Wave Invoicing Website

Wave Invoicing Website

Introduction

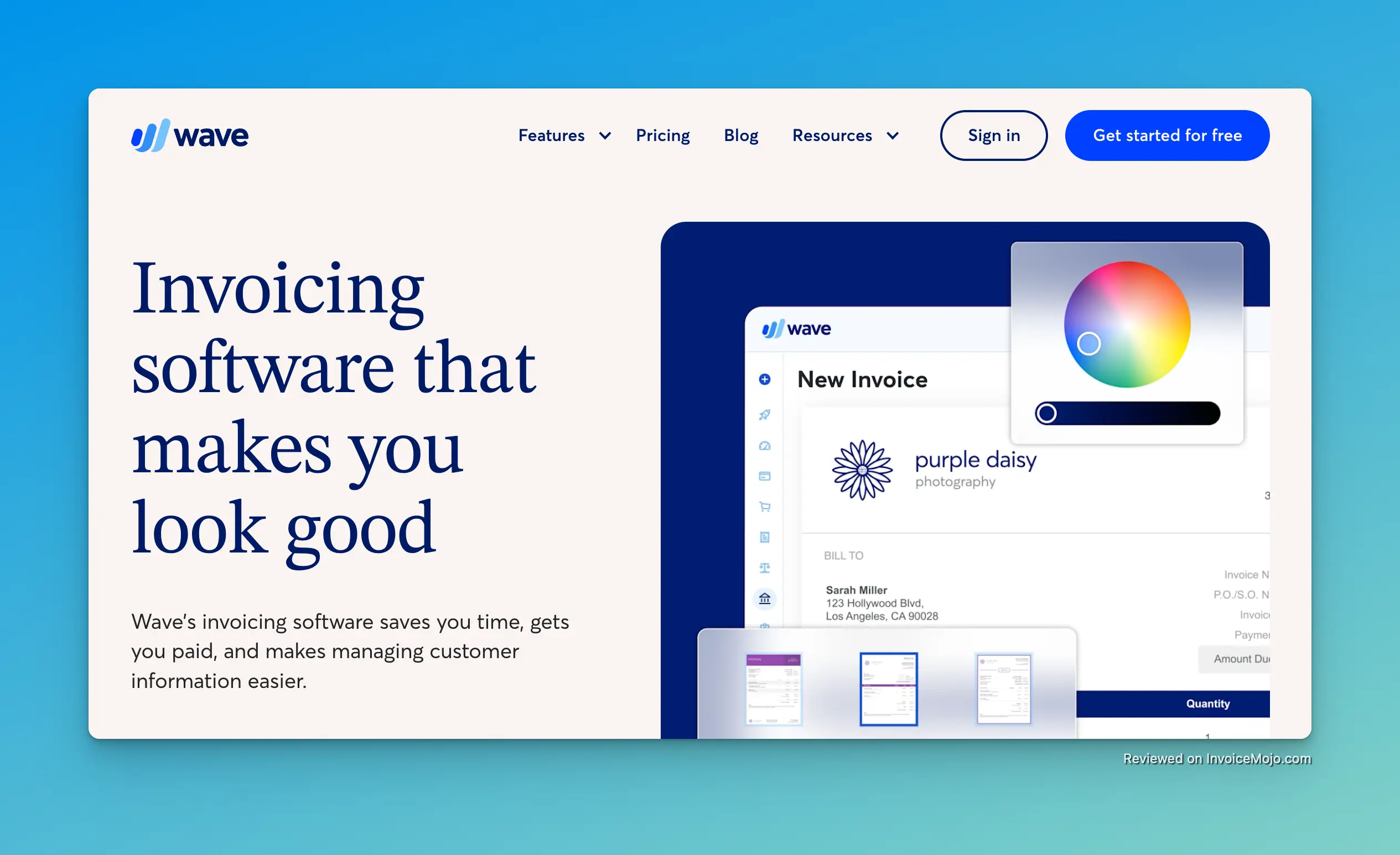

Imagine you’re a freelancer juggling multiple clients, manually tracking invoices in a spreadsheet, and anxiously waiting for payments. Or perhaps you’re a small business owner tired of expensive accounting software eating into your profits. Wave Invoicing aims to solve these problems. It’s a free, cloud-based invoicing and accounting tool built specifically for entrepreneurs on a budget. Wave is currently only available to businesses in the United States and Canada. This regional limitation is important to note before diving deeper into its features and benefits.

Designed for micro-businesses, freelancers, and small business owners who need to send professional invoices, track expenses, and get paid on time – without the hefty price tag or complexity of traditional accounting software. But is “free” too good to be true?

Let’s explore what you get for free (spoiler: a lot), what paid services are available, and where Wave might have limitations. By the end of this review, you’ll know whether Wave Invoicing is the solution your business needs, or if you might outgrow its free offerings.

Key Features

Invoicing Made Easy

Wave is an invoicing powerhouse that allows you to create and send unlimited invoices with no caps or hidden fees. Designing an invoice is straightforward with professional templates that you can customize with your logo, colors, and item details. You can add all the essentials like due dates, line items, quantities, and taxes. For those who bill clients on a recurring basis (monthly retainers or subscriptions), Wave supports recurring invoices so you don’t have to recreate the same invoice repeatedly. This can be a huge time-saver (note: recurring billing is available on the Pro plan). Once an invoice is sent, Wave tracks when clients view it and can automatically send friendly payment reminders before or after the due date. No more awkwardly chasing down payments; Wave does the nudging for you. You can also set up late payment fees if needed. Another handy feature is the ability to convert estimates to invoices: draft an estimate for a client, and when approved, turn it into an invoice with one click. The Wave Invoicing mobile app lets you create and send invoices right from your phone. Whether you’re at a client site or at a cafe, you can quickly send a new invoice and receive notifications when it’s viewed or paid.

