarding plan, use available training resources, and carefully set up your approval and payment workflows to maximize the platform’s benefits for your specific business needs. Bill provides solutions that can genuinely help businesses save time and money, but only when properly matched to your specific requirements and transaction volume.

Ultimately, Bill is a comprehensive tool that offers significant advantages for growing businesses ready to move beyond manual financial management. By automating accounts receivable and payable processes, providing mobile access to financial data, and simplifying approval workflows, BILL.com can transform how small and midsize businesses handle their financial operations, enabling them to focus more on growth and less on paperwork.