QuickBooks Website

QuickBooks Online (QBO) is a cloud-based accounting software by Intuit, designed to simplify bookkeeping for freelancers and small business owners. As one of the leading choices in accounting software today, QBO offers an all-in-one platform to manage invoicing, expenses, banking, and even payroll. Millions of businesses worldwide use QuickBooks Online for its reliability and robust features, making it a de-facto standard. Many accountants are fluent in QBO, which speaks to its authority in small business accounting. QBO stands out for its comprehensive feature set and ease of access. Because it’s cloud-based, you can log in from anywhere—on your laptop, tablet, or mobile—and your data stays synced in real time. This accessibility, combined with Intuit’s long-standing reputation (over 30 years in the accounting software market), has made QBO a top pick for businesses that want professional bookkeeping without the complexity of traditional accounting systems. Freelancers appreciate features like simple invoicing and expense capture, while small businesses benefit from advanced tools that can scale as they grow. It’s this versatility that keeps QBO at the forefront of accounting solutions for entrepreneurs and SMEs. In this review, we’ll provide a detailed analysis of QuickBooks Online’s features, pricing, pros and cons, and real user feedback. By the end, you’ll know whether QBO is the right choice for your freelance or small business needs.

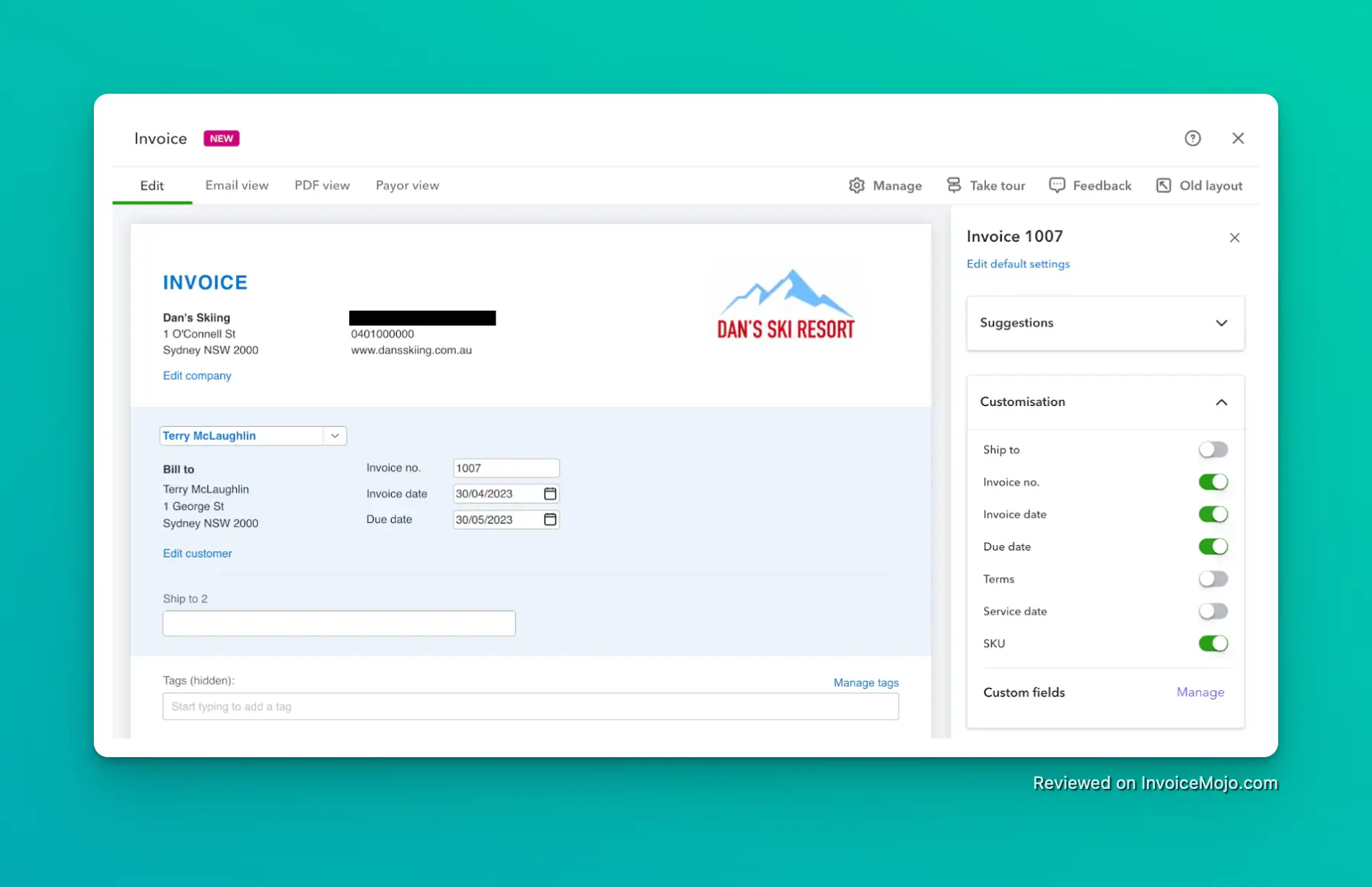

QuickBooks Online’s invoicing is powerful yet user-friendly. You can create professional invoices with your own branding, send them via email, and enable online payments so clients can pay with a click. QBO’s invoicing supports recurring invoices (great for ongoing contracts) and payment reminders to nudge clients about due or overdue payments.

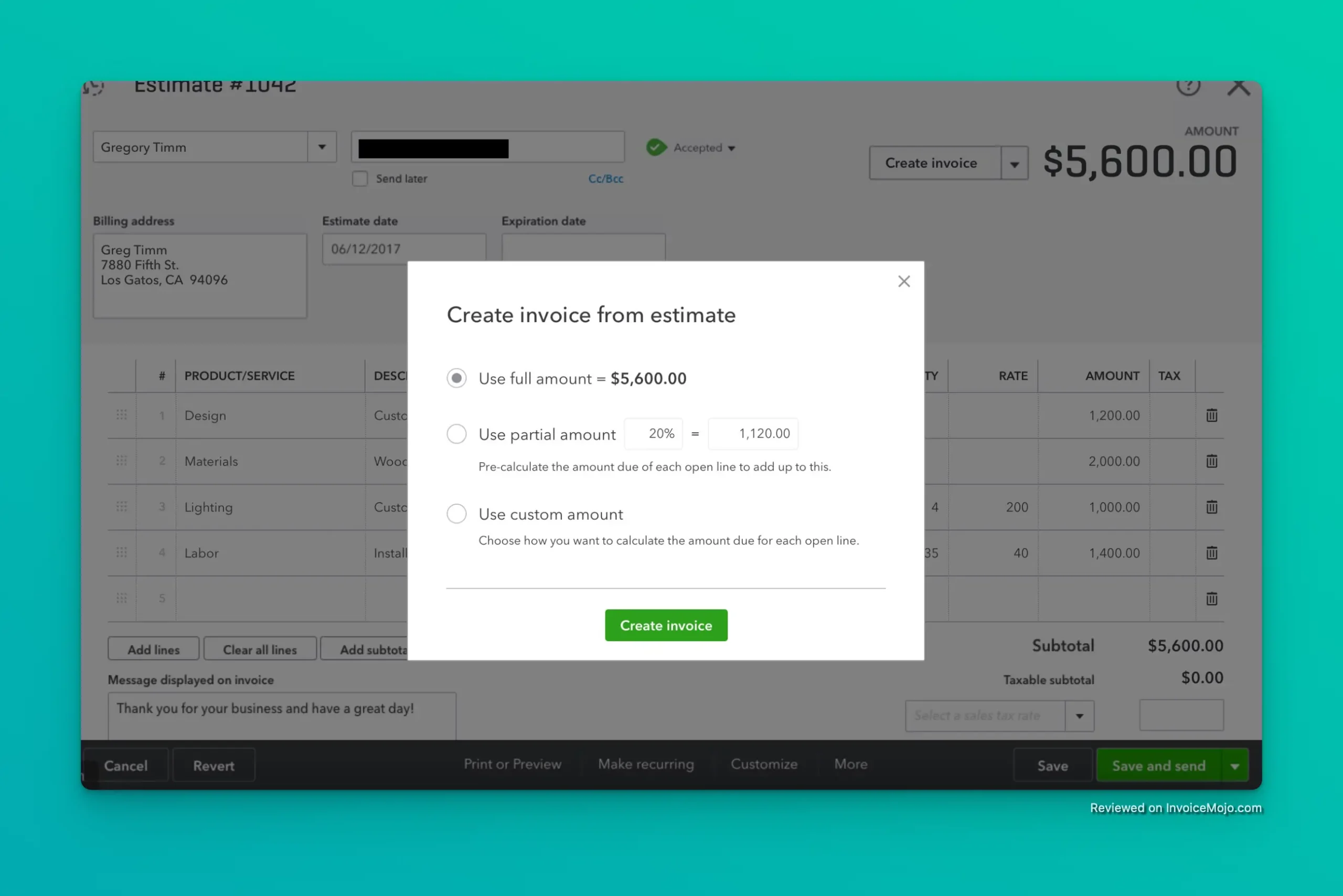

This means less time chasing payments and improved cash flow. Freelancers will love the ability to convert estimates to invoices in one click once a client approves a quote, ensuring you don’t double-enter information.