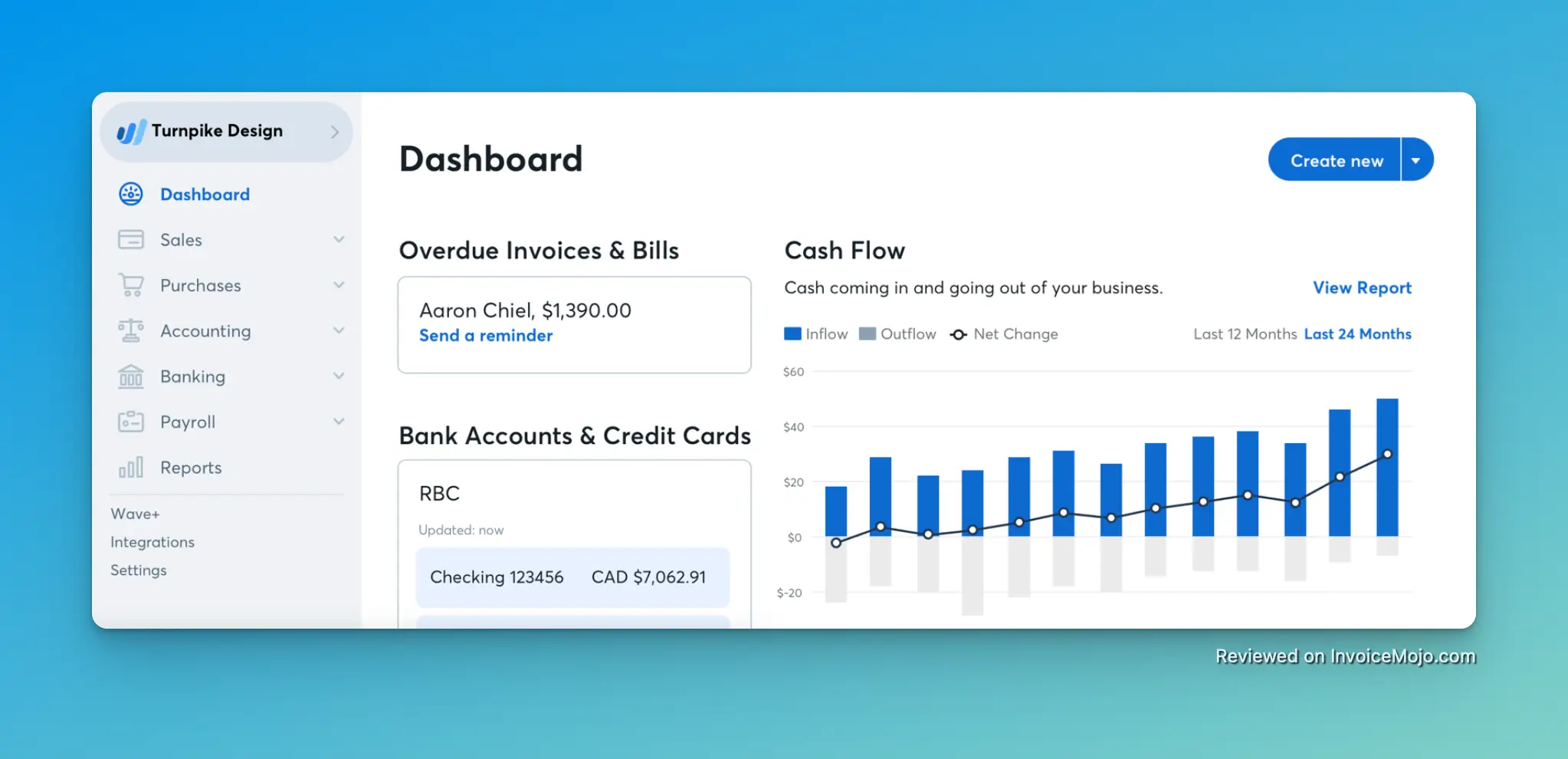

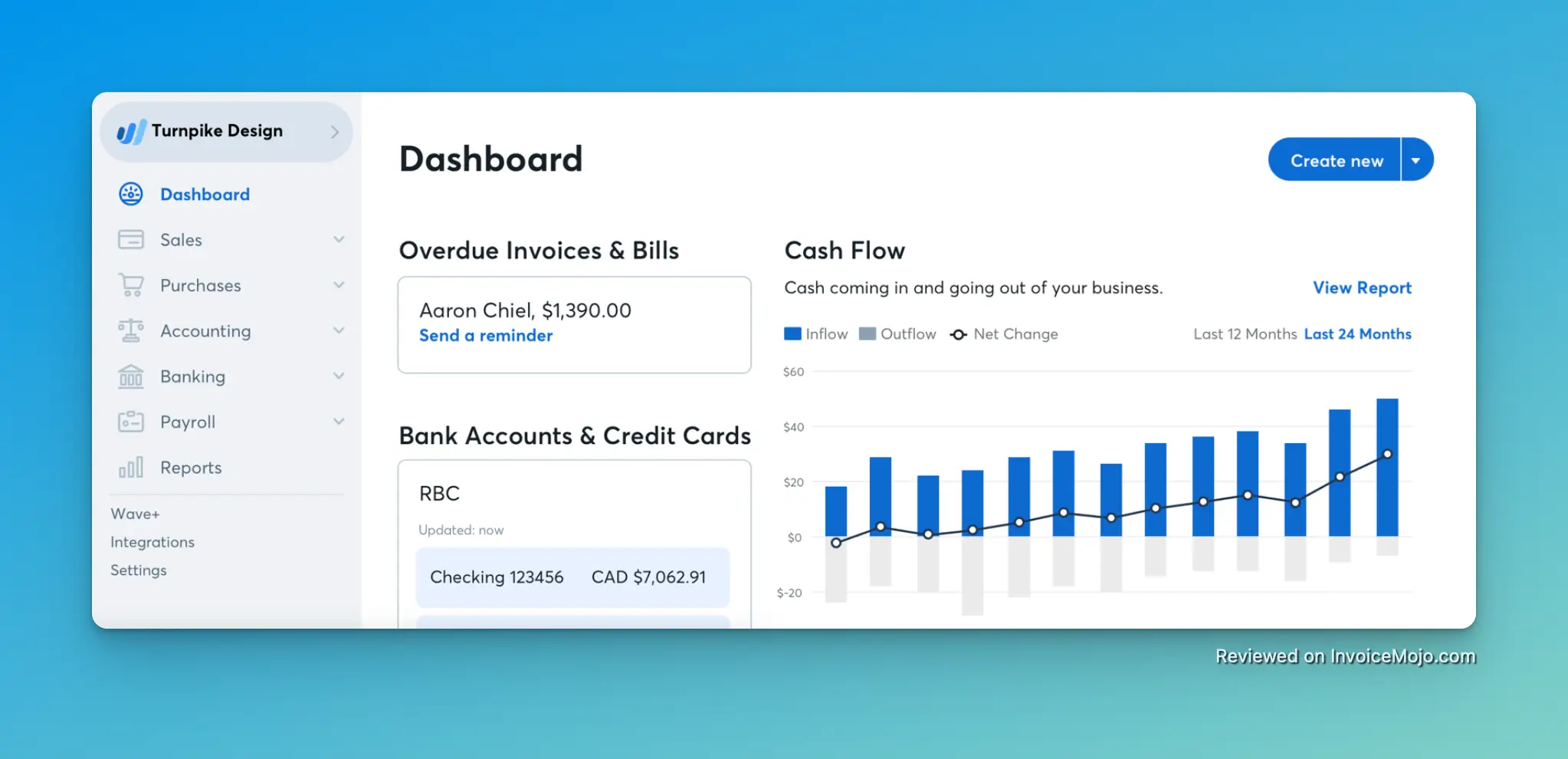

Wave Invoicing Dashboard

Wave Invoicing Dashboard

Accounting & Expense Tracking

Beyond invoicing, Wave is a full-fledged accounting software. All your sent invoices, recorded payments, and expenses flow into an accounting dashboard that helps you track income and expenses. Wave supports double-entry bookkeeping behind the scenes, but you don’t need to be an accountant to use it. The interface is user-friendly and designed for non-accountants. Key accounting features include:

- Expense Tracking: You can manually record expenses, attach receipts, and mark expenses as paid. Wave allows you to connect your bank or credit card to automatically import transactions, so your expense tracking can be largely automated.

- Chart of Accounts: Wave comes with a default chart of accounts which you can customize. This means you can track Accounts Receivable (unpaid invoices) and Accounts Payable (bills), though Wave’s focus is primarily on income/expenses rather than advanced payable management.

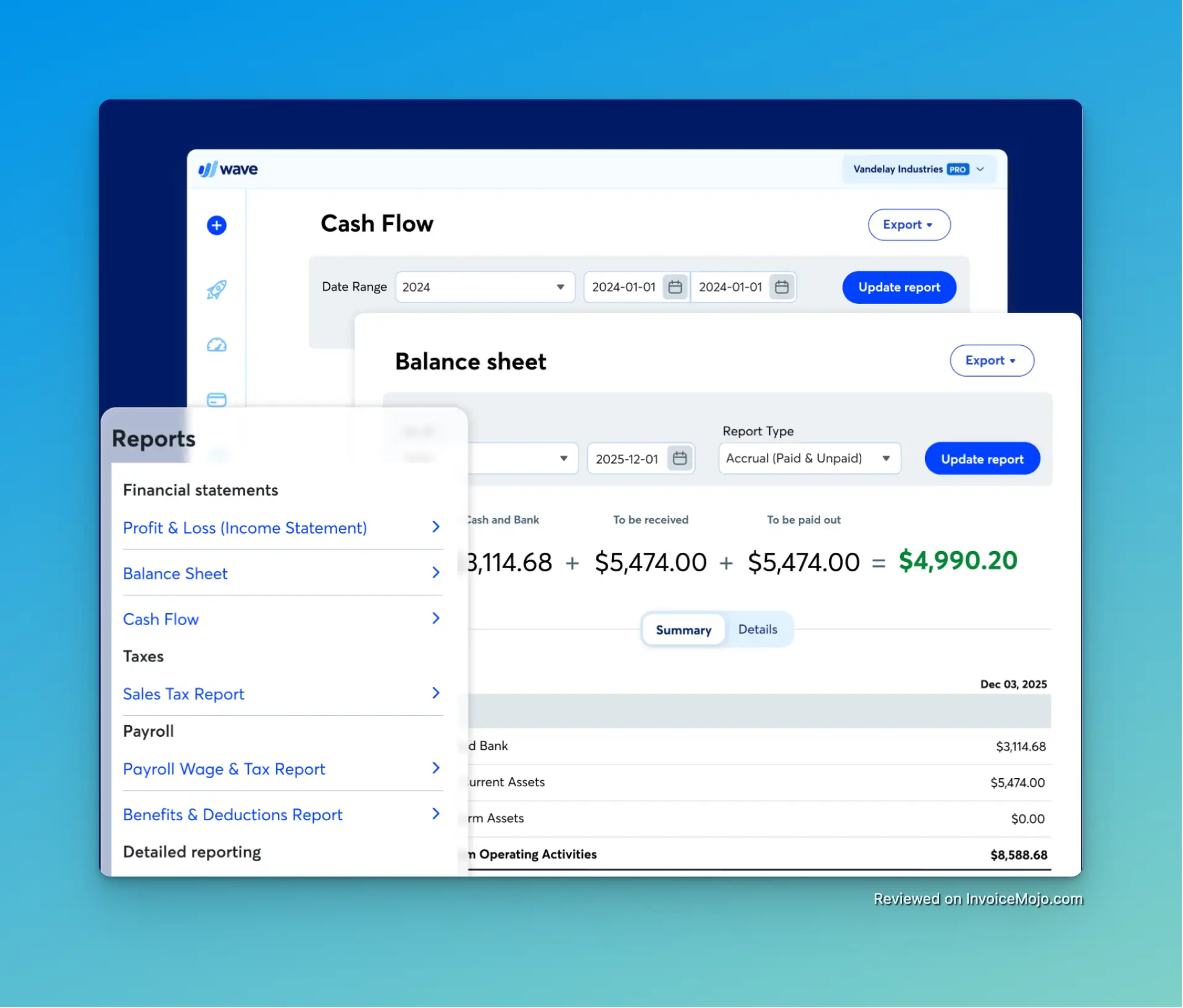

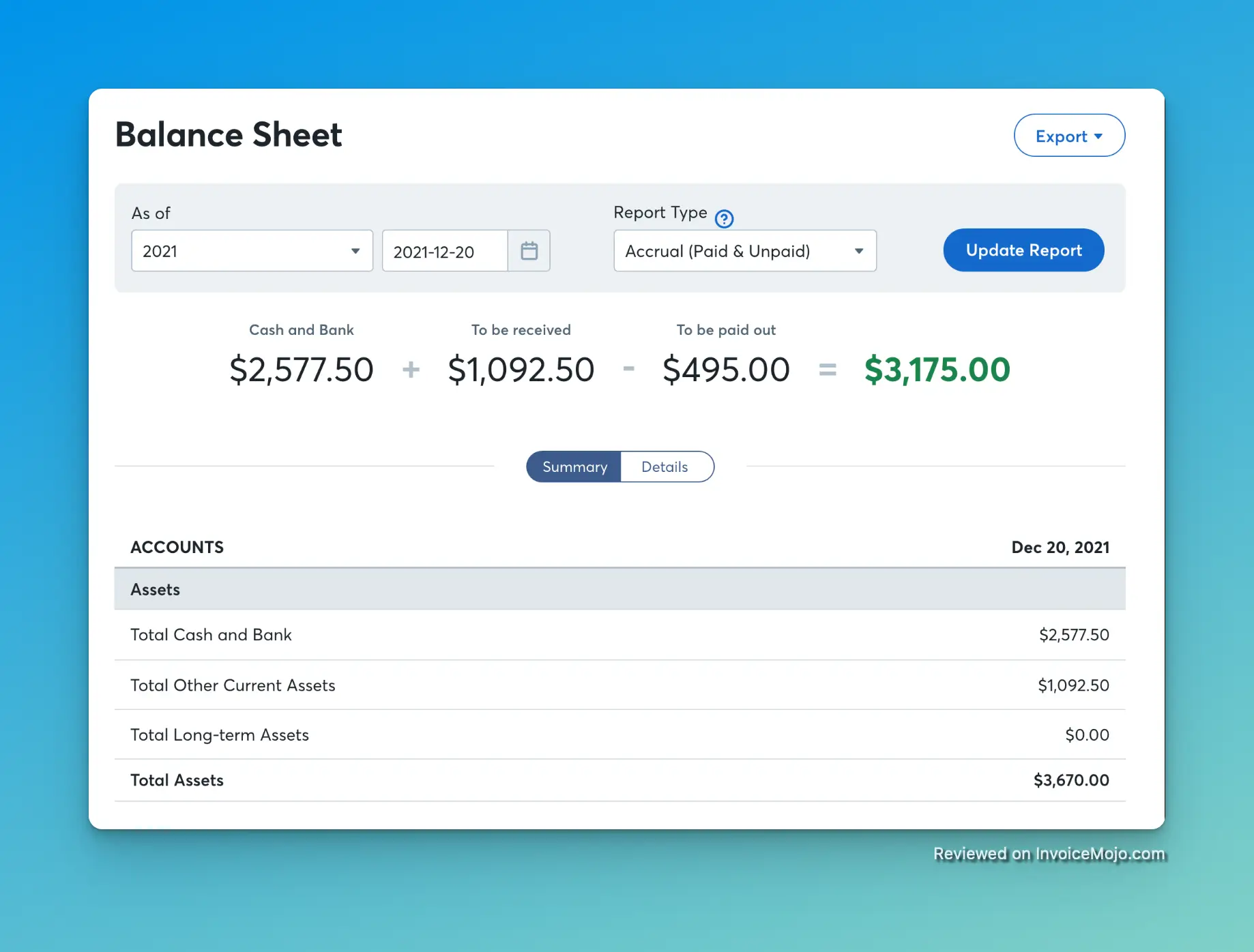

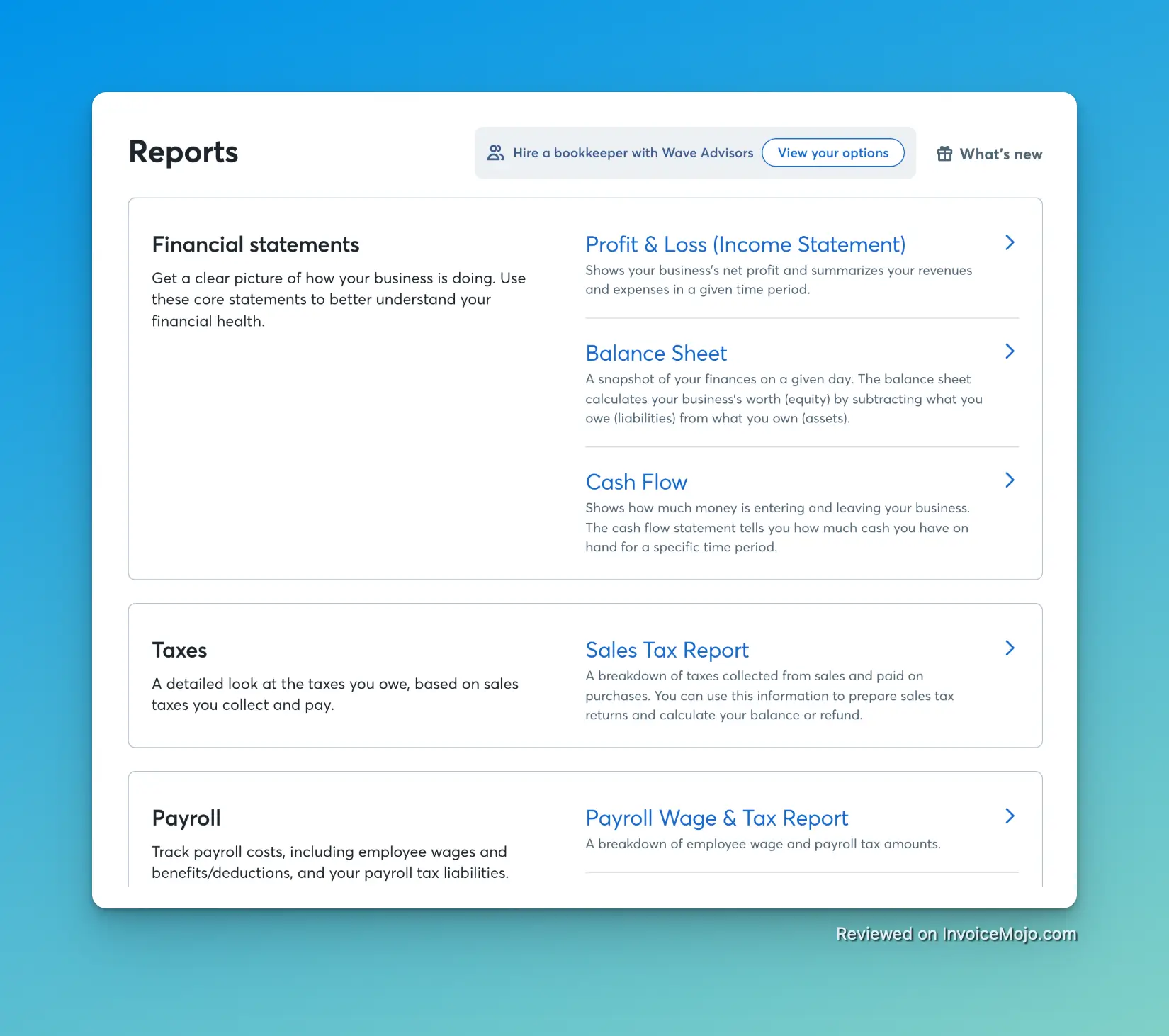

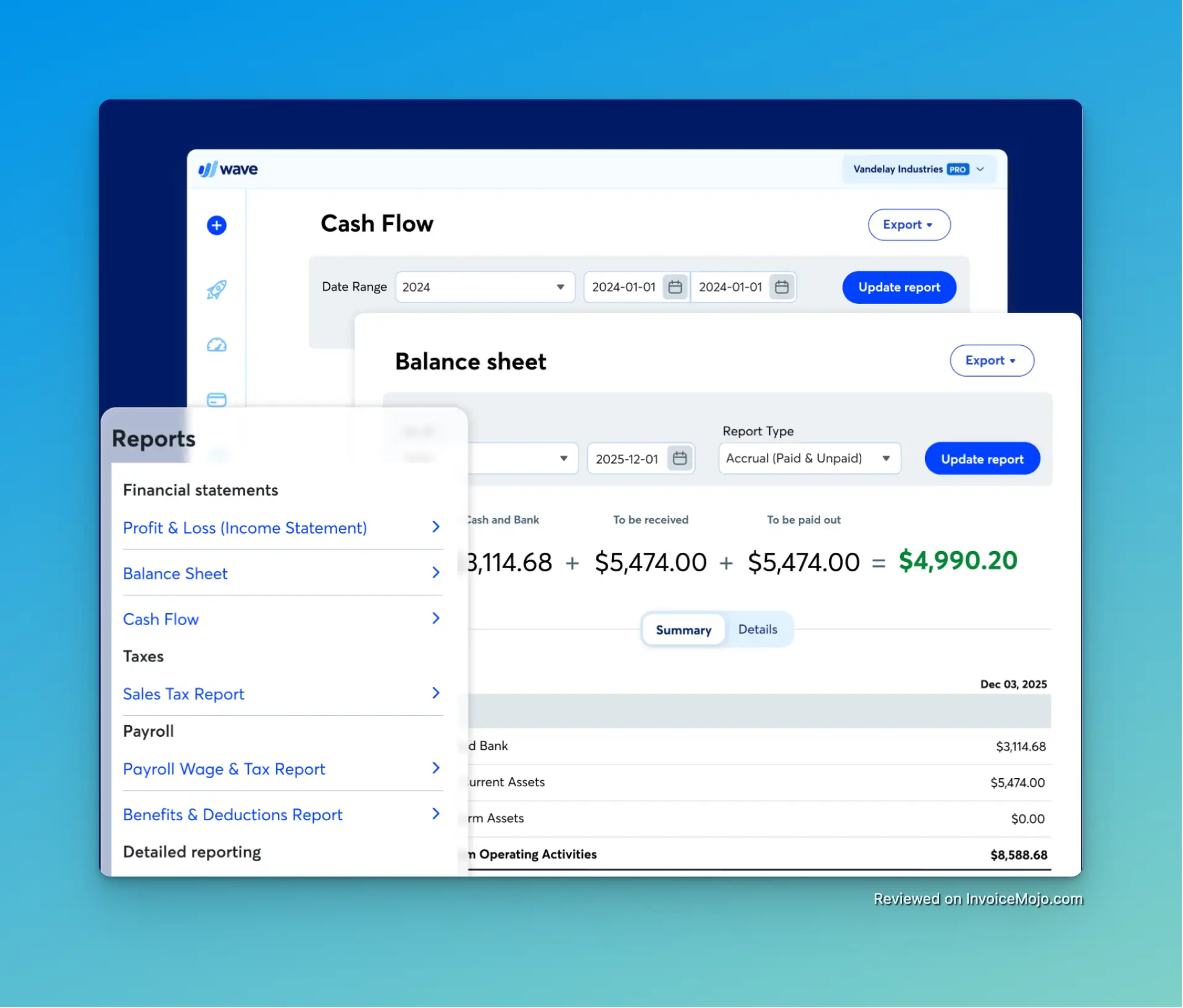

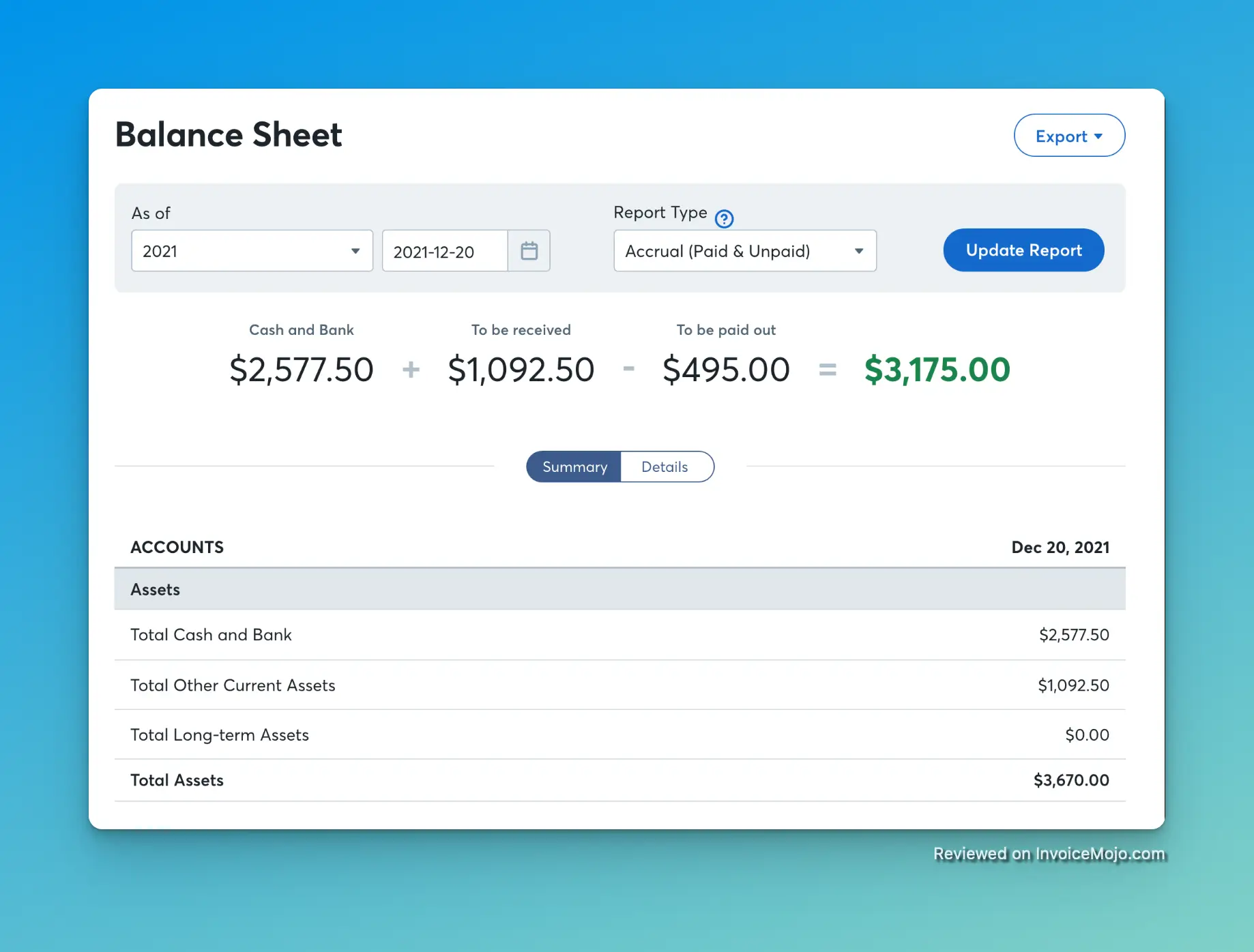

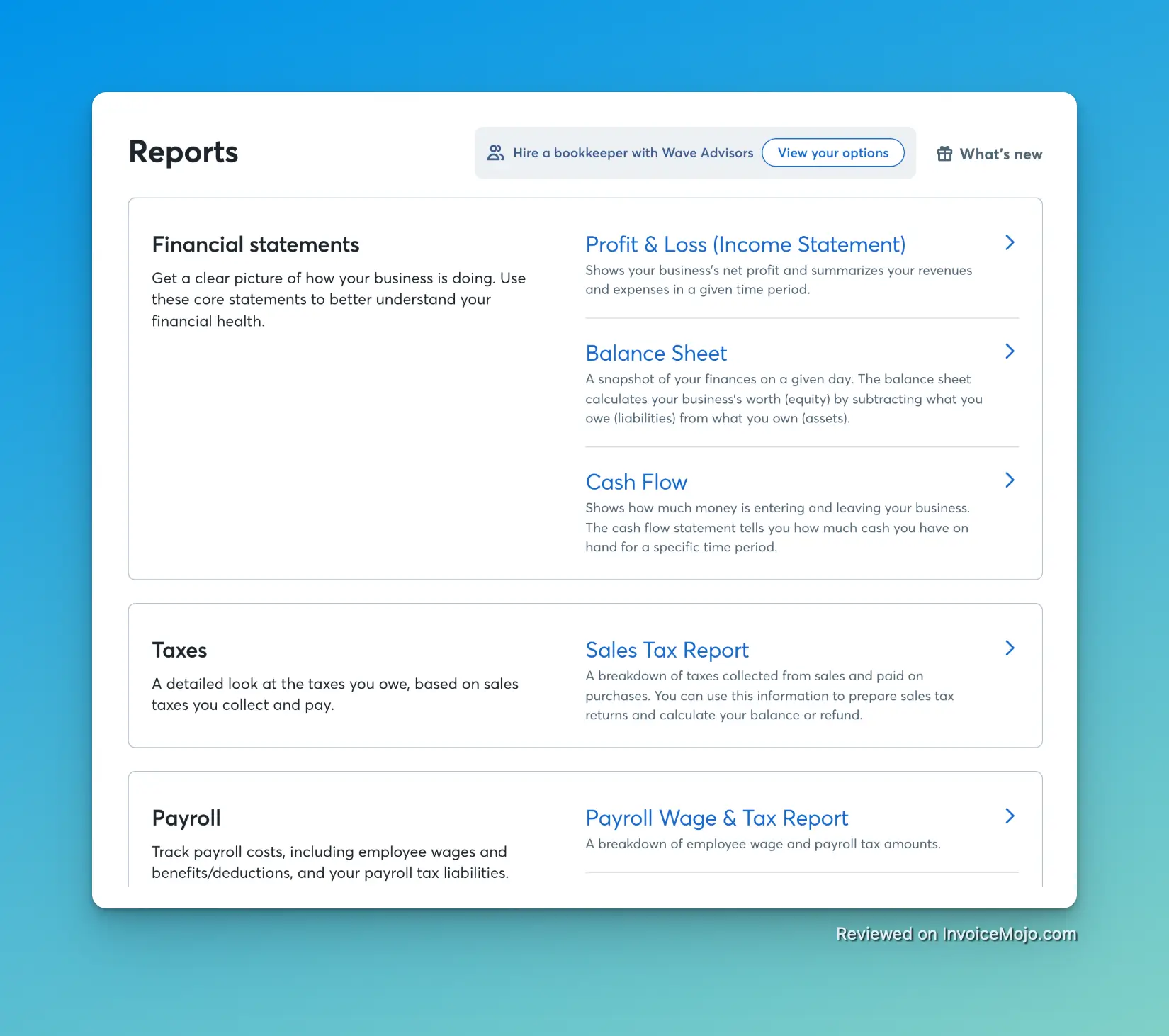

- Reports: Even though it’s free, Wave provides a solid set of accounting reports. You can generate financial statements like Profit & Loss, Balance Sheet, and Cash Flow reports with a few clicks. It also offers helpful reports for tax time, such as Sales Tax reports, and aged receivables/payables to see who owes you or whom you owe.

- Multiple Businesses: If you operate more than one business, Wave lets you create multiple business profiles under the same login, keeping the accounting data separate for each. The free pricing applies per business as well.

One important limitation is that Wave does not support inventory management or project tracking. If you sell products and need to manage stock levels, Wave’s item list is very basic: you can save product/service items with prices for invoicing, but it won’t track stock or alert you when inventory is low. Similarly, there’s no built-in time tracking and no project management module.

Accounting features in Wave

Accounting features in Wave

Automation & Time-Savers

Wave shines in automating financial admin tasks, which is impressive for a free platform. Here are some notable automation features:

- Bank Connection & Auto-Import: You can securely connect your business bank account and credit cards to Wave. On the Pro plan, Wave will automatically import your bank transactions daily, auto-merge them with any existing entries, and even attempt to categorize them for you using machine learning. This means your bookkeeping gets partially done in the background – saving you from manual data entry.

- Automatic Invoice Reminders & Recurring Billing: Wave can automatically send invoice reminders to clients. You can configure when reminders go out (e.g., a week before due, on due date, 1 week overdue). Additionally, the recurring invoices feature (Pro plan) is a set-and-forget solution for ongoing billing.

- Receipt Scanning: Using your phone’s camera, you can snap a photo of a receipt and Wave will read the details and create an expense transaction for you automatically. Under the free plan, this feature may require a paid add-on for unlimited use, whereas it’s included in the Pro plan.

- Integrations: Wave offers connections to some third-party tools. It integrates with PayPal, Etsy for pulling in sales data, and Zapier to connect Wave with hundreds of other apps. Wave has also integrated with H&R Block to help with tax filing.

Viewing the balance sheet in Wave

Viewing the balance sheet in Wave

Payments and Getting Paid Faster

When you create an invoice in Wave, you can choose to enable online payments. If enabled, your client will see a “Pay Now” button on the invoice and can pay via credit card or ACH bank transfer. Setting up Wave Payments is straightforward. Once approved, you can accept payments directly to your bank account. Wave charges per-transaction fees:

- 2.9% + $0.60 per credit card transaction (3.4% + $0.60 for Amex)

- 1% for bank payments (ACH)

There are no monthly fees or setup fees for Wave Payments: you only pay when you get paid. If you upgrade to the Pro plan, Wave waives the 60¢ transaction fee on the first 10 transactions each month. According to Wave, customers who enable online payments get paid three times faster than those who only accept cash or checks. Clients are more likely to click a button and pay by card than to write a check.

Other Notable Features

- Estimates/Quotes: Wave lets you create estimates and quotes and send them to clients. If a client approves an estimate, you can turn it into an invoice with one click.

- Multi-Currency Invoicing: If you work with international clients, Wave supports invoicing in multiple currencies. You can set your currency per invoice or customer.

- Payroll (Paid Add-On): Wave offers an optional Payroll service if you have employees or contractors. It’s available for the US and Canada and starts at around $20-$40 per month plus a few dollars per employee.

- Wave Mobile Apps: Wave offers mobile apps for invoicing, receipts, and general account management. The mobile experience isn’t as full-featured as the web version, but improving over time.

- Customer Support: Wave offers a help center with guides and a community forum. Direct support (like live chat) is available if you are on the Pro plan or if you use any paid service.

Report options in Wave Invoicing

Report options in Wave Invoicing

Pricing and Plans

One of Wave’s biggest selling points is its pricing – or the fact that much of it is free. Wave’s model is to provide free software and make money through financial services (payment processing, payroll, etc.). In late 2024, Wave introduced a new tiered pricing structure that includes a free Starter plan and a paid Pro plan.

Pricing Comparison

| Feature |

Starter (Free) |

Pro ($16/month) |

| Invoicing & Estimates |

Unlimited |

Unlimited |

| Accounting & Reports |

Full accounting, basic reports |

Full accounting, basic reports |

| Bank Transaction Import |

Manual CSV import |

Automatic bank feeds & auto-categorization |

| Receipt Scanning (OCR) |

Available as $8/mo add-on |

Included unlimited |

| Recurring Invoices |

Not available |

Included |

| Users/Collaborators |

1 user + limited accountant access |

Unlimited users with roles |

| Customer Support |

Self-serve Help Center & community |

Priority support (live chat/email) |

| Online Payment Fees |

Standard 2.9% + $0.60 (cards), 1% (ACH) |

First 10 transactions/mo have $0 per-transaction fee |

| Payroll (add-on) |

$20+ per month (optional) |

$20+ per month (optional) |

The free plan remains one of the most generous offerings in the market. Wave isn’t suddenly charging for sending invoices or using the accounting tools.

Pros & Cons

Pros

- Free Core Features: You get unlimited invoices, accounting, and basic features at no cost, which is ideal for freelancers and small businesses watching expenses.

- Easy to Use: Wave is very user-friendly, with an intuitive dashboard and navigation that non-accountants can grasp quickly. The learning curve is minimal, especially for basic tasks.

- Professional Invoices & Branding: Wave’s invoice templates and customization options give even tiny businesses a professional look.

- Time-Saving Automations: Wave offers numerous automations that save you time. These features reduce manual data entry and follow-up, which is a big efficiency win for a one-person business.

- Integrated Payments: Accepting credit cards and ACH directly through your invoice is a big plus. It encourages faster client payments and reduces the hassle of offline payments.

- All-in-One Convenience: With invoicing, accounting, receipt scanning, and even payroll in one system, Wave provides a unified solution.

- Multiple Businesses & Personal Finance: Wave allows multiple business accounts under one login (free each), and even personal accounting.

- No Forced Upgrades for Basic Use: Unlike some freemium tools, Wave doesn’t force you to upgrade as you grow – you can stick with free forever if it meets your needs.

Cons

- Limited Advanced Features: Wave lacks some advanced accounting features like project management, time tracking, inventory management, or budgeting tools.

- Mobile App Quirks: While Wave has mobile apps, they are not as robust as the web version. Some users report bugs or slow performance in the mobile apps.

- Customer Support for Free Users: Free users do not get direct email or chat support with Wave’s team. You’re expected to use the help center or community unless you are a Pro subscriber or use a paid financial service.

- Occasional Sync Issues: Automatic bank feeds can sometimes be temperamental. Not all banks are supported, and sometimes connections break and require reauthentication.

- Server Slowdowns: A few users have cited that Wave can occasionally be slow or have downtime during peak times.

- Payments Risk and Holds: In rare cases, Wave might hold a payout if something triggers a risk flag, which could delay your funds. Also, Wave Payments is only available in certain countries (primarily the U.S. and Canada).

- Not Ideal for Large or Complex Businesses: If you’re scaling up, Wave might not scale with you. Companies that grow beyond a handful of employees or need features like multi-department accounting might outgrow Wave.

What Users Are Saying

We’ve analyzed user feedback across multiple platforms to give you the real story on what Wave users love and where they encounter challenges.

User Satisfaction by Category

Ease of Use

- “Wave makes sense right away without complicated setup. I don’t need an accounting degree to use it.”

- “Their invoicing system is very easy to use and customer friendly.”

- “The dashboard is intuitive. I figured out how to send my first invoice in minutes.”

Value for Money

- “Getting so many features for free is almost unbelievable compared to QuickBooks pricing.”

- “They charge a reasonable amount for credit card processing for small companies.”

- “Even the Pro plan is affordable compared to alternatives.”

Invoice Quality & Customization

- “My clients comment on how professional my invoices look.”

- “The templates are clean and customizable enough to match my branding.”

- “Converting estimates to invoices with one click has saved me hours.”

Banking & Transactions

- “When the bank sync works, it’s amazing. All my expenses just appear.”

- “Auto-categorization gets better over time and learns my business.”

- “Some users mention that bank integration can be confusing at times.”

- “Not all banks connect smoothly, and connections occasionally break.”

Customer Support

- “The self-help resources are decent, but getting actual human help on the free plan is impossible.”

- “Unless you get the paid support, it’s hard to get immediate help when you need it.”

- “Support is minimal if you’re on the free plan – be prepared to troubleshoot yourself.”

Payments Processing

- “Getting paid by card directly through the invoice speeds up my cash flow significantly.”

- “The fees are competitive with Square and Stripe but integrated right into my accounting.”

- “A handful of users reported funds being held or accounts frozen temporarily due to risk controls.”

- “Some experienced frustration with delay in payouts when they needed money urgently.”

Mobile Experience

- “The mobile app is good enough for sending quick invoices on the go.”

- “Receipt scanning from my phone has eliminated my shoebox of paper receipts.”

- “The mobile apps can be buggy and don’t have all the features of the web version.”

The consensus seems to be that Wave excels at providing a user-friendly, affordable solution for basic accounting and invoicing needs. Most negative experiences revolve around support limitations on the free plan or occasional technical hiccups.

Final Verdict

Overall Rating

Wave Invoicing earns a solid 4.4 out of 5 stars, making it an exceptional value for freelancers and small businesses seeking free accounting software. The combination of robust invoicing features, user-friendly interface, and genuinely free core functionality creates a compelling package that meets the essential needs of its target audience.

The software loses some points for limited customer support on the free plan, occasional bank sync issues, and the absence of inventory management. Additionally, its regional limitation to the US and Canada restricts its global appeal, preventing it from achieving a perfect score despite its generous offering.

So, is Wave Invoicing the right choice for you? If you’re a freelancer, consultant, or run a small business with relatively straightforward finances, Wave offers exceptional value. It’s rare to find a robust invoicing and accounting solution for free that’s also easy to use. You can get started in minutes, send your first invoice, track your first expense, and see reports without spending a dime. The strengths of Wave are its simplicity, price, and integration of invoicing with accounting. It excels at helping you get paid faster and keep tidy books with minimal effort. For anyone who has felt overwhelmed by bookkeeping or tired of paying monthly fees for features they don’t use, Wave will feel refreshing. Wave is particularly ideal for:

- Service-based businesses (freelance designers, writers, consultants, tradespeople)

- Very small teams that just need to track money in and out

- Startups or side hustles on a tight budget

- Businesses with straightforward financial needs

Who might find Wave limiting? If you anticipate rapid growth or need advanced features like inventory management, project costing, or extensive integrations with other apps, you might outgrow Wave. Larger small businesses, say those with 10+ employees or very high transaction volumes, might eventually need a more scalable solution like QuickBooks Online or Xero. Given that it costs nothing to start, you can sign up and try Wave alongside whatever you’re using now to see how it fits. Many users find that once they start using Wave, they wonder how they managed without it. It removes much of the administrative burden from your plate, letting you focus on your actual business. For a freelancer or small business owner wearing multiple hats, that’s an enormous win. Wave Invoicing & Accounting delivers significant value whether you stick with the free version or opt for the Pro plan’s conveniences. It’s not perfect—no software is—but when you weigh what it delivers against the cost (or lack thereof), Wave is an offering that’s hard to beat for its target market.

Wave Invoicing Website

Wave Invoicing Website Wave Invoicing Dashboard

Wave Invoicing Dashboard Accounting features in Wave

Accounting features in Wave Viewing the balance sheet in Wave

Viewing the balance sheet in Wave Report options in Wave Invoicing

Report options in Wave Invoicing