Invoices can include a “Pay Now” button (via QuickBooks Payments or integrations like PayPal/Square), making it easier for customers to pay promptly. Another standout is progress invoicing: if you bill projects in phases or percentages, QBO lets you invoice for partial work completed, which is ideal for long-term projects or large orders

You can also track invoice status (QBO shows if an invoice has been viewed and paid) and send reminders with one click. Overall, QBO’s invoicing features are more robust than many competitors, ensuring you look professional and get paid faster.

Creating an invoice in QuickBooks

Keeping on top of expenses is crucial for any business, and QuickBooks Online excels here. It automatically tracks expenses by linking to your bank and credit card accounts: transactions are imported and categorized, reducing manual data entry.

You can snap photos of receipts with the QuickBooks mobile app and attach them to expense entries, creating a digital paper trail for every purchase (no more shoeboxes of receipts!). QBO also lets you create custom expense categories (or use default tax categories) to organize your spending.

This categorization makes tax time easier, as you can quickly pull reports for deductible expenses. A handy feature for freelancers on the go is mileage tracking: using the mobile app, QBO can automatically track your business miles via GPS, which is valuable for those who need to deduct mileage.

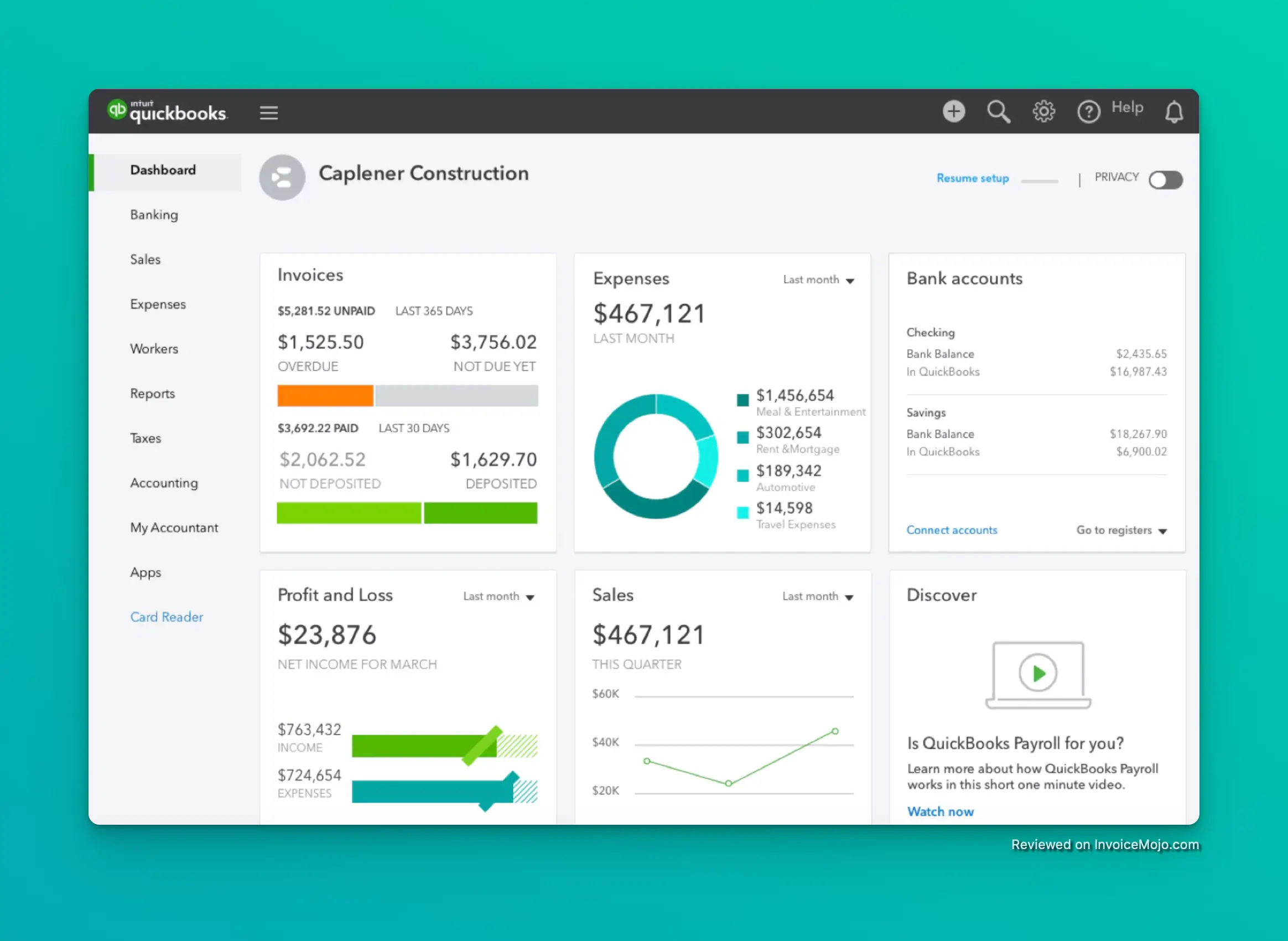

Additionally, QuickBooks supports bill management: you can record vendor bills, set due dates, and schedule payments, ensuring you never miss a payable. Cash flow insights in QBO show your income vs. expenses at a glance on the dashboard, giving you real-time awareness of your financial health.

For small businesses that need multi-currency expense tracking, QBO Essentials (and above) allows you to handle expenses in multiple currencies: useful if you deal with international vendors. Overall, QBO’s expense tracking is thorough, helping improve accuracy and save time by automating routine bookkeeping tasks.

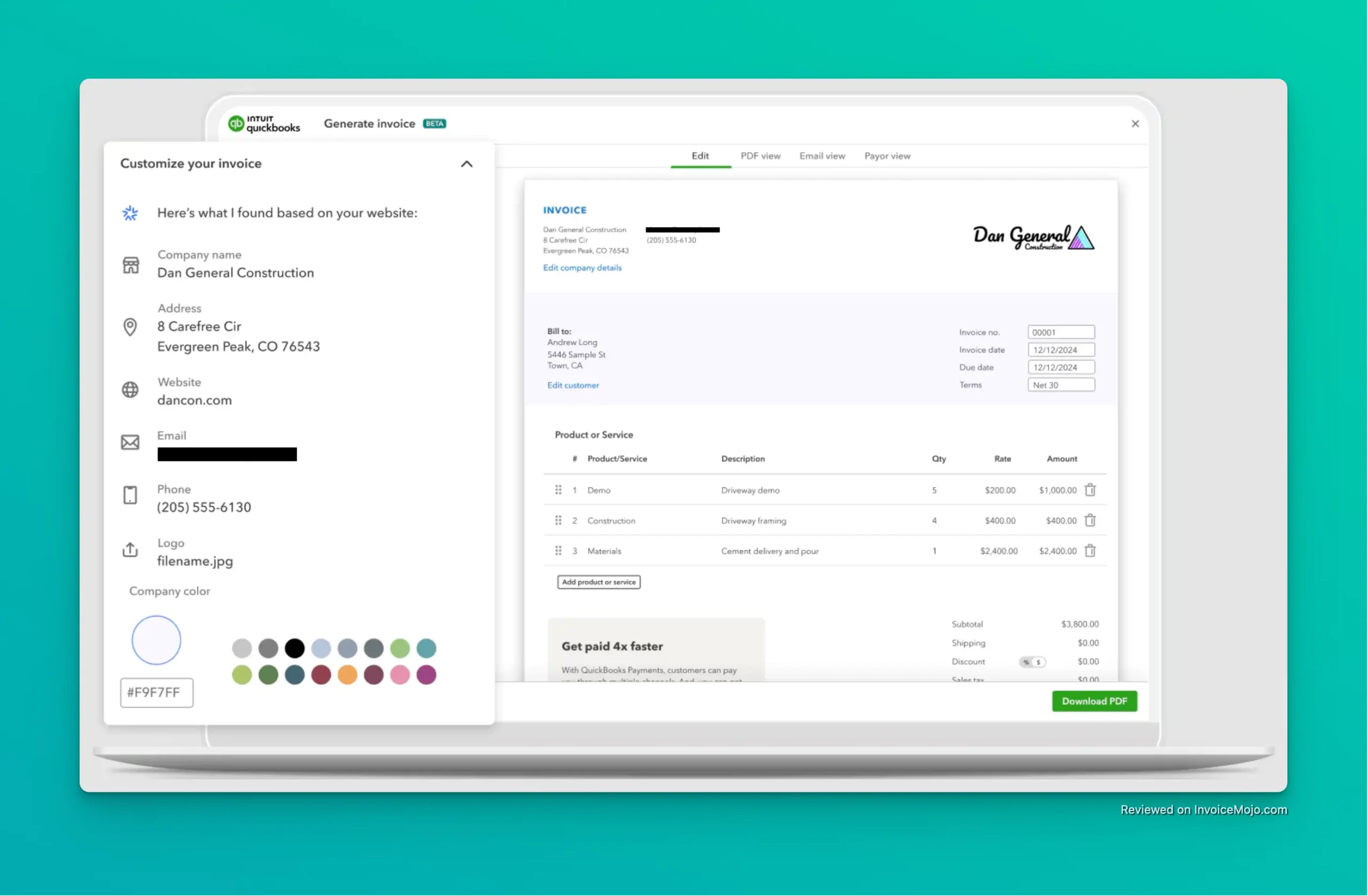

Invoicing customization options in QuickBooks

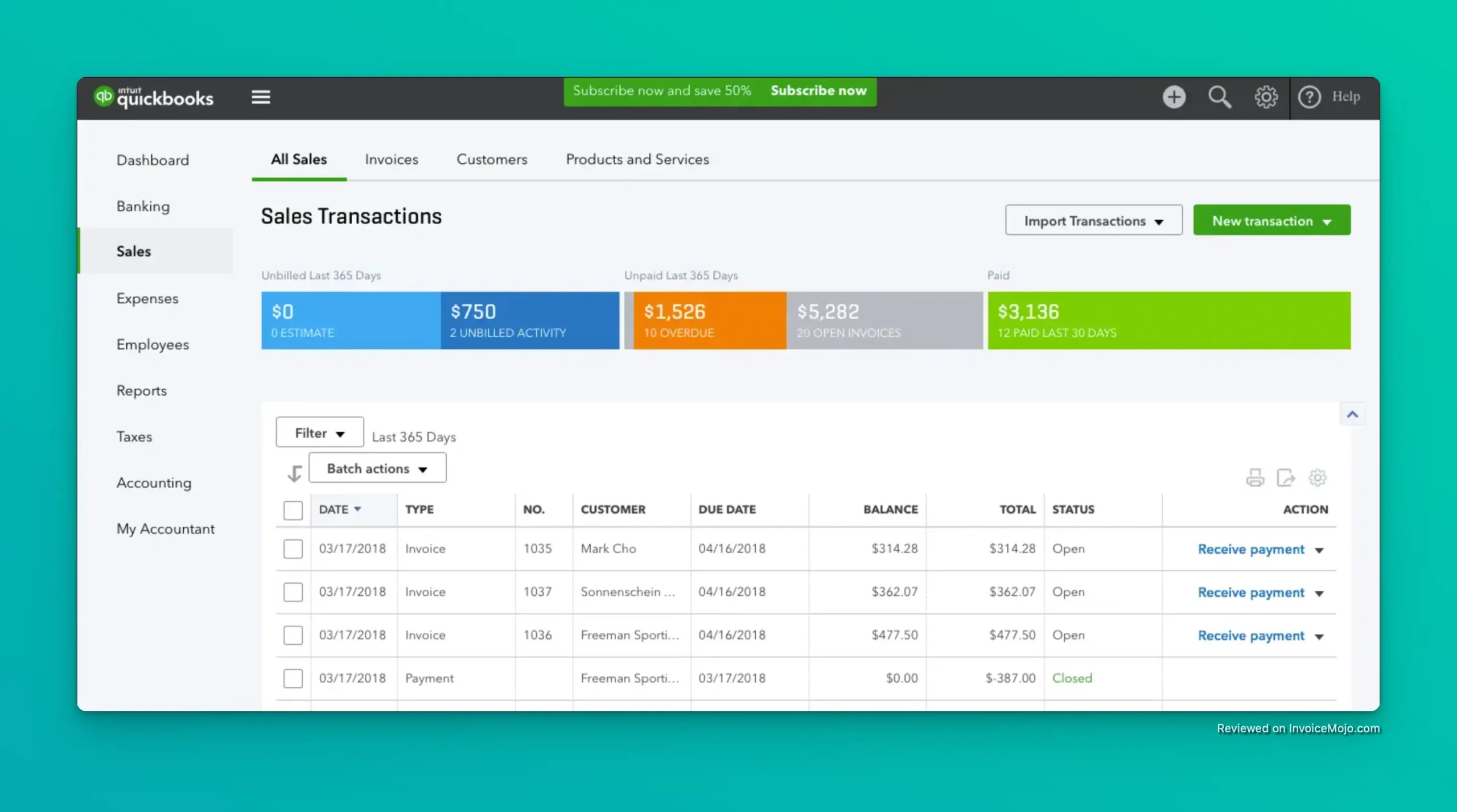

Bank reconciliation is made much simpler with QuickBooks Online’s automated banking features. Once you connect your bank accounts and credit cards, QBO will import transactions daily and attempt to match them with your recorded income and expenses.

The reconciliation tool in QBO presents your bank statement data side-by-side with your QuickBooks data, allowing you to tick off matches and quickly identify discrepancies. QBO’s smart matching learns from your habits. For example, if you often categorize a certain vendor as “Office Supplies,” it will start auto-suggesting categories for new transactions.

This reduces errors and ensures your books always reflect your actual bank balance. Each month, you can perform a formal bank reconciliation to confirm that your ledger and bank statements agree. QBO provides prompts for any unreconciled transactions and helps locate differences down to the penny.

This feature is crucial for maintaining accurate financial records and catching mistakes (or missing transactions) before they become problems. Freelancers with only one bank account will find this process straightforward, while businesses with multiple accounts can reconcile each account separately.

The benefit is confidence that your reported income and expenses are correct and that your cash flow is accurately tracked. With QuickBooks, reconciling accounts—a task that used to be tedious—is now largely automated and takes only minutes each month.

Sales transactions record in QuickBooks

Collaboration is easy with QuickBooks Online’s multi-user access. Depending on your subscription level, you can invite additional users to your QBO account. For example, a business partner, an accountant, or employees who handle invoicing or expenses.

Each user can be assigned specific roles and permissions. For instance, you might allow a sales employee to create invoices but not see bank registers, or give your accountant full access to review and correct transactions. This granular permission system ensures that each team member only sees what’s relevant to their job.

QuickBooks Online supports up to 25 users on its highest plan (Advanced), which is usually plenty for small businesses. The lower-tier plans come with smaller user limits: Simple Start includes one user (plus 2 accountant users), Essentials up to 3 users, and Plus up to 5 users.

Even freelancers on the Simple Start plan can invite their external accountant as a special user at no extra cost, enabling seamless accountant collaboration during tax season. Multi-user access is in real-time, meaning if your assistant records an expense, you’ll see it instantly on your end.

QBO also keeps an audit log tracking changes each user makes, providing transparency and accountability: a valuable feature if multiple people handle the books. In short, QBO’s multi-user capability allows your bookkeeping to scale from a one-person operation to a growing team without missing a beat.

One of QuickBooks Online’s strongest advantages is its vast ecosystem of integrations. QBO connects with over 750 popular business apps, which means you can seamlessly link your accounting data with other tools you use.

For example, QBO integrates with payment processors (PayPal, Stripe, Square), e-commerce platforms (Shopify, Amazon), CRM systems, project management tools, and more. If you use PayPal for freelance payments or Etsy for selling products, those transactions can flow automatically into QuickBooks, eliminating manual entry.

Similarly, QBO’s integration with Stripe or Square lets you accept credit card payments and have them recorded in your books without extra steps. For businesses, integration with POS (Point of Sale) systems or inventory management apps can be a game-changer. Sales and stock levels get updated in QuickBooks without double work.

QBO also connects with Zapier, which is a tool that can create custom integrations or automate tasks between QBO and countless other apps (like automatically adding a new QBO customer from a Gmail email, for instance).

Additionally, QBO’s own add-ons like QuickBooks Time (formerly TSheets) for time tracking and QuickBooks Payroll are deeply integrated, providing a unified experience. The extensive integrations save time, reduce errors, and extend QBO’s functionality to fit almost any niche need.

This flexibility is a major reason why QBO is trusted by such a wide variety of small businesses. It can adapt to your workflow, rather than forcing you to change how you operate.

Creating an invoice from an estimate in QuickBooks

In today’s on-the-go world, the QuickBooks Online mobile app is a huge plus for busy freelancers and business owners. Available on iOS and Android, the app is highly rated (around 4.7/5 on the Apple App Store) for its clean design and useful functionality.

With the mobile app, you can perform many core accounting tasks right from your phone or tablet. For instance, you can create and send invoices on the spot. Say you just finished a job for a client, you can bill them before you even leave their office. You can also accept invoice payments and see when a client has viewed an invoice.

The app allows you to capture receipts by snapping a photo, which gets attached to an expense entry in QBO (no need to keep the paper copy). You can record expenses and categorize them on the fly, check your account balances, and even reconcile transactions from your phone.

Need to check a customer’s outstanding balance or contact info quickly? The mobile app lets you access customer and vendor details and even message customers from within the app. Many users praise the app’s dashboard for giving a quick overview of key figures like profit and loss, expenses, and open invoices.

Essentially, the QBO mobile app extends the software’s ease of use to wherever you are, whether in a client meeting, traveling, or just away from your desk. It’s like carrying your bookkeeping office in your pocket, which is ideal for small business owners who wear many hats.

Managing payroll can be a headache for small businesses, but QuickBooks Online offers an integrated solution through QuickBooks Online Payroll (an add-on service). If you have employees or contractors, you can add payroll functionality to QBO for an additional monthly fee.

QuickBooks Payroll is available in tiers (Core, Premium, and Elite in the U.S.), and it handles tasks like calculating wages and deductions, withholding taxes, and even filing payroll tax forms for you. The beauty of using QBO with Payroll is that all the data syncs. When you run payroll, the salaries, tax withholdings, and payroll expenses are automatically recorded in your books.

This integration saves time and ensures accuracy (no need to enter payroll journals manually). For example, on the Core plan, QuickBooks Payroll will automatically calculate paychecks, do direct deposits, and prepare W-2s at year-end. Premium and Elite plans add features like same-day deposits, HR support, and a guarantee against tax filing errors.

Each plan’s cost is a combination of a base fee (starting around $45-$50/month for Core) plus a per-employee charge. While payroll is not included in the standard QBO subscription, having the option to add it means your accounting and payroll are under one roof, which is convenient.

Freelancers may not need payroll, but if you hire even one or two employees as your business grows, it’s easy to activate this service and not skip a beat. QuickBooks also offers contractor payments and 1099 filing as part of this add-on, which is useful for businesses that work with freelancers.

For product-based small businesses, inventory management is essential, and QuickBooks Online covers this in its higher-tier plans. QBO Plus and Advanced include robust inventory tracking features that allow you to manage products, quantities, and even cost of goods sold.

When enabled, you can add inventory items with details like SKU, initial quantity on hand, and reorder point. QBO will then track inventory levels as you purchase (through bills or expense entries) and sell (through invoices or sales receipts) items. The system will alert you when stock is low on a particular item, so you know to reorder

You can even create purchase orders in QBO to send to your suppliers, and once the items arrive, convert the purchase order into a bill, automatically updating your inventory counts. QBO’s inventory features also support bundling: if you frequently sell items together (or a combination of products and services), you can bundle them as a single line item for convenience.

The inventory tracking is perpetual, meaning your books always reflect the latest on-hand counts and inventory value. There are also on-demand inventory reports, such as Inventory Valuation, Best Sellers, or Slow Moving Products, which give insight into which products are making you money and which are sitting on the shelf.

This is extremely helpful for managing cash flow and understanding your business performance. It’s important to note that inventory tracking in QBO is geared toward small to mid-sized inventories. It covers the basics well, but very large or complex inventories might require an external solution or an upgrade to QuickBooks Enterprise.

QuickBooks Dashboard

QuickBooks Online uses a subscription pricing model with several plans to choose from. Each plan offers a different level of functionality and number of users, allowing you to select the tier that best fits your needs and budget.

| Plan | Monthly Price (USD) | Users Included | Key Features |

|---|---|---|---|

| Self-Employed | $15 | 1 | Track income & expenses, capture receipts, basic reports, quarterly tax estimation (for freelancers/sole proprietors) |

| Simple Start | $35 | 1 (+accountant) | Basic accounting: invoicing & payments, expense tracking, bank feeds & reconciliation, general reports, tax prep, bill tracking |

| Essentials | $65 | 3 | All Simple Start features + manage and pay bills, time tracking for employees, multi-currency transactions |

| Plus | $99 | 5 | All Essentials features + project tracking and profitability, inventory management (track products and cost of goods) |

| Advanced | $235 | 25 | All Plus features + advanced reporting and analytics, custom user permissions, batch invoicing, workflow automation, and 24/7 premium support |

Note: QuickBooks Self-Employed is a separate Intuit product for freelancers. It’s not part of the core QBO tiers and cannot be upgraded to the small business plans. All plans (Simple Start and above) include free unlimited invoicing, the ability to connect bank accounts for transactions, and core reports. They differ primarily in added features and user count. QuickBooks frequently runs promotions. For example, 50% off the monthly price for the first three months, or a choice of a 30-day free trial. There are no contracts; you can switch plans or cancel any time without penalty. This flexibility is great if you start on one tier and realize you need to upgrade or downgrade. It’s also worth noting what’s not included in these base prices: Payroll is an add-on service with its own fee, as well as QuickBooks Live Bookkeeping (a separate service where Intuit’s bookkeepers help manage your books). Those are optional and not required to use QBO, but available if you need extra help.

When evaluating QBO’s pricing, it’s helpful to compare it to other popular accounting software:

QuickBooks Online is on the higher end of small-business accounting software pricing, but justifies its price through depth of features, accountant familiarity, and all-in-one convenience with integrated payroll and hundreds of integrations.

To provide real-world perspective, we looked at user reviews across multiple platforms: On Trustpilot, QuickBooks earns around 4.5/5 stars from tens of thousands of reviews. Users praise QBO for helping them stay organized and efficient, with freelancers appreciating the ease of invoicing and expense tracking. About 83% of Trustpilot reviewers gave QBO a full 5-star rating in a UK-based survey. On G2, QuickBooks Online holds a solid 4.0/5 rating from over 3,400 reviews. Users highlight QBO’s rich features, particularly invoicing and financial reporting. Many appreciate that accountants are already familiar with it. However, some mention slow customer support and a learning curve for non-accountants. Across platforms, positive feedback emphasizes time savings, easier tax filing, and peace of mind that finances are properly organized. Negative comments typically focus on cost, support response times, and the learning curve.

Yes, it’s well-suited for freelancers who need to send invoices, track expenses, and manage finances. Simple Start or even QuickBooks Self-Employed are affordable entry points that provide professional invoicing and tax organization.

It’s designed for non-accountants with an intuitive interface, guided setups, and automation features. While there’s a learning curve, most users become comfortable after a few weeks of use.

Yes, QuickBooks offers Payroll as an optional add-on service with plans to calculate wages, handle tax withholdings, and even file tax forms for you. It syncs seamlessly with your accounting data.

Intuit uses bank-grade security (128-bit+ SSL encryption), secure data centers, and offers two-factor authentication. Regular backups ensure your data is protected, often more securely than on a personal computer.

Absolutely. QBO connects to banks, payment processors (PayPal, Stripe), e-commerce platforms, CRM systems, and hundreds more. If a direct integration doesn’t exist, Zapier can often bridge the gap.

QuickBooks Desktop is locally installed software with some advanced industry-specific features, while QBO is cloud-based with anywhere access and regular updates. QBO offers better multi-user access without networking, while Desktop may be faster for some complex operations.

place as a top choice for freelancers and small business owners. It shines in providing a one-stop platform: you can invoice clients, track every dollar in and out, manage your taxes, run payroll, and much more, all under one roof.

The convenience of cloud access and a robust mobile app means your business finances are always at your fingertips, which in today’s fast-paced world, is a huge advantage.

We highly recommend QuickBooks Online for freelancers ready to move beyond spreadsheets, consultants who need professional invoices and expense tracking, and small to medium businesses that want to streamline their bookkeeping and possibly collaborate with an accountant.

If you anticipate growth in your business, QBO’s scalability and extensive integrations make it a solution that can grow with you. Its ease of use (once you get the hang of basics) and widespread support network add to its trustworthiness: you’re not just buying software, but joining an ecosystem that will support your business journey.

That said, QuickBooks Online isn’t for everyone. If you are a hobbyist or very small operation with minimal transactions and you’re extremely budget-conscious, you might find QBO’s cost and complexity unnecessary. A simpler or free tool like Wave could suffice until you expand.

In conclusion, QuickBooks Online stands out as a comprehensive accounting partner for your business. Its strengths in automation, reporting, and integration far outweigh its higher price point. For the vast majority of freelancers and small businesses aiming to stay on top of their finances and make data-driven decisions, QuickBooks Online is an investment that pays off in saved time, fewer headaches, and greater financial clarity